Retirement planning for singles: Challenges and solutions

Written: Editor | August 22, 2023

Building a Strong Financial Foundation

When it comes to retirement planning, singles face unique challenges and opportunities. While they may not have the advantage of a dual income or a spouse to share expenses and savings with, they also have the freedom to make independent financial decisions. By taking the right steps, singles can build a strong financial foundation for a secure retirement.

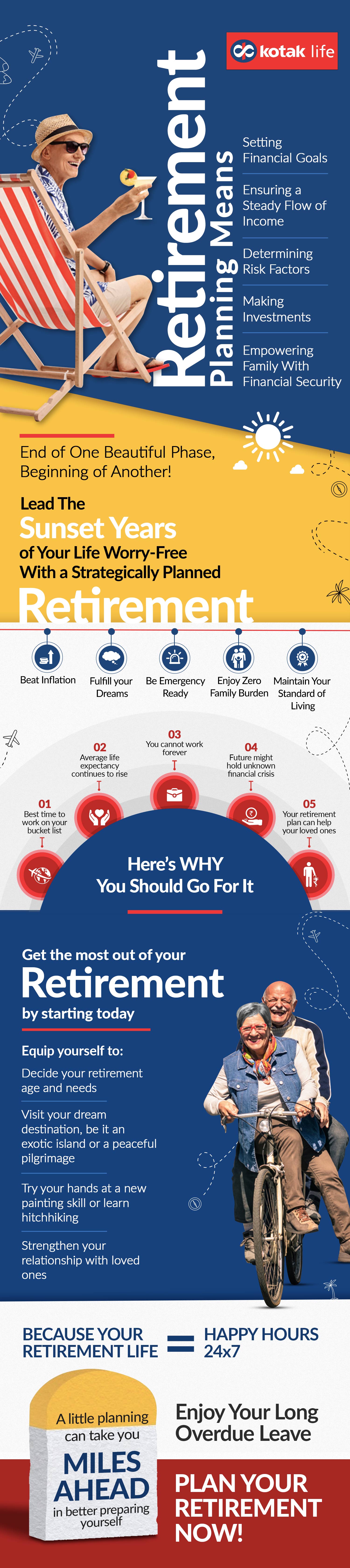

Setting financial goals for retirement as a single person

As a single individual, it's essential to set specific financial goals for retirement. Consider factors such as desired retirement age, lifestyle expectations, and healthcare expenses. Plan and save accordingly, taking into account the impact of inflation and the potential need for long-term care.

Creating a budget and managing expenses

Creating a budget is crucial for singles to have a clear understanding of their income, expenses, and savings potential. It helps identify areas where expenses can be reduced or eliminated. By being mindful of spending habits and making smart financial choices, singles can maximize their savings and stay on track with their retirement goals.

Building an emergency fund

Having an emergency fund is essential for all individuals, especially singles who may not have a fallback option during unexpected financial situations. Aim to save at least three to six months' worth of living expenses in a separate savings account. This emergency fund will provide a safety net and prevent the need to dip into retirement savings prematurely.

By diligently setting financial goals, creating a budget, and building an emergency fund, singles can pave the way for a financially secure and comfortable retirement.

Investment Strategies for Singles

Understanding risk tolerance and time horizon

When planning for retirement as a single individual, it's crucial to assess your risk tolerance and time horizon. Risk tolerance refers to your ability to handle fluctuations in the value of your investments. It's important to choose investments that align with your comfort level and financial goals. Similarly, determining your time horizon helps to determine the appropriate investment strategies. Singles often have longer time horizons compared to couples, so they can take advantage of higher-risk, higher-return investments.

Diversifying investment portfolio for long-term growth

Diversification is a key strategy for singles planning for retirement. By spreading your investments across different asset classes, such as stocks, bonds, and real estate, you can reduce the impact of any single investment performing poorly. This helps to protect your portfolio and maximize potential returns over the long term. Investing in index funds or exchange-traded funds (ETFs) can be a good option for diversification.

Exploring retirement savings options (IRA, 401(k), etc.)

Singles should take advantage of retirement savings options available to them, such as Individual Retirement Accounts (IRAs) and employer-sponsored 401(k) plans. These accounts offer tax advantages and can help grow your savings faster. Consider contributing the maximum amount possible to these accounts each year to take full advantage of the benefits. Additionally, if you're self-employed, look into options like a Simplified Employee Pension (SEP) IRA or a solo 401(k) plan.

By understanding risk tolerance, diversifying your investment portfolio, and exploring retirement savings options, singles can create a solid retirement plan that aligns with their financial goals and future needs.

:max\_bytes(150000):strip\_icc()/what-singles-need-to-know-estate-planning-2000-a2129e86464f4f02a935e3b10c274154.jpg)

Estate Planning and Long-Term Care

Importance of having an estate plan as a single individual

Retirement planning is essential for everyone, including singles. As a single individual, it's crucial to have an estate plan in place to ensure your assets are distributed according to your wishes after you're gone. Without an estate plan, state laws will determine how your assets are distributed, which may not align with your intentions.

Choosing a power of attorney and healthcare proxy

When it comes to estate planning, singles need to consider who will make important decisions on their behalf in case of incapacity. Choosing a power of attorney allows someone you trust to manage your financial affairs, while a healthcare proxy can make healthcare decisions on your behalf. It's important to select individuals who understand your values and are willing to act in your best interests.

Considering long-term care insurance options

Long-term care is another aspect that singles should take into account when planning for retirement. Since singles don't have a spouse or partner to rely on for support, having long-term care insurance can provide financial assistance in case of medical emergencies or extended care needs. This type of insurance can help protect your assets and ensure you receive the care you need.

Overall, singles should prioritize estate planning, choose trusted individuals for power of attorney and healthcare proxy roles, and consider long-term care insurance options to secure a comfortable retirement and future. It's essential to consult with a professional financial advisor or an estate planning attorney to tailor a plan that meets your specific needs and goals.

Maximizing Social Security Benefits for Singles

Understanding social security benefits for singles

Retirement planning for singles requires careful consideration of social security benefits. Since singles do not have the option of relying on a spouse's benefits, it's essential to understand how to make the most out of their own benefits.

Singles are eligible for the same social security benefits as married individuals. These benefits are based on the individual's earnings record and the age at which they decide to start receiving benefits. It's important to note that starting benefits early can result in a reduced monthly benefit, while delaying benefits can lead to larger monthly payments.

Strategies to maximize social security benefits

There are a few strategies that singles can employ to maximize their social security benefits:

-

Delaying claiming benefits: By waiting until full retirement age or even beyond, singles can receive a higher monthly benefit amount. This strategy can be particularly advantageous for those with longer life expectancies.

-

Maximizing earnings: Singles can increase their future benefits by maximizing their earnings during their working years. This can be achieved through career advancement, additional education, or starting a business.

-

Consider spousal benefits: If singles were previously married for at least 10 years, they may be eligible for spousal benefits based on their ex-spouse's earnings record. This can provide an additional source of income during retirement.

-

Seek professional advice: Due to the complexities involved in maximizing social security benefits, singles should consider consulting with a financial advisor or retirement planning professional. They can provide personalized guidance based on individual circumstances.

By understanding social security benefits and employing effective strategies, singles can ensure a more financially secure retirement.

Health Insurance and Healthcare Costs

Navigating health insurance options for singles

Retirement planning can be a daunting task, especially for singles who don't have a partner to rely on. One crucial aspect to consider is health insurance coverage. Singles who don't have access to employer-sponsored insurance will need to navigate the individual health insurance market.

It is essential to research different health insurance options and compare their costs and coverage. Websites like Healthcare.gov can provide a wealth of information on available plans and subsidies for those who qualify. Additionally, exploring options through professional associations or organizations like AARP can also be beneficial.

Addressing potential healthcare costs in retirement

Healthcare costs can be a significant financial burden in retirement, and singles should plan accordingly. Some key points to consider are:

-

Medicare: Singles should understand the basics of Medicare and know the importance of enrolling during the initial enrollment period. Familiarize yourself with the different parts of Medicare, such as Part A, Part B, and Part D prescription drug coverage.

-

Long-term care insurance: Consider investing in long-term care insurance to protect against the potential high costs of in-home care or assisted living facilities in the future.

-

Health savings accounts (HSAs): If eligible, singles can utilize HSAs to save for medical expenses in retirement. HSAs offer tax benefits and can be used to cover various medical costs.

By proactively researching health insurance options and planning for potential healthcare expenses, singles can better navigate the complexities of retirement planning and ensure financial security in their golden years.

Creating a Support Network and Social Connections

Retirement can be a fulfilling and enjoyable phase of life for singles. However, it is crucial for singles to plan ahead and create a support network to navigate the emotional and financial aspects of retirement successfully.

Building a support network for emotional and financial support

-

Family and Friends: Reach out to family members and friends who can provide emotional support during retirement. Having a strong support system can help manage any feelings of loneliness or isolation that may arise.

-

Financial Advisor: Working with a financial advisor specializing in retirement planning can be beneficial for singles. They can offer guidance on investments, budgeting, and developing a retirement income strategy to ensure financial stability.

-

Networking Groups: Joining local networking groups or online communities for retirees can provide opportunities to meet others in similar situations. These groups can offer valuable advice and support on various retirement topics.

Exploring social opportunities and staying connected in retirement

-

Volunteer Work: Engaging in volunteer activities not only gives a sense of purpose but also provides opportunities to meet new people and make a positive impact on the community.

-

Join Clubs or Organizations: Participating in clubs or organizations based on personal interests, such as book clubs, fitness groups, or hobby-based communities, can help singles form new social connections.

-

Take Classes or Workshops: Continuing education classes or workshops can offer opportunities to learn new skills, meet like-minded individuals, and expand social networks.

It is important for singles to proactively build a support network and explore social opportunities in retirement. By doing so, they can ensure emotional well-being and a fulfilling retirement experience.

Adjusting Retirement Plans as a Single Person

When it comes to retirement planning, singles face unique challenges. Without the support of a partner, it's essential to take specific steps to ensure a comfortable and fulfilling retirement. Here are some key considerations for those planning for retirement as a single person.

Reviewing and updating retirement plans as life circumstances change

To effectively plan for retirement as a single person, regularly reviewing and updating your retirement plans is crucial. Life circumstances such as job changes, health issues, and financial goals can change over time, requiring adjustments to your retirement strategy. It's essential to reassess your savings, investments, and retirement income sources to make sure they align with your current situation.

Considering alternative retirement lifestyles and living arrangements

As a single person in retirement, you have the flexibility to explore alternative retirement lifestyles and living arrangements. Downsizing your home, moving to a more affordable location, or exploring co-housing options are all viable options to stretch your retirement savings. Additionally, joining social or interest-based groups can help mitigate the potential feelings of loneliness that some singles may experience during retirement.

By adapting your retirement plans to fit your unique circumstances and exploring alternative lifestyle options, you can ensure a rewarding and fulfilling retirement as a single person. Taking proactive steps to secure your financial future and embracing new experiences can help you make the most of this exciting chapter in your life.

Conclusion

In conclusion, retirement planning is crucial for singles as they navigate their financial future. By starting early and considering important factors such as budgeting, savings, and investments, singles can secure a comfortable retirement. It is important to set clear retirement goals, seek professional advice, and regularly review and adjust the financial plan.

Importance of early retirement planning for singles

Financial Stability:

Planning for retirement early allows singles to build a strong financial foundation. By maximizing contributions to retirement accounts and establishing a disciplined savings habit, singles can accumulate sufficient wealth to support their expenses during retirement.

Longer Time Horizon:

Singles typically have a longer time horizon for retirement planning compared to couples. This provides an opportunity to benefit from compounding interest and higher returns on investments over the years.

Flexibility and Independence:

Retirement planning for singles offers greater flexibility and independence in financial decision-making. Singles have the freedom to choose their retirement lifestyle, travel, and pursue personal interests without the need to consult a partner.

Frequently Asked Questions

Q: Should singles consider long-term care insurance for retirement planning?

A: Yes, long-term care insurance can provide financial protection in case of future medical needs. It is advisable for singles to evaluate this option as part of their retirement plan.

Q: Are there specific retirement savings strategies for singles?

A: Singles can consider strategies such as maximizing contributions to retirement accounts, diversifying investments, and exploring additional income streams to bolster their retirement savings.

Q: How can singles ensure a comfortable retirement without a spouse's income?A: By diligently saving, considering downsizing options, and implementing an effective investment plan, singles can build a sufficient nest egg to support their retirement lifestyle without relying on a partner's income.