The Simplest Money-Saving Plan That Anyone Can Follow

Written: Editor | May 10, 2023

Setting Financial Goals

When it comes to saving money, having a plan is essential. Creating a simple money-saving plan can help you take control of your finances and achieve your financial goals. Here are some key steps to consider:

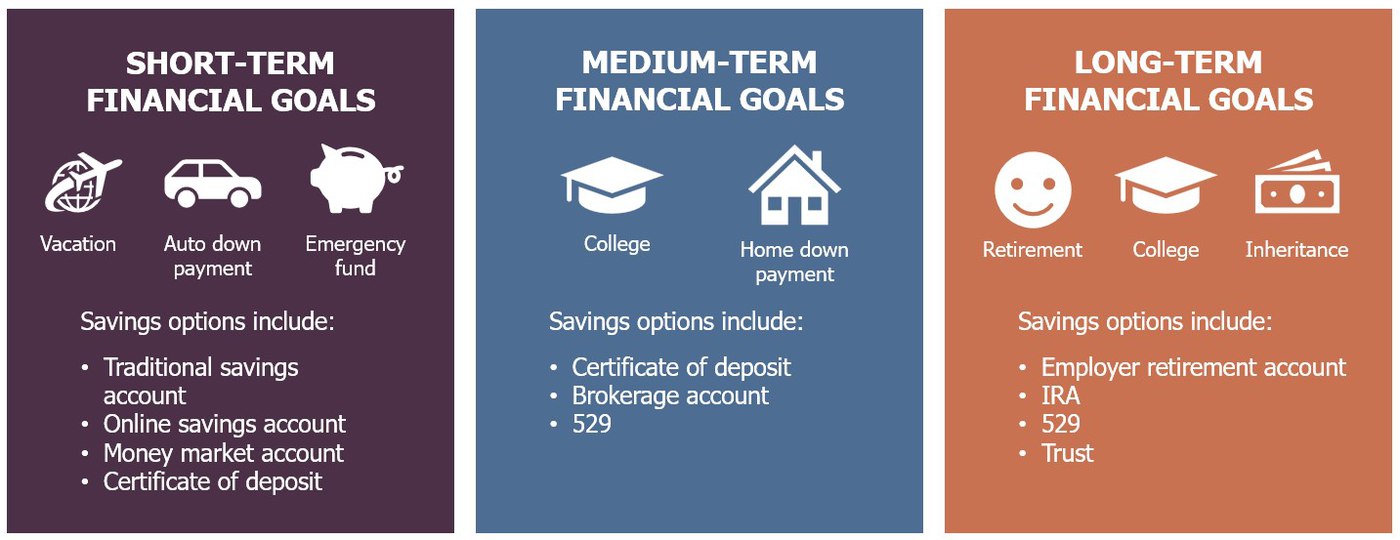

Identifying short-term and long-term financial goals

Start by identifying your financial goals, both short-term and long-term. Short-term goals may include paying off debts or saving for a vacation, while long-term goals may include buying a home or planning for retirement. Setting specific and achievable goals will give you a clear target to work towards.

Strategies for achieving your goals

Once you have identified your financial goals, it's time to develop strategies to achieve them. This may include cutting back on unnecessary expenses, finding ways to increase your income, or automating your savings. Consider seeking professional advice or guidance to help you develop a personalized plan that aligns with your goals.

Creating a realistic budget

A realistic budget is key to saving money effectively. Take the time to analyze your income and expenses, and identify areas where you can cut back. Set a realistic savings target each month and allocate funds towards your financial goals. Remember to track your spending regularly and make adjustments as needed.

By following these steps and sticking to your plan, you can create a simple money-saving plan that works for you. Remember that saving money is a gradual process, and consistency is key. With dedication and a clear plan, you can achieve your financial goals and build a more secure future.

Implementing Simple Money-Saving Strategies

Are you looking for a simple and effective way to save money? With the right strategies and mindset, you can start building your savings without feeling overwhelmed. Here are some key tips to help you implement a simple money-saving plan.

Automating savings

One of the easiest ways to save money is by automating your savings. Set up automatic transfers from your checking account to a separate savings account. By doing this, you ensure that a portion of your income goes directly into savings without you having to think about it. This allows you to effortlessly build up your savings over time.

Cutting back on discretionary expenses

A major part of any money-saving plan is reducing discretionary expenses. Take a close look at your spending habits and identify areas where you can cut back. This could include eating out less frequently, canceling unused subscriptions, or finding more affordable alternatives for your everyday expenses. By making small changes to your spending habits, you can save a significant amount of money in the long run.

Tracking daily expenses

To better understand where your money is going, it's important to track your daily expenses. Keep a record of everything you spend, whether it's a cup of coffee or a new pair of shoes. This will help you identify any unnecessary or impulse purchases that you can eliminate. Additionally, tracking your expenses allows you to set realistic budgets and stay on track with your savings goals.

Implementing a simple money-saving plan doesn't have to be complicated. By automating your savings, cutting back on discretionary expenses, and tracking your daily expenses, you can start building your savings and achieve financial peace of mind. Remember, every little step counts when it comes to saving money.

Practical Tips for Saving Money

Saving on groceries and household items

When it comes to saving money, one of the first areas to look at is your grocery and household expenses. Here are a few tips to help you cut costs in this area:

-

Make a shopping list: Plan your meals for the week and create a shopping list based on that. Stick to the list and avoid impulse buying.

-

Compare prices: Before making a purchase, compare prices at different stores or online. Look for sales and discounts to save even more.

-

Buy generic or store brands: Many generic or store brands offer the same quality as name brands but at a lower price. Give them a try and see if you notice any difference.

Reducing utility bills

Your utility bills can add up quickly, but there are ways to reduce them and save money in the long run. Consider these ideas:

-

Energy-efficient appliances: Replace old, energy-consuming appliances with energy-efficient ones. They may have a higher upfront cost but will save you money on your monthly bills.

-

Adjust thermostat settings: Lowering your thermostat by a few degrees in the winter and raising it in the summer can significantly reduce your heating and cooling costs.

-

Unplug unused electronics: Electronics continue to consume energy even when they're turned off. Unplug them when not in use or use power strips with surge protectors to easily turn them off.

Earning extra income through side hustles

In addition to cutting expenses, finding ways to earn extra income can help boost your savings. Consider these side hustles:

-

Freelancing or consulting: Leverage your skills and offer services on freelance platforms or as a consultant. This can be anything from writing and graphic design to coaching or tutoring.

-

Rent out unused space: If you have a spare room, consider renting it out on platforms like Airbnb. You can also rent out your car or other assets you don't use frequently.

-

Start an online business: The internet opens up endless possibilities for starting a small online business. You can sell handmade products, offer virtual services, or create an online course.

By implementing these practical tips, you can start saving money and making progress towards your financial goals. Remember, even small changes can add up over time.

Building a Savings Habit

When it comes to saving money, starting with a simple plan can make a big difference in your financial future. Developing a savings habit is essential for achieving your financial goals and gaining financial security.

Creating a savings routine

-

Set a goal: Determine how much you want to save and by when. A specific and measurable goal will help you stay focused and motivated.

-

Automate your savings: Set up automatic transfers from your checking account to a separate savings account. This way, you'll save money without even thinking about it.

-

Track your expenses: Keep a record of your spending to identify areas where you can cut back. Small changes, like reducing eating out or canceling unnecessary subscriptions, can add up over time.

Rewarding yourself for reaching milestones

-

Celebrate small victories: When you reach a savings milestone, treat yourself to something affordable and enjoyable. It's important to acknowledge your progress and stay motivated.

-

Visualize your goal: Create a visual representation of your savings goal, such as a chart or a picture. Seeing your progress can inspire you to keep going.

Overcoming challenges and staying motivated

-

Stay accountable: Share your savings goals with a friend or family member who can provide support and encouragement. Being accountable to someone else will help you stay on track.

-

Stay flexible: Life can throw unexpected expenses your way. Be prepared to adjust your savings plan if needed, but always strive to keep saving.

-

Stay inspired: Read personal finance books or listen to podcasts that offer tips and success stories. Surrounding yourself with positive financial content will help you stay motivated.

Remember, every small step you take towards saving money will make a difference in the long run. Start building your savings habit today and watch your financial future grow!

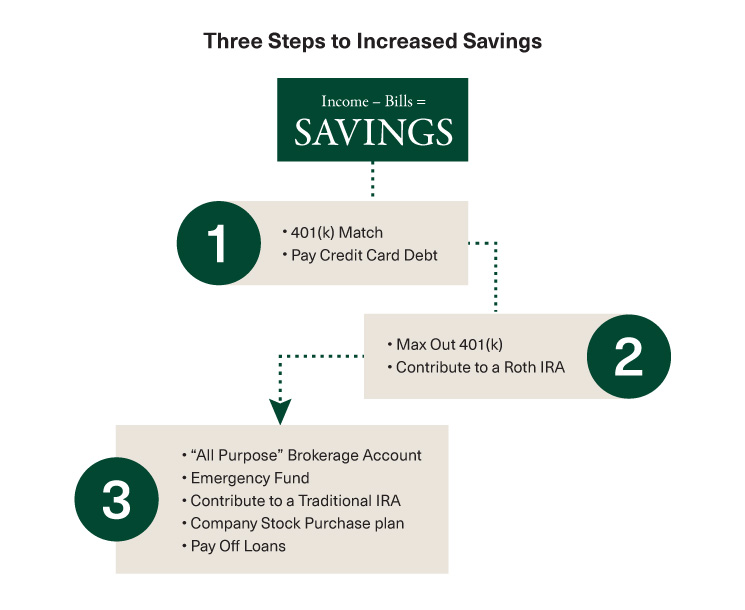

Making Smart Investments

When it comes to saving money, having a plan is crucial for success. One of the simplest and most effective ways to save money is by making smart investments. By understanding different investment options and diversifying your portfolio, you can maximize your savings and achieve your financial goals.

Understanding different investment options

There are various investment options available, each with its own advantages and risks. Some common investment options include stocks, bonds, mutual funds, real estate, and retirement accounts. It's important to research and understand each option before making any investment decisions. Consider factors such as potential returns, risks, and your own investment goals. Consulting with a financial advisor can also provide valuable guidance in choosing the right investment strategy for you.

Diversifying your portfolio

Diversification is key in reducing investment risk and maximizing returns. Instead of putting all your eggs in one basket, diversifying your portfolio means spreading your investments across different asset classes and sectors. For example, instead of investing solely in stocks, you can also consider bonds, real estate, or other investment vehicles. This approach helps mitigate the impact of market fluctuations and reduces the likelihood of suffering significant losses.

By diversifying your investments, you increase the potential for long-term growth and reduce the impact of any one investment performing poorly. This strategy is especially important during periods of market volatility. Regularly reviewing and rebalancing your portfolio can help ensure that it stays aligned with your goals and risk tolerance.

Remember, making smart investments requires careful consideration and understanding of your financial situation and goals. By taking the time to educate yourself and seek professional advice, you can develop a money-saving plan that suits your needs and sets you on the path to financial success.

Monitoring and Adjusting Your Money Saving Plan

Creating a money saving plan is a great first step, but the key to success lies in consistently monitoring and adjusting your plan as needed. By regularly reviewing your progress and making necessary adjustments to your budget, you can ensure that you stay on track and reach your savings goals.

Reviewing your progress regularly

To effectively monitor your money saving plan, it's important to review your progress on a regular basis. This can be done monthly or quarterly, depending on your preferences. Take the time to assess how well you've stuck to your budget and track your savings. This will help you identify any areas where you may be overspending or falling behind on your goals.

Making necessary adjustments to your budget

As you review your progress, you may find that you need to make adjustments to your budget. Life is full of unexpected expenses, and your financial situation may change over time. If you find that you're not saving as much as you had hoped, take a look at where you can cut back or find ways to increase your income. This might involve reducing discretionary spending, finding ways to save on monthly bills, or exploring additional sources of income.

By regularly monitoring and adjusting your money saving plan, you can ensure that it remains effective and aligned with your financial goals. Remember, saving money is a journey, and it's okay to make changes along the way. Stay committed and keep striving towards your savings goals, and you will reap the rewards in the long run.

Conclusion

Embarking on a money-saving journey may seem daunting, but it's a crucial step towards achieving financial security. By starting a simple savings plan today and adopting sustainable habits, you can pave the way for a more prosperous future.

The importance of starting a money saving plan today

Taking control of your finances and starting a savings plan is essential for several reasons:

-

Building an emergency fund: Life is full of unexpected events, and having an emergency fund can provide a safety net during those challenging times.

-

Reaching financial goals: Whether you aspire to buy a house, start a business, or travel the world, saving money is a fundamental step towards achieving your dreams.

-

Peace of mind: Knowing that you have financial security and a plan in place can relieve stress and allow you to focus on other aspects of your life.

Tips for sustaining your savings habit in the long run

To ensure your money-saving journey is successful in the long run, consider the following tips:

-

Set realistic goals: Start with small, achievable targets and gradually increase your savings as you become more comfortable.

-

Create a budget: Track your spending habits and identify areas where you can cut back. This will free up more money for saving.

-

Automate your savings: Set up automatic transfers from your checking account to your savings account to ensure consistency and eliminate the temptation to spend.

Final thoughts on achieving financial security

Saving money is not just about frugality; it's about securing your financial future. By adopting a simple money-saving plan and being consistent in your efforts, you can take control of your finances and build a better life for yourself and your loved ones. Start today, stay committed, and watch as your savings grow.