How to save for retirement when you’re starting late

Written: Editor | July 31, 2023

Strategies for Catching Up

Increasing contributions and maxing out retirement accounts

If you're starting to save for retirement late, one of the best strategies is to ramp up your contributions. Make it a priority to save as much as possible to catch up on lost time. Take advantage of retirement accounts, such as an Individual Retirement Account (IRA) or a workplace-sponsored 401(k) plan. Consider making the maximum annual contributions allowed by these accounts. By doing so, you'll be able to make the most of the tax advantages and potential investment growth.

Taking advantage of employer matching contributions

If your employer offers a matching contribution to your retirement account, this is an opportunity that you shouldn't miss. Make sure you contribute enough to receive the full match, as it's essentially free money. This can significantly boost your retirement savings without requiring additional funds from your own pocket.

Investing aggressively for potential higher returns

When you're catching up on retirement savings, you may need to take a more aggressive approach to investing. This means allocating a larger portion of your portfolio to higher-risk investments, such as stocks. Although this comes with increased volatility, the potential for higher returns can help you achieve your retirement goals faster. However, it's crucial to assess your risk tolerance and consult with a financial advisor to ensure that your investment strategy aligns with your goals and circumstances.

Remember, starting late doesn't mean you can't catch up. By implementing these strategies, you can still make significant progress towards a comfortable retirement. Be disciplined with your savings and investments, and seek professional guidance if needed. With a proactive approach, you can secure your financial future, even if you're getting a late start.

(Note: Please note that the information provided in this article is for informational purposes only and should not be considered as financial advice. It's always recommended to consult with a financial professional regarding your specific situation.)

Lifestyle Adjustments

Reducing unnecessary expenses and prioritizing savings

Saving for retirement when starting late requires some lifestyle adjustments. One of the first steps is to take a close look at your expenses and identify areas where you can cut back. Review your monthly budget and identify any unnecessary expenses that can be eliminated or reduced. This could include eating out less, canceling unused subscriptions, or finding more affordable alternatives for certain services or products. By prioritizing savings and redirecting the money towards your retirement fund, you can start building a nest egg even if you're starting late.

Delaying retirement age or working part-time during retirement

If you have started saving for retirement late, it may be necessary to consider delaying your retirement age. This allows you to continue earning and contributing to your retirement fund for a longer period. Additionally, you can choose to work part-time during retirement to supplement your income and continue building savings. This not only provides financial stability but also allows you to enjoy a more comfortable retirement in the future.

Considering downsizing or relocating to reduce living costs

Another option to save for retirement when starting late is to consider downsizing or relocating to reduce living costs. This could involve moving to a smaller home or a more affordable location with a lower cost of living. By reducing expenses such as mortgage or rent payments, utility bills, and property taxes, you can free up more money to allocate towards your retirement savings. Downsizing or relocating may also offer the opportunity to liquidate assets and contribute the proceeds into your retirement fund.

Overall, starting late in saving for retirement requires making lifestyle adjustments and being proactive in maximizing your savings potential. By reducing unnecessary expenses, delaying retirement age or working part-time, and considering downsizing or relocating, you can still build a solid retirement fund and secure your financial future. Remember, every contribution counts, and it's never too late to start saving for retirement.

Seeking Professional Guidance

Are you starting late on saving for retirement? Don't worry, you still have options! It's never too late to plan for your future, and seeking professional guidance can help you make the most of your savings. Here are some key steps to consider:

Working with a financial advisor or retirement planner

Find a trusted expert: A financial advisor or retirement planner can provide guidance tailored to your specific situation. They can assess your current financial status, help you set realistic retirement goals, and develop a personalized plan to achieve them. Their expertise can be invaluable when starting late.

Understanding retirement investment options and risk management

Educate yourself: Familiarize yourself with different retirement investment options, such as individual retirement accounts (IRAs), 401(k)s, or annuities. Each comes with its own advantages and risks, so it's crucial to understand them before making any decisions. A financial advisor can help you assess which options are suitable for your goals and risk tolerance.

Creating a diversified portfolio for long-term growth

Diversify your investments: It's essential to spread your investments across various asset classes, such as stocks, bonds, and real estate. Diversification can help mitigate risk and maximize potential returns. Working with a financial advisor can help you create a well-balanced portfolio tailored to your needs.

Remember, starting late doesn't mean you have to panic. With the right guidance and strategy, you can still build a sufficient retirement nest egg. Saving more aggressively, cutting unnecessary expenses, and considering additional income sources can also help boost your retirement savings.

It's crucial to take action as soon as possible and establish a clear plan for your retirement. Seeking professional advice can provide expert guidance, ensure you make informed choices, and give you peace of mind as you work towards your financial goals.

So don't hesitate – start today and secure your financial future!

Making the Most of Retirement Savings

Creating a realistic retirement budget

If you've started saving for retirement late, don't panic. There's still plenty you can do to ensure a comfortable retirement. The first step is to create a realistic retirement budget that takes into account your financial situation and future goals. Assess your current expenses and estimate your future expenses during retirement. This will help you determine how much you need to save and how long your savings will last.

Exploring supplemental income and passive income streams

In addition to saving, it's worth exploring supplemental income and passive income streams. Consider taking on a part-time job or freelancing to boost your income. This extra income can go directly into your retirement savings, allowing you to catch up faster. You can also look into passive income opportunities, such as investing in real estate or starting a side business. These income streams can provide you with ongoing revenue even after retirement.

Adapting investment strategies as retirement approaches

As retirement approaches, it's essential to review and adapt your investment strategies. You may want to shift from high-risk investments to more conservative options to protect your savings. Consult with a financial advisor who can help you make informed decisions based on your specific situation. It's also important to regularly monitor your portfolio and make adjustments as needed. Stay informed about market trends and seek professional guidance to maximize your retirement savings.

Remember, it's never too late to start saving for retirement, but you'll need to be proactive and make strategic choices. Stick to your budget, explore additional income opportunities, and adjust your investments as you approach retirement. With careful planning and disciplined saving, you can still achieve a secure and fulfilling retirement.

Note: The information provided here is for general informational purposes only and should not be considered as financial advice. Please consult with a professional advisor before making financial decisions.

Conclusion

So you've realized that you're behind on your retirement savings. Don't panic! While it's true that starting late can make it a bit more challenging, there are still plenty of proactive steps you can take to secure a comfortable financial future.

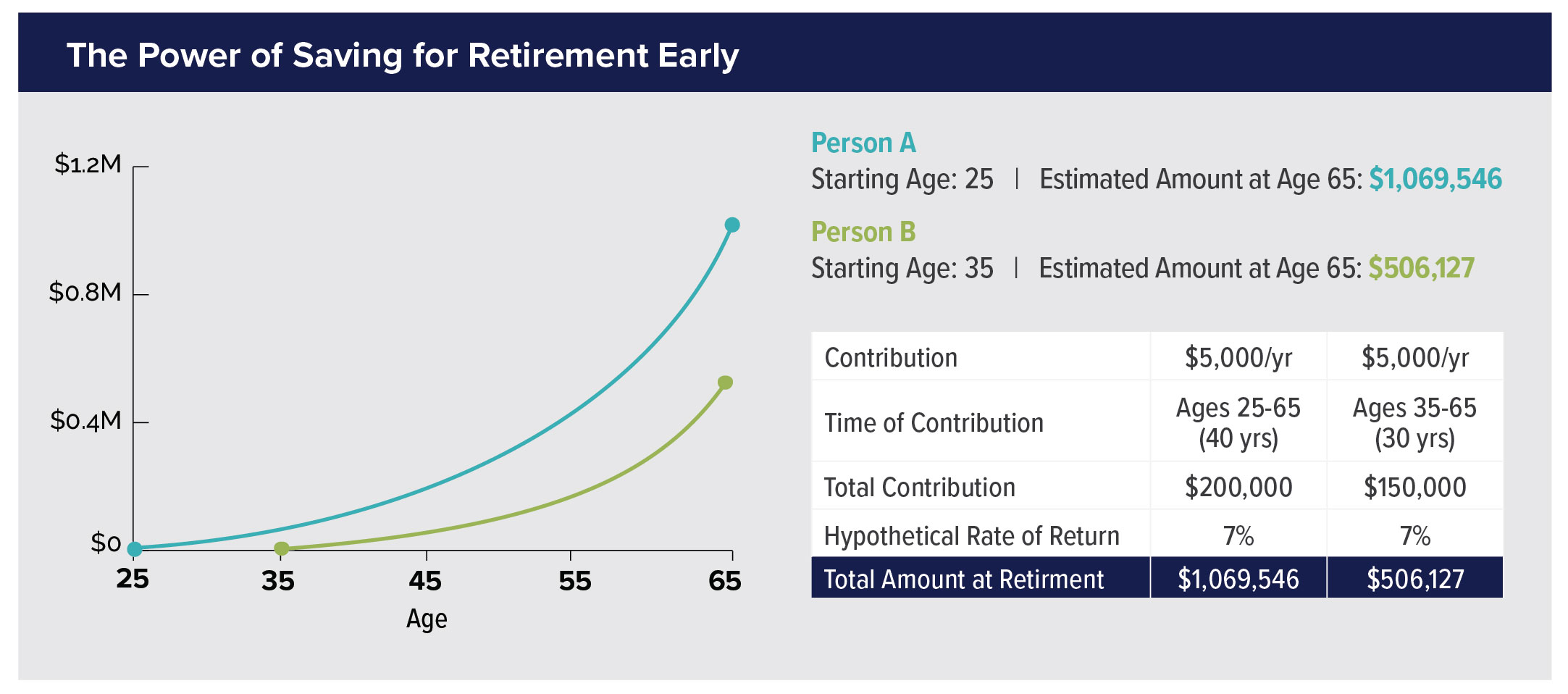

Emphasizing the importance of starting retirement savings early

Yes, it's true that starting early is ideal when it comes to retirement savings, but that doesn't mean all hope is lost if you haven't. The earlier you start, the more time your money has to grow through the power of compound interest. However, even if you're starting late, it's important to begin saving as soon as possible to take advantage of the time you do have left.

Taking proactive steps for a secure financial future

-

Maximize Contributions: If you haven't been contributing the maximum amount to your retirement accounts, now is the time to increase your contributions. Take advantage of catch-up contributions available to individuals aged 50 and over.

-

Delay Retirement: Consider delaying your retirement age if possible. This will allow you to continue earning income and increase your retirement savings.

-

Invest Strategically: Review your investment strategy to ensure it aligns with your goals and risk tolerance. Seek professional advice if needed to make informed choices.

Common mistakes to avoid when saving for retirement late

-

Panic: Panicking and making impulsive financial decisions can lead to poor choices. Stay calm and focus on taking action.

-

Overlooking Expenses: Take a hard look at your current expenses and identify areas where you can cut back. Every dollar you save can be put towards your retirement savings.

-

Neglecting Debt: Prioritize paying off high-interest debt as it can eat into your retirement savings. Create a plan to tackle your debts systematically.

Remember, it's never too late to start saving for retirement. Take control of your financial future today, and you'll be on the path to a secure retirement.