Following the Market: Unlocking Potential with Index-Tracking Mutual Funds

Written: Editor | October 6, 2023

What are Index-Tracking Mutual Funds?

Introduction to Index-Tracking Mutual Funds

Index-tracking mutual funds, also known as index funds or passive funds, are investment funds that aim to replicate the performance of a specific stock market index. These funds invest in a diversified portfolio of securities that match the composition of the chosen index. They do not rely on active fund management or attempt to outperform the market, but rather seek to mirror the returns of the underlying index.

The appeal of index-tracking mutual funds lies in their simplicity and low fees. By investing in a broad-based index, investors gain exposure to a wide range of stocks and sectors, which helps to spread risk. Moreover, as these funds are not actively managed, they have lower operating costs compared to actively managed funds.

Advantages and disadvantages of Index-Tracking Mutual Funds

There are several advantages to investing in index-tracking mutual funds. First, they offer broad market exposure, allowing investors to participate in the overall performance of the index without having to select individual stocks. This diversification helps to mitigate the risk of holding a single security.

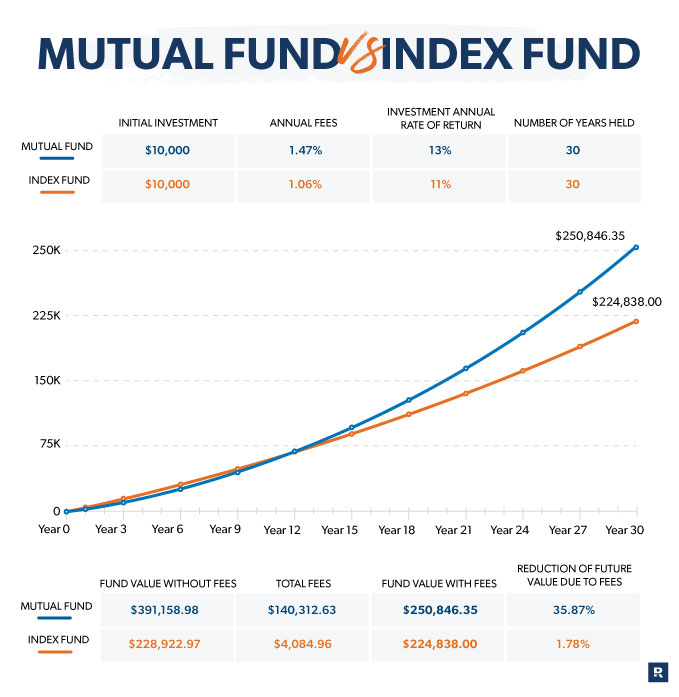

Second, index funds tend to have lower expense ratios compared to actively managed funds. This means that investors keep a higher percentage of their returns, as there are fewer management fees involved.

Additionally, index-tracking mutual funds are renowned for their transparency. The holdings of these funds are publicly disclosed on a regular basis, giving investors complete visibility into the securities they own.

However, there are also some disadvantages to consider. As these funds aim to replicate the performance of a specific index, they are susceptible to market volatility. If the index underperforms, the fund's returns may also be lower.

Furthermore, index funds lack the potential for outperformance that active fund management offers. While active managers aim to beat the market, index-tracking funds simply seek to match it, which could limit the potential for higher returns.

In conclusion, index-tracking mutual funds are a popular investment option due to their simplicity, low fees, and broad market exposure. However, investors should carefully consider their investment goals and risk tolerance before deciding whether to include index funds in their portfolio.

Types of Index-Tracking Mutual Funds

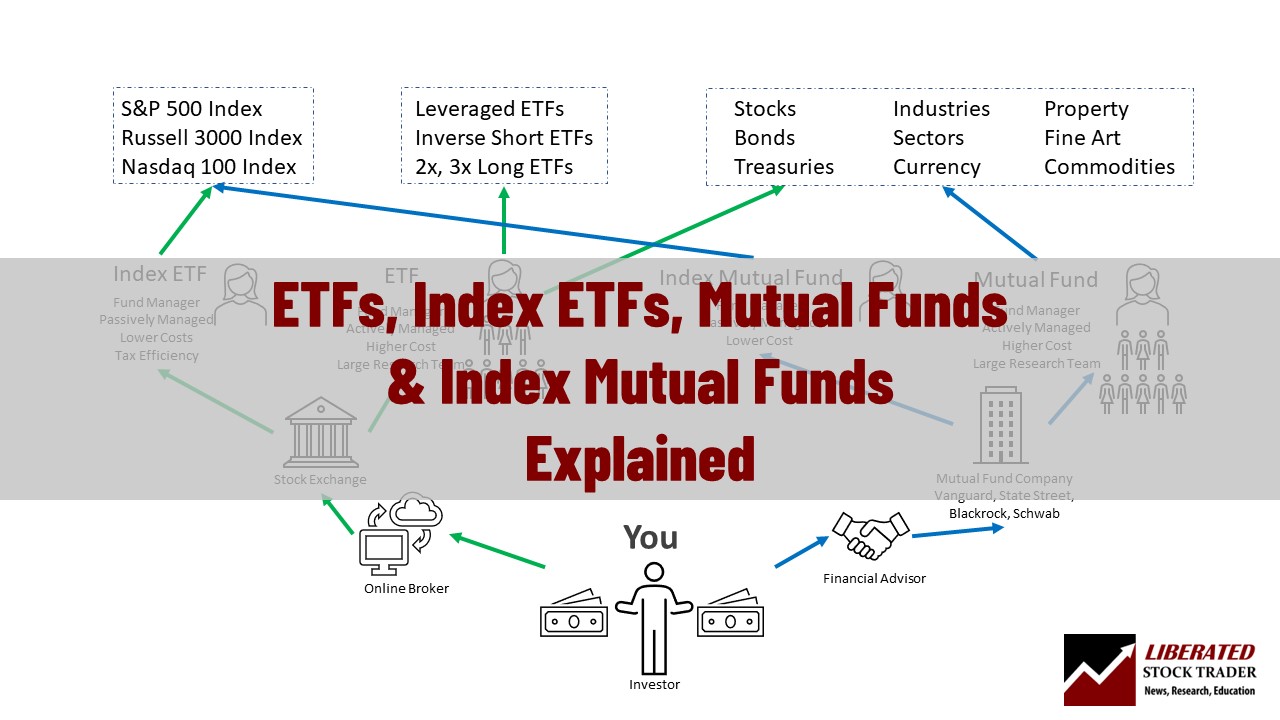

When it comes to investing, index-tracking mutual funds have gained popularity for their low fees and diversification benefits. This article will explore two common types of index-tracking mutual funds: passively managed index funds and exchange-traded funds (ETFs).

Passively Managed Index Funds

Passively managed index funds are designed to replicate the performance of a specific index, such as the S&P 500 or the FTSE 100. They aim to mirror the returns and composition of the index by holding the same securities in the same proportions. Unlike actively managed funds, which rely on a fund manager's expertise to select securities, passively managed index funds follow a rule-based approach.

The primary advantage of passively managed index funds is their low expense ratios. Since they do not require extensive research and analysis, their management fees tend to be lower than actively managed funds. Additionally, they offer broad market exposure, making them an attractive choice for investors seeking diversified portfolios.

Exchange-Traded Funds (ETFs)

Exchange-traded funds, or ETFs, are similar to passively managed index funds in terms of replicating the performance of an index. However, ETFs differ in the way they are traded. Unlike traditional mutual funds, which are bought and sold at the end of the trading day at the net asset value (NAV), ETFs can be bought and sold throughout the trading day on stock exchanges, just like individual stocks.

ETFs offer additional benefits such as intraday liquidity, lower expenses compared to some mutual funds, and the ability to trade options and futures contracts. They also provide access to a wide range of asset classes and market segments. Due to these advantages, ETFs have gained popularity among both institutional and individual investors.

In summary, index-tracking mutual funds offer investors a cost-effective way to gain exposure to various markets and asset classes. Passively managed index funds and ETFs allow investors to participate in the performance of a specific index while minimizing management fees. Understanding the differences between these two types of funds can help investors make informed decisions when building a well-diversified investment portfolio.

Popular Index-Tracking Mutual Funds

Vanguard Total Stock Market Index Fund

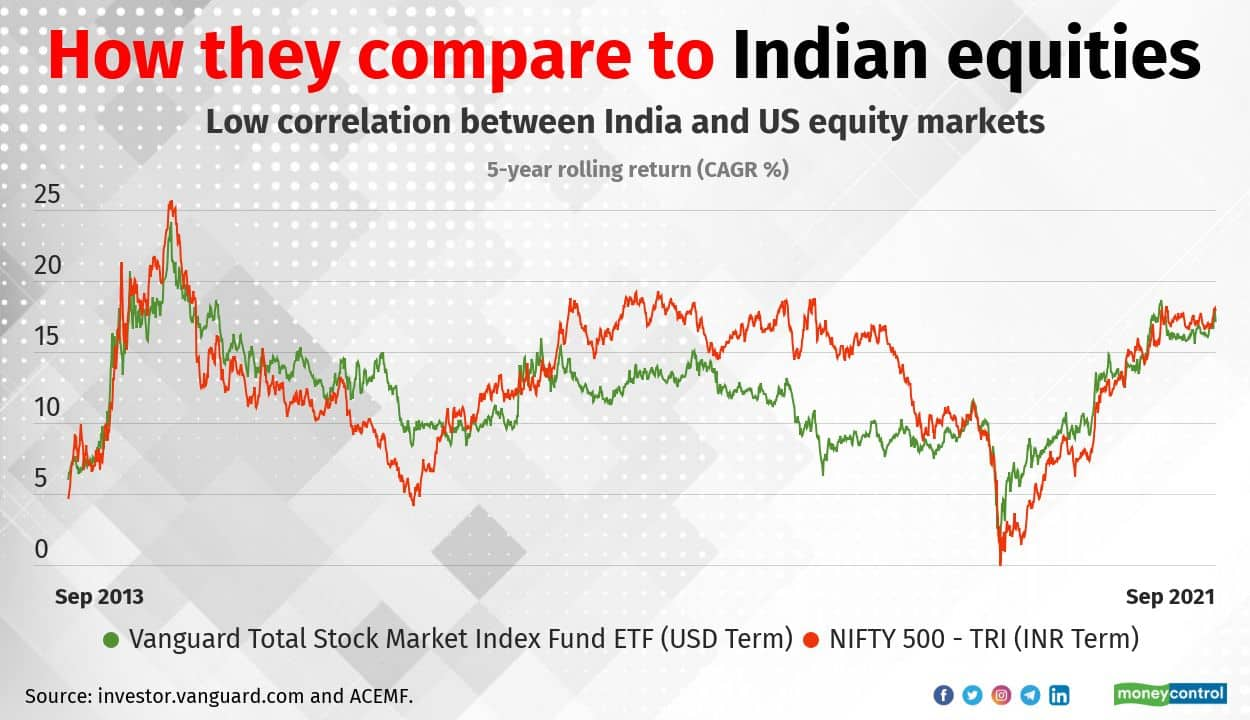

The Vanguard Total Stock Market Index Fund is one of the most popular index-tracking mutual funds available. It aims to track the performance of the CRSP US Total Market Index, which represents approximately 100% of the investable U.S. stock market. The fund provides investors with exposure to a diverse range of large, mid, small, and micro-cap stocks across various sectors.

The key advantages of this fund are its low expense ratio and broad diversification. With an expense ratio significantly lower than the industry average, investors can keep more of their returns. Additionally, the broad diversification that this fund offers helps reduce the risks associated with investing in individual stocks.

Schwab S&P 500 Index Fund

The Schwab S&P 500 Index Fund is another well-known index-tracking mutual fund. It seeks to replicate the performance of the S&P 500 Index, which is composed of 500 of the largest U.S. companies across various sectors. By investing in this fund, investors gain exposure to the overall performance of the U.S. stock market.

This fund is popular among investors due to its low expense ratio and its simplicity. With a diversified portfolio that closely mirrors the S&P 500 Index, investors can achieve broad market exposure with just one investment. The low expense ratio helps maximize returns by minimizing costs.

Both the Vanguard Total Stock Market Index Fund and the Schwab S&P 500 Index Fund are suitable options for investors looking to passively invest in the stock market. These funds allow investors to gain broad market exposure while minimizing costs. It is important to carefully consider the investment objectives, risks, and expenses of each fund before making a decision.

In conclusion, index-tracking mutual funds such as the Vanguard Total Stock Market Index Fund and the Schwab S&P 500 Index Fund provide investors with a cost-effective and diversified way to invest in the stock market. By tracking well-established indices, these funds offer broad market exposure while minimizing the risks associated with investing in individual stocks.

Factors to Consider when Investing in Index-Tracking Mutual Funds

When it comes to investing in mutual funds, index-tracking funds have gained popularity. As an investor, it's crucial to understand the factors that influence the success of this type of investment.

Expense Ratios and Fees

One of the first factors to consider when investing in index-tracking mutual funds is the expense ratio. This ratio represents the percentage of the fund's assets that are used to cover operating expenses. Lower expense ratios mean more of your investment is working for you, rather than being consumed by fees.

In addition to the expense ratio, it's important to be aware of any other fees associated with the fund. This can include transaction fees, account maintenance fees, and sales charges. These fees can significantly impact your returns over time, so it's essential to carefully evaluate them before investing.

Performance and Tracking Error

Another key factor to consider is the fund's performance and tracking error. Performance refers to how well the fund has historically tracked its target index. It's important to compare the fund's performance with its benchmark index to gauge its effectiveness in replicating the index's returns.

Tracking error is a measure of how closely a fund's returns match those of its benchmark index. A lower tracking error indicates a better replication of the index's performance. Before investing, it's important to review a fund's historical tracking error to ensure it aligns with your investment goals.

It's also worth considering the fund's investment strategy. Some index-tracking funds hold all the securities in the target index (replication), while others use sampling techniques to track a representative subset of the index's holdings (optimization). Understanding the fund's strategy can provide insight into its potential limitations and risks.

In conclusion, when investing in index-tracking mutual funds, it's essential to consider the expense ratios and fees associated with the fund, as well as its performance and tracking error. By carefully evaluating these factors and understanding the fund's investment strategy, investors can make informed decisions that align with their financial goals.

Benefits of Investing in Index-Tracking Mutual Funds

Index-tracking mutual funds, also known as passive funds or index funds, offer several benefits for investors. Here are some key advantages of investing in these funds:

-

Diversification: Index-tracking mutual funds provide instant diversification as they aim to replicate the performance of a specific market index. By investing in a single fund, investors gain exposure to a wide range of companies across various sectors, reducing their portfolio's risk.

-

Lower Costs: Compared to actively managed funds, index-tracking mutual funds generally have lower expense ratios. This is because they require less research and decision-making by fund managers since their goal is to mirror the performance of a designated index. Lower costs result in higher net returns for investors over the long term.

-

Consistent Returns: While index-tracking mutual funds may not outperform the market, they are designed to closely match the performance of the underlying index. This can lead to consistent returns over time, especially in stable market conditions.

-

Transparency: Index-tracking funds disclose their holdings regularly, allowing investors to know exactly which securities they own. This transparency enables investors to make informed decisions and understand the risks associated with their investments.

-

Passive Management: Unlike actively managed funds, which involve an investment team actively selecting and managing securities, index-tracking funds follow a passive management strategy. This means they do not rely on individual stock picking or market timing. Passive management can be beneficial for investors seeking long-term, low-maintenance investment options.

Tips for Choosing the Right Index-Tracking Mutual Fund

When selecting an index-tracking mutual fund, consider the following factors:

-

Cost: Compare expense ratios across different funds to find the most cost-effective option. Even a small difference in fees can have a significant impact on long-term returns.

-

Tracking Error: Assess the fund's ability to accurately replicate the performance of the chosen index. Lower tracking error indicates a closer alignment with the index's returns.

-

Asset Size: Consider the fund's asset size and liquidity. Larger funds often have lower expenses and are more liquid, making it easier for investors to buy or sell shares.

-

Diversification: Evaluate the fund's holdings and ensure they provide adequate diversification across sectors and industries.

-

Performance History: Review the fund's historical performance to assess its track record in replicating the index and delivering consistent returns.

By carefully considering these factors and conducting thorough research, investors can choose the right index-tracking mutual fund that aligns with their investment goals and risk tolerance.