Mastering Weekly Budgeting: Essential Tips for Beginners

Written: Editor | October 5, 2023

Setting Realistic Financial Goals

If you're new to budgeting and want to take control of your finances, setting realistic financial goals is the first crucial step. By identifying your short-term and long-term goals, you can create a budget that aligns with your aspirations and helps you achieve financial success. Here are some tips to get you started:

Identifying short-term and long-term financial goals

-

Short-term goals: These are objectives you want to achieve within the next year or so. Examples include saving for a vacation, paying off credit card debt, or starting an emergency fund.

-

Long-term goals: These are goals you want to accomplish over a longer period, such as five or ten years. They could include buying a home, saving for retirement, or starting a business.

Tips for setting achievable goals for beginners

-

Start small: Begin with achievable goals that are within your current financial means. This will help build your confidence and momentum as you progress.

-

Be specific: Clearly define what you want to achieve and by when. Specific goals are easier to track and measure progress against.

-

Make them measurable: Break your goals down into measurable milestones. This allows you to track your progress and make adjustments if needed.

-

Consider your priorities: Align your financial goals with your values and priorities. This will help you stay motivated and committed to achieving them.

Remember, budgeting is a journey, and it's okay to adjust your goals along the way. Stay focused, be flexible, and celebrate your milestones as you work towards financial freedom.

:max\_bytes(150000):strip\_icc()/what-makes-for-a-successful-budget-1289233\_final-225d5c28eefd4a0a8ecbebce0f599b1d.jpg)

Tracking Expenses

How to track and categorize expenses effectively

Tracking and categorizing your expenses is essential when it comes to effective budgeting. Here are some tips to help you get started:

-

Keep receipts and records: Make it a habit to keep all your receipts and records of expenses. This will help you track where your money is going and identify areas where you can cut back.

-

Create categories: Categorize your expenses into different categories such as groceries, bills, entertainment, etc. This will make it easier for you to see where your money is being spent and identify any areas of overspending.

-

Use a spreadsheet or budgeting app: Utilize technology to your advantage by using spreadsheet software or budgeting apps to track and categorize your expenses automatically. This will save you time and make it easier to analyze your spending patterns.

Using budgeting apps and tools for expense tracking

There are numerous budgeting apps and tools available that can simplify your expense tracking process. Here are a few popular options:

-

Mint: A free budgeting app that allows you to connect your bank accounts and credit cards, automatically categorizes your expenses, and provides insights into your spending patterns.

-

You Need a Budget (YNAB): This app focuses on helping you create a budget and track your expenses. It also provides educational resources to help you manage your money effectively.

-

Wally: A user-friendly app that lets you track expenses, set savings goals, and gives you an overview of your spending habits.

Remember, effective expense tracking is the foundation of successful budgeting. By monitoring your spending habits, you can make informed decisions and take control of your financial future.

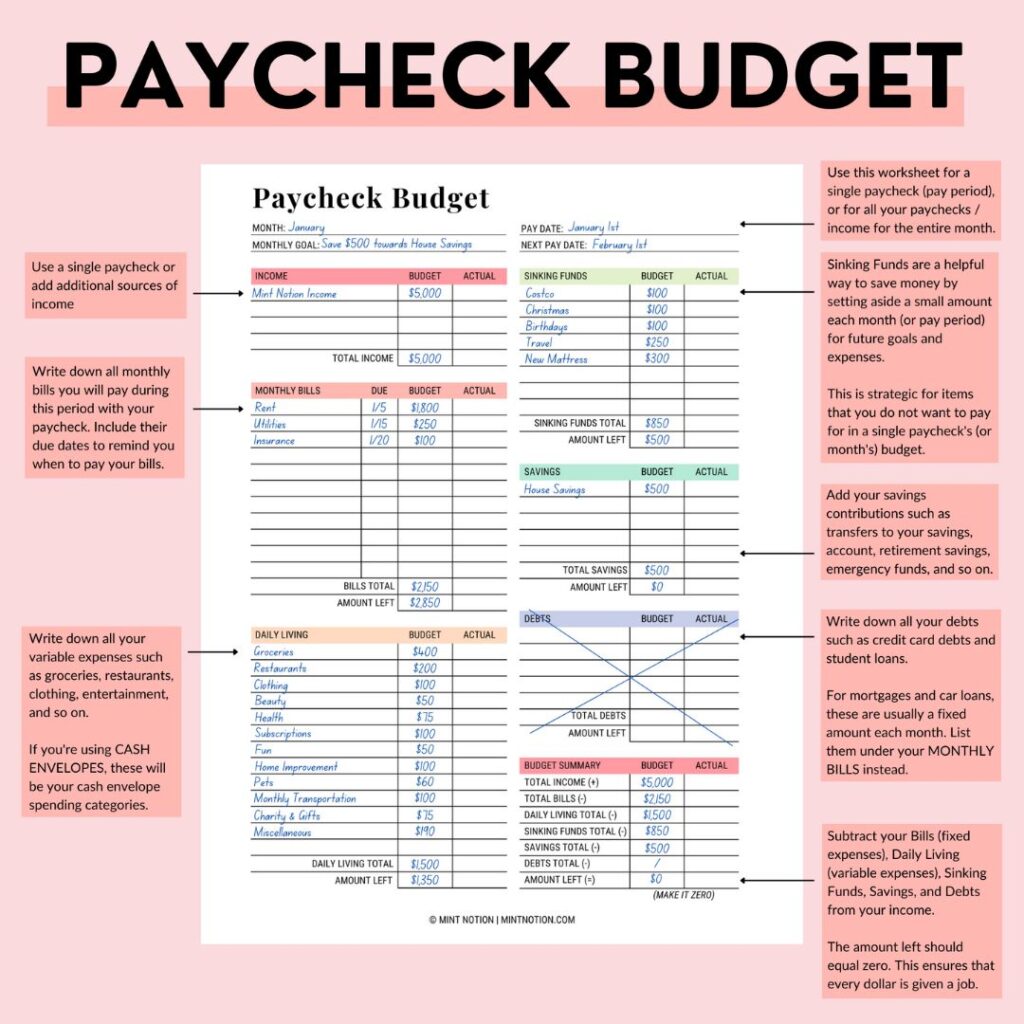

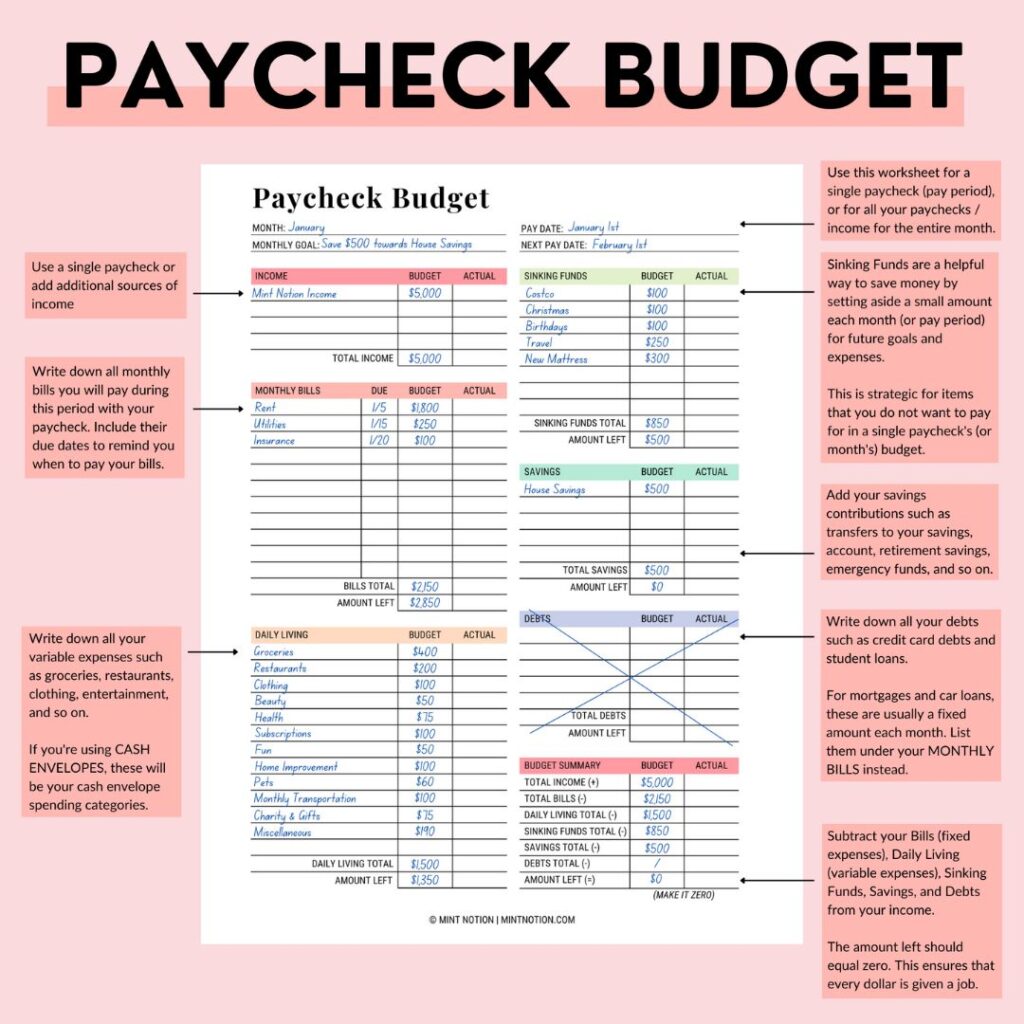

Creating a Weekly Budget

If you're a beginner at budgeting, don't worry, we've got you covered! Follow these simple steps to create a basic weekly budget and take control of your finances.

Steps to create a basic weekly budget

-

Gather your financial information: Start by collecting all your income sources and expenses. This includes your salary, side gigs, bills, rent, groceries, and any other recurring payments.

-

Track your expenses: Keep a record of your daily expenses for a week. This will help you identify areas where you can cut back and save money.

-

Set financial goals: Determine what you want to achieve financially, whether it's paying off debt, saving for a vacation, or building an emergency fund. This will give you a clear focus and motivation.

-

Create spending categories: Divide your expenses into different categories such as housing, transportation, food, entertainment, and savings. Allocate a certain amount of your income to each category.

Allocating funds for essential expenses and savings

-

Essential expenses: Prioritize your essential expenses such as rent, bills, groceries, and transportation. Make sure you allocate enough funds to cover these expenses before anything else.

-

Savings: Set aside a portion of your income for savings. Aim to save at least 20% of your income, but start with whatever amount you can afford. Automate your savings by setting up automatic transfers to a separate savings account.

Remember, budgeting is a journey, and it may take some time to find the right balance. Keep reviewing and adjusting your budget as needed. With practice, you'll develop good financial habits and achieve your financial

Saving Strategies

Implementing effective saving strategies for beginners

When it comes to budgeting, one of the most important skills to develop is effective saving strategies. If you're just starting out, here are some tips to help you get on the right track:

-

Set realistic goals: Start by setting achievable savings goals. It could be a specific amount or percentage of your income that you want to save each week. Having a clear target will motivate you to stick to your budget.

-

Track your expenses: Keep a record of all your expenses to identify areas where you can cut back. Use budgeting apps or spreadsheets to make it easier to track your spending and see where your money is going.

Tips for cutting expenses and increasing savings

-

Eliminate unnecessary expenses: Review your expenses and identify items or services that you can live without. This could be eating out less often, cancelling unused subscriptions, or finding more affordable alternatives for certain expenses.

-

Reduce utility bills: Look for ways to save on your utility bills by being more energy-conscious. Unplug devices when not in use, turn off lights, and adjust the thermostat to save on heating and cooling costs.

-

Shop smart: Take advantage of sales, discounts, and coupons when shopping. Plan your meals and make a grocery list to avoid impulse buying and wasting food.

Remember, saving money is a journey, and it's important to celebrate your small victories along the way. By implementing these strategies and making conscious choices, you'll be well on your way to building a strong financial foundation.

Managing Debt

Strategies for managing debt while budgeting

Managing debt can be overwhelming, especially if you're just starting out. But with the right strategies, you can take control of your finances and work towards becoming debt-free. Here are some tips to help you manage your debt while budgeting:

-

Create a budget: Start by assessing your income and expenses. Identify areas where you can cut back and prioritize debt payments in your budget.

-

Snowball or avalanche method: Choose a debt repayment strategy that works best for you. The snowball method involves paying off smaller debts first, while the avalanche method focuses on tackling high-interest debts first.

-

Consolidate your debts: Consider consolidating your debts into a single loan or credit card with a lower interest rate. This can simplify your payments and help you save on interest charges.

Approaches to tackle debts for beginners

If you're new to managing debts, here are a few approaches to consider:

-

Mindful spending: Take a close look at your spending habits and identify areas where you can cut back. Avoid unnecessary expenses and focus on paying off your debts.

-

Seek professional help: If you're struggling to manage your debts on your own, don't hesitate to seek help from a financial advisor or credit counselor. They can provide guidance and help you develop a personalized plan.

-

Stay committed: Tackling debts takes time and patience. Stay committed to your budgeting and debt repayment plan, and celebrate small victories along the way.

Remember, managing debt is a journey, and with the right tools and mindset, you can take control of your finances and achieve your financial

Adjusting and Evaluating Your Budget

When it comes to budgeting, taking a proactive approach can help you stay on track and achieve your financial goals. As a beginner, it's important to adjust and evaluate your budget regularly to ensure it aligns with your changing needs and circumstances.

Making necessary adjustments to your budget over time

-

Track your expenses: Keep a record of your income and expenses to understand where your money is going. This will help you identify areas where you can cut back and make necessary adjustments to your budget.

-

Review your budget periodically: As your income or financial situation changes, your budget may need to be adjusted accordingly. Regularly review your budget and make modifications to reflect any new financial goals or priorities.

Regularly evaluating and fine-tuning your budget

-

Monitor your spending habits: Analyze your spending patterns to identify any areas of overspending or potential savings. Look for opportunities to reduce expenses and reallocate funds to other areas of your budget.

-

Set realistic goals: Establish achievable financial goals and use them as benchmarks to measure your progress. Regularly evaluate your budget to ensure that it aligns with these goals and make any necessary changes to stay on track.

By regularly adjusting and evaluating your budget, you can improve your financial well-being and achieve your long-term financial goals. Remember, budgeting is a continuous process, and with time and practice, you'll become more skilled at managing your money effectively.

Tips for Maintaining a Weekly Budget

Practical tips for staying committed to your budget

Managing your finances can feel overwhelming, especially if you're new to budgeting. But don't worry, with these practical tips, you'll be well on your way to maintaining a weekly budget and achieving your financial goals.

-

Track your expenses: Keep a record of every expenditure, no matter how small. This will help you identify areas where you can cut back and save money.

-

Create a budget: List all your income and expenses for the week and allocate specific amounts for each category. Stick to this budget as much as possible.

-

Avoid impulse purchases: Before making any non-essential purchases, give yourself a cooling-off period. If you still want it after a day or two, then consider buying it.

Overcoming common challenges faced by beginners

Starting a weekly budget can be challenging, but with these tips, you can overcome common obstacles.

-

Set realistic goals: Don't aim for dramatic changes overnight. Set achievable goals that you can work towards gradually.

-

Expect setbacks: It's normal to have setbacks along the way. Don't be too hard on yourself, and use them as learning opportunities.

-

Seek support: Share your budgeting journey with supportive friends or family members who can provide encouragement and guidance.

Remember, budgeting is a skill that takes practice. Stay committed, be patient with yourself, and you'll soon see the positive impact on your financial health

Building an Emergency Fund

The importance of emergency funds in financial planning

If you're just starting out on your financial journey, one of the first things you should prioritize is building an emergency fund. Having a safety net in place can provide peace of mind and protect you from unexpected expenses that could otherwise derail your financial stability.

An emergency fund serves as a buffer in case of unforeseen circumstances like job loss, medical emergencies, or car repairs. By having money set aside specifically for emergencies, you won't have to rely on credit cards or loans, which can lead to additional financial stress.

Steps to start building an emergency fund as a beginner

-

Set a goal: Determine how much you want to save for your emergency fund. Start with a small target, such as $500, and gradually work your way up to three to six months' worth of living expenses.

-

Automate your savings: Set up automatic transfers from your checking account to a separate savings account dedicated to your emergency fund. This way, you won't be tempted to spend the money you're trying to save.

-

Reduce unnecessary expenses: Look for ways to trim your budget and redirect those savings towards your emergency fund. Cut back on eating out, subscriptions you don't use, or other non-essential expenses.

-

Consider a side hustle: If your regular income isn't enough to save for emergencies, consider taking on a part-time job or freelancing to boost your savings.

Remember, building an emergency fund takes time and discipline. Stick to your savings plan and avoid dipping into the fund unless it's a true emergency. Eventually, you'll have peace of mind knowing you're financially prepared for unexpected events.

Conclusion

You've made an important decision to start budgeting, and these weekly budgeting tips for beginners will help you on your journey to financial success. Remember, budgeting is not about depriving yourself, but rather about making conscious decisions that align with your financial goals.

Recap of key budgeting tips for beginners

-

Create a budget: Start by tracking your expenses and income to get a clear picture of your financial situation.

-

Set achievable goals: Determine what you want to achieve with your budget, whether it's saving for a vacation or paying off debt.

-

Prioritize your spending: Allocate your money to cover essential expenses first, such as bills and groceries, before spending on non-essentials.

-

Track your expenses: Keep a record of all your expenses to identify areas where you can cut back and save.

Encouragement and motivation to start your budgeting journey

Starting a budget may feel overwhelming at first, but remember that every small step counts. Celebrate your progress and stay motivated by rewarding yourself when you reach milestones or sticking to your budget for a set period of time.

With consistent effort and discipline, you will start to see positive changes in your financial situation. Don't be discouraged by setbacks; learn from them and keep adjusting your budget as needed. Before you know it, budgeting will become a natural part of your financial routine, helping you achieve your money goals and build a secure future.