Budgeting Made Easy: Essential Strategies for Beginners

Written: Editor | October 18, 2023

Creating a Basic Budget

Setting Financial Goals and Priorities

When it comes to budgeting, setting clear financial goals and priorities is crucial for beginners. Start by identifying your short-term and long-term goals. Do you want to save for a vacation, pay off debt, or build an emergency fund? Prioritize these goals based on their importance and feasibility.

Track Income and Expenses: Next, track your income and expenses to gain a clear understanding of your financial situation. Make a list of all your income sources, including salary, freelance work, or side hustle earnings. Then, track your monthly expenses, categorizing them into essentials (such as rent, utilities, and groceries) and non-essentials (like eating out or entertainment).

Create a Budget: With a clear view of your financial goals, income, and expenses, it's time to create a budget. Allocate your income towards your priorities, ensuring that essential expenses are covered first. Set aside a portion for savings and debt payments, and allocate the rest for non-essential expenses.

Monitor and Adjust: Remember, budgeting is an ongoing process. Continuously monitor your spending and compare it to your budget. Adjust your allocations if needed to ensure that your financial goals are being met.

Conclusion

By creating a basic budget and setting financial goals, beginners can gain control over their finances, reduce debt, and build a solid financial foundation. Remember, consistency is key, so make it a habit to review and adjust your budget regularly.

Popular Budgeting Methods

The 50/30/20 Rule: Balancing Needs, Wants, and Savings

If you're new to budgeting, the 50/30/20 rule is a simple and effective way to manage your finances. This rule suggests allocating 50% of your income for necessities, 30% for discretionary spending, and 20% for savings. Here's how it works:

-

Needs: Start by determining your monthly income after taxes. Allocate 50% of that amount to cover essential expenses such as rent/mortgage, utilities, groceries, and transportation.

-

Wants: The next 30% is for discretionary spending, which includes non-essential items like dining out, entertainment, and shopping. This gives you some flexibility to enjoy things you love without overspending.

-

Savings: Finally, allocate 20% of your income to savings. This can be used for emergency funds, retirement contributions, or saving towards goals like buying a house or going on vacation.

The Envelope System: Managing Money with Cash

For those who prefer a more hands-on approach, the envelope system is a great budgeting method. Here's how it works:

-

Categorize your expenses: Start by dividing your expenses into different categories such as groceries, transportation, dining out, and entertainment.

-

Allocate cash: Assign a specific amount of cash to each category. Put the designated amount in separate envelopes for each category.

-

Use cash for expenses: Whenever you need to make a purchase, take the required amount from the relevant envelope. This helps you stay on track with your budget and avoid overspending.

-

Adjust as needed: If you run out of cash in one envelope, you'll need to adjust your spending in that category or from another envelope.

Remember, the key to successful budgeting is finding a method that works best for you and sticking to it. Start with one of these popular methods and adapt them to fit your financial goals and lifestyle.

Saving Strategies for Beginners

Saving money can sometimes feel like a daunting task, especially if you're just starting out. However, with the right strategies, you can make saving a habit that is both achievable and rewarding. Here are two key strategies to help you get started:

Building an Emergency Fund

One of the first steps towards financial security is building an emergency fund. This fund acts as a safety net for unexpected expenses, such as medical bills or car repairs. Start by setting aside a small amount each month, and gradually increase the amount as you become more comfortable. Aim for three to six months' worth of living expenses in your emergency fund, so you can handle unexpected situations without relying on credit cards or loans.

Automating Savings for Long-term Goals

Another effective strategy is to automate your savings for long-term goals, such as buying a house or planning for retirement. Set up an automatic transfer from your checking account to a separate savings account each month. This way, you won't have to remember to save, and you'll be less tempted to spend the money on unnecessary items. Over time, your savings will grow without much effort on your part.

Remember, saving is a journey, and it's important to be patient with yourself. Start small, celebrate your progress, and adjust your savings goals as necessary. By incorporating these strategies into your financial routine, you'll be well on your way to achieving your financial dreams.

Reducing Expenses

If you are new to budgeting, it can feel overwhelming trying to figure out where to start. But don't worry, with a few simple strategies, you can start saving money and taking control of your finances.

Identifying and Cutting Unnecessary Costs

-

Analyze your expenses: Take a close look at your spending habits and identify areas where you can cut back. Are you spending too much on dining out, subscription services, or impulse purchases? By understanding where your money is going, you can make smarter decisions.

-

Create a budget: Start by listing your fixed expenses, such as rent or mortgage payments, utilities, and loan payments. Then allocate a certain amount for variable expenses like groceries, entertainment, and transportation. Stick to your budget each month and adjust as needed.

Tips for Frugal Living

-

Meal planning: Plan your meals for the week and create a shopping list. This will help you avoid unnecessary trips to the grocery store and prevent impulse buying. Look for sales and coupons to save even more.

-

Comparison shopping: Before making a purchase, compare prices from different stores or online platforms. Take advantage of discounts, sales, and promotions to get the best deals on everything from clothing to electronics.

-

Avoid unnecessary debt: Minimize the amount of debt you take on and focus on paying off high-interest loans first. Consider consolidating your debt or negotiating lower interest rates to save money in the long run.

Remember, budgeting is a continuous process, and it may take some time to adjust to your new spending habits. Stay committed, track your progress, and celebrate your achievements along the way. Financial freedom is within your reach!

Managing Debt

If you're new to budgeting and looking for strategies to manage your debt, you're in the right place! Debt can be overwhelming, but with the right approach, you can take control of your finances and work towards a debt-free future.

Debt Repayment Strategies: Snowball vs. Avalanche Method

-

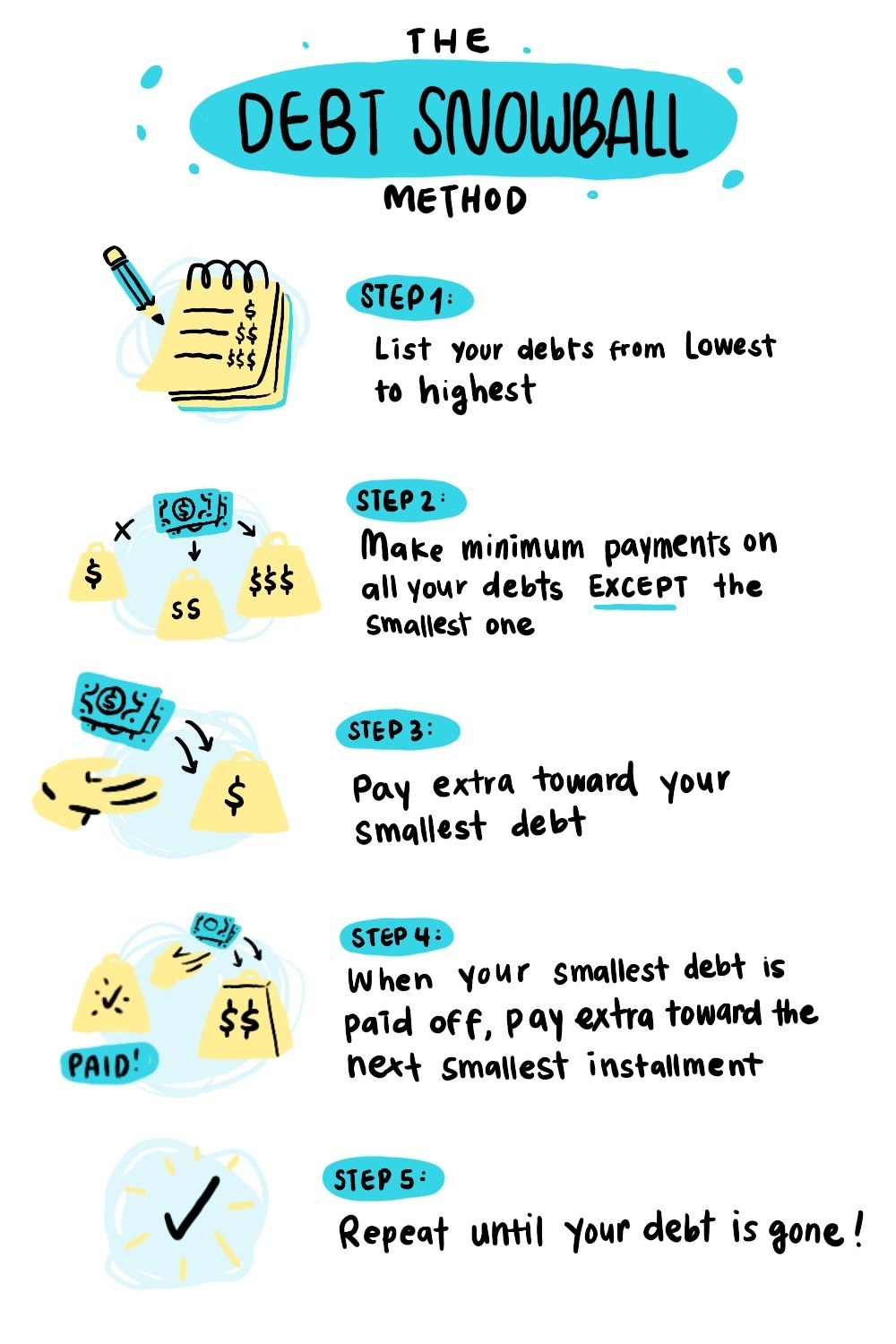

Snowball Method: This strategy involves paying off your debts from smallest to largest balance. Start by making minimum payments on all your debts, and then put any extra money towards the smallest debt. Once that debt is paid off, take the amount you were paying towards it and apply it to the next smallest debt. This method builds momentum and motivation as you see debts being eliminated one by one.

-

Avalanche Method: With this strategy, you prioritize your debts based on interest rates. Start by making minimum payments on all your debts, but put any extra money towards the debt with the highest interest rate. Once that debt is paid off, move on to the one with the next highest interest rate. This method saves you more money in interest over time.

Consolidating Debt for Simplified Payments

Consider consolidating your debts into a single loan or credit card with a lower interest rate. This allows you to make one payment instead of multiple payments each month, making it easier to manage your debt. However, be cautious and carefully research the terms and conditions of the consolidation option to ensure it benefits your financial situation.

Remember, the key to successful debt management is consistency and sticking to your budget. Track your expenses, cut unnecessary costs, and allocate a portion of your income towards debt repayment each month. With time and dedication, you can achieve your goal of becoming debt-free.

Reviewing and Adjusting Your Budget

If you're just starting out on your budgeting journey, it's important to understand that creating a budget is only the first step. To effectively manage your finances, you need to review and adjust your budget periodically. Here are a couple of strategies to help you stay on track.

Periodically Assessing and Adjusting Your Budget

-

Set Regular Checkpoints: Make it a habit to review your budget at regular intervals, such as monthly or quarterly. This allows you to identify any changes in your financial situation or spending patterns and make necessary adjustments.

-

Track Your Expenses: Keep a record of all your expenses, including small ones like coffee or snacks. This will help you identify areas where you may be overspending and enable you to make adjustments accordingly.

Staying Motivated and Consistent in Budgeting

-

Set Realistic Goals: When creating your budget, set achievable financial goals that align with your long-term vision. Having clear objectives will keep you motivated to stick to your budget.

-

Reward Yourself: Celebrate your milestones along the way. Treat yourself whenever you achieve a budget-related goal, whether it's paying off debt or establishing an emergency fund. This will provide positive reinforcement and keep you motivated.

Remember, budgeting is a continuous process. As your financial situation evolves, so should your budget. By regularly reviewing and adjusting your budget, as well as staying motivated and consistent, you'll be well on your way to achieving financial success.

Conclusion

If you are new to budgeting, you may feel overwhelmed and unsure of where to start. But don't worry – with the right strategies and mindset, you can take control of your finances and work towards your financial goals.

Benefits of Budgeting for Financial Security and Freedom

-

Track Your Spending: Creating a budget allows you to have a clear understanding of where your money is going. This awareness helps you identify areas where you can cut back and save.

-

Eliminate Debt: By budgeting and allocating a portion of your income towards debt repayment, you can accelerate your journey to becoming debt-free.

-

Save for the Future: Budgeting enables you to save for emergencies, retirement, or big financial goals, providing you with a sense of security and peace of mind.

Next Steps for a Successful Budget Journey

-

Set Financial Goals: Determine what you want to achieve with your money, be it paying off debt, saving for a house, or building an emergency fund. This will give you motivation and clarity for your budgeting journey.

-

Create a Realistic Budget: Track your income and expenses and allocate amounts for different categories like housing, transportation, groceries, and entertainment. Make sure to prioritize your financial goals.

-

Stick to Your Budget: Consistency is key. Monitor your spending, adjust your budget as needed, and find ways to stay accountable, whether through apps, spreadsheets, or regular check-ins with a trusted friend or partner.

Remember, budgeting is a continuous process and requires patience and discipline. Be flexible and willing to make adjustments along the way. With diligence, you can achieve financial security