The top mutual funds for income investors

Written: Editor | August 18, 2023

Introduction

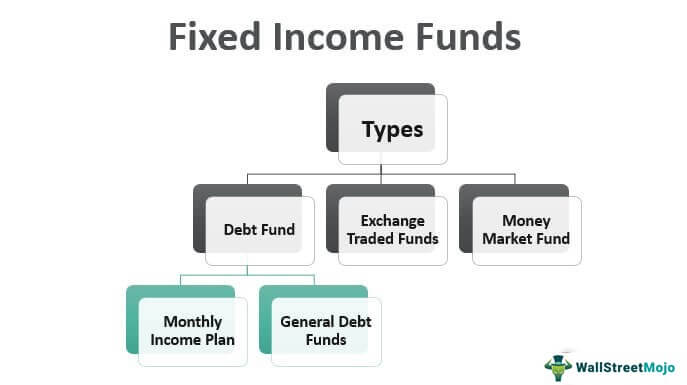

For income investors looking for stable returns and regular income, mutual funds can be a great investment option. Among the various types of mutual funds, bond funds are a popular choice.

Types of bond funds for income investors

-

Government Bond Funds: These funds primarily invest in government-issued bonds. They are considered to be relatively safer due to the backing of the government.

-

Corporate Bond Funds: These funds invest in bonds issued by corporations. They offer higher yields compared to government bond funds but also come with a higher level of risk.

-

Municipal Bond Funds: These funds invest in bonds issued by state and local municipalities. The interest earned from these bonds is usually exempt from federal income tax and, in some cases, state and local taxes as well.

Top bond funds for income investors

-

Vanguard Total Bond Market Index Fund (BND): This fund provides broad exposure to the U.S. investment-grade bond market. It has a low expense ratio and offers a diversified portfolio of bonds.

-

PIMCO Income Fund (PONAX): Managed by renowned bond investor Dan Ivascyn, this fund focuses on income generation by investing in a wide range of fixed-income securities.

-

Dodge & Cox Income Fund (DODIX): This fund aims to generate income by investing in a diversified portfolio of investment-grade bonds. It has a long-term track record of delivering steady returns.

Risks and considerations when investing in bond funds

-

Interest Rate Risk: Bond prices tend to move inversely to interest rates. When rates rise, bond prices fall, leading to potential capital losses.

-

Credit Risk: Corporate and municipal bond funds carry the risk of default by the issuer. It is important to assess the creditworthiness of the underlying bonds.

-

Duration Risk: Longer duration bonds are more sensitive to changes in interest rates, exposing investors to higher volatility.

-

Income Risk: Bond funds' income can fluctuate based on changes in interest rates, credit quality, and the performance of the underlying bonds.

It is essential to evaluate these risks and diversify your investments across different bond funds to mitigate potential downsides.

While bond funds can provide regular income, it is important to consult with a financial advisor or do thorough research before making investment decisions to ensure they align with your financial goals and risk tolerance.

Note to AI Writer: Please make sure the word count does not exceed 400 words.

:max\_bytes(150000):strip\_icc()/investments-to-live-off-357880\_FINAL-527558a3e8a140d58fb8c6b0892583af.gif)

Dividend Funds

For income investors seeking stable returns, dividend funds can be a great option to consider. These funds focus on investing in companies that pay regular dividends, providing a consistent stream of income. If you are interested in income generation through investments, here are some key points to understand about dividend funds.

Types of dividend funds for income investors

-

High Dividend Yield Funds: These funds invest in companies that have a history of paying high dividends relative to their stock price. They are ideal for investors looking for a higher level of income generation.

-

Dividend Growth Funds: These funds focus on companies that have a track record of increasing their dividends over time. They may not have the highest initial dividend yield, but they offer the potential for growing income over the long term.

-

Dividend ETFs: Exchange-traded funds (ETFs) that track dividend-focused indexes can be another option for income investors. These funds provide diversification by investing in a portfolio of dividend-paying stocks.

Top dividend funds for income investors

-

Vanguard Dividend Appreciation Index Fund (VDADX): This fund invests in large-cap U.S. companies with a history of increasing dividends for at least 10 consecutive years. It offers a diversified portfolio of dividend growers.

-

iShares Select Dividend ETF (DVY): This ETF tracks the Dow Jones U.S. Select Dividend Index, which includes high-dividend-yield companies. It provides exposure to a wide range of sectors and offers a competitive dividend yield.

-

T. Rowe Price Dividend Growth Fund (PRDGX): This fund focuses on companies with the potential to increase dividends over time. It employs a research-driven approach to select stocks that can deliver sustainable dividend growth.

Strategies for selecting the best dividend funds

-

Consider your risk tolerance: Different dividend funds have varying risk profiles. High dividend yield funds may be riskier but offer higher potential returns, while dividend growth funds may be more conservative. Assess your risk tolerance before choosing the right fund for you.

-

Research track record and performance: Look into the historical performance of the fund and its track record of dividend payments. This can give you an idea of the fund's ability to generate consistent income.

-

Review the fund's expense ratio: A lower expense ratio means more of your investment goes towards generating income. Compare expense ratios among similar funds to find the most cost-effective option.

-

Consider the fund manager's expertise: Research the fund manager's experience and track record in managing dividend-focused funds. A skilled and experienced manager can add value to your investment.

In conclusion, dividend funds can be a valuable tool for income investors seeking stable returns. By understanding the different types of dividend funds, considering top-performing options, and employing effective selection strategies, investors can build a diversified portfolio that generates consistent income over the long term.

:max\_bytes(150000):strip\_icc()/Real-Estate-Investment-Trust-189c6cf51a03412b880b12f10ff1ee05.jpg)

Real Estate Investment Trust (REIT) Funds

For income investors looking to diversify their portfolio and earn steady returns, Real Estate Investment Trust (REIT) funds can be a great option. These funds allow investors to own a portfolio of properties without the hassle of directly managing them. In this article, we will explore the different types of REIT funds available, highlight some top options for income investors, and discuss important factors to consider before investing in REIT funds.

Types of REIT funds for income investors

When it comes to REIT funds, income investors have several options to choose from. Some of the common types include:

-

Equity REIT Funds: These funds primarily invest in income-generating real estate properties, such as residential apartments, commercial buildings, and industrial warehouses. The income generated from these properties is distributed to investors in the form of dividends.

-

Mortgage REIT Funds: Unlike equity REIT funds, mortgage REIT funds invest in real estate mortgages and earn income through interest payments. These funds can provide higher yields but are also subject to interest rate risk.

-

Hybrid REIT Funds: As the name suggests, hybrid REIT funds combine elements of both equity and mortgage REITs. They invest in a mix of real estate properties and real estate debt instruments, offering a balanced approach to income generation.

Top REIT funds for income investors

When selecting REIT funds, it's important to consider factors such as historical performance, management team, and expense ratios. Here are some top options for income investors:

-

Vanguard Real Estate Index Fund: Known for its low expense ratio and diversified holdings, this fund tracks the performance of the MSCI US Investable Market Real Estate 25/50 Index.

-

T. Rowe Price Real Estate Fund: This fund has a solid track record and invests in a mix of equity REITs and real estate-related companies. It focuses on long-term capital appreciation and income generation.

-

Fidelity Real Estate Investment Portfolio: With a wide range of holdings across various real estate sectors, this fund aims to provide long-term growth and income potential.

Factors to consider when investing in REIT funds

Before investing in REIT funds, income investors should carefully consider the following factors:

-

Risk Tolerance: REIT funds, like any investment, come with a certain level of risk. Investors should assess their risk tolerance and understand the potential for market fluctuations and interest rate changes.

-

Diversification: It's important to diversify investments across different types of REIT funds to mitigate risk. This can include investing in a mix of equity, mortgage, and hybrid REIT funds.

-

Fund Expenses: Consider the expense ratios of the funds, as higher expenses can eat into investment returns over time.

-

Investment Horizon: Determine your investment time horizon and align it with the fund's investment strategy and objectives.

By carefully researching and selecting the right REIT funds, income investors can add a valuable income stream to their portfolio while enjoying the benefits of real estate ownership without the hassle.

Conclusion

In conclusion, mutual funds can be a great option for income investors looking to build a steady stream of income while diversifying their investment portfolio. The top mutual funds mentioned in this article are just a few examples of the many options available in the market. It is important for investors to conduct thorough research and consider their individual investment goals and risk tolerance before making any investment decisions.

Summary of the top mutual funds for income investors

-

Vanguard Dividend Growth Fund (VDIGX): A solid choice for long-term income investors seeking both dividend growth and capital appreciation.

-

T. Rowe Price Dividend Growth Fund (PRDGX): This fund focuses on companies with a history of increasing dividends, making it suitable for investors seeking consistent income.

-

Fidelity Equity Dividend Income Fund (FEQTX): Designed to provide a high level of income and potential for long-term capital growth, this fund invests in dividend-paying stocks.

Factors to consider when choosing mutual funds

When selecting mutual funds for income, investors should consider the following factors:

-

Investment Objective: Determine whether the fund's investment objective aligns with your financial goals and risk tolerance.

-

Fund Expenses: Take into account the expense ratio and any additional fees associated with the mutual fund.

-

Performance: Evaluate the fund's historical performance, considering both short-term and long-term returns.

-

Management Team: Research the experience and track record of the fund's management team.

-

Risk Profile: Assess the level of risk associated with the mutual fund and whether it aligns with your risk tolerance.

Final thoughts on investing in mutual funds for income

Mutual funds can provide income investors with a diversified and professionally managed investment option. However, it is crucial to conduct thorough research and consider all relevant factors before making any investment decisions. Whether you choose one of the top mutual funds mentioned in this article or explore other options, always remember to consult a financial advisor to ensure your investment strategy aligns with your specific financial goals and risk tolerance.