How to Pay Off Credit Card Debt

Written: Editor | June 26, 2023

Creating a Payoff Plan

Assessing Your Debt and Setting Goals

If you find yourself struggling with credit card debt, it's time to take control and create a payoff plan. Start by assessing your debt and setting clear goals to help you stay motivated throughout the process.

-

Calculate Your Total Debt: Begin by gathering all your credit card statements and adding up the outstanding balances. This will give you a clear picture of the amount you owe.

-

Set Realistic Goals: Determine how quickly you want to pay off your debt. Be realistic and create a timeline that works for your financial situation. Setting smaller milestones along the way can help keep you motivated.

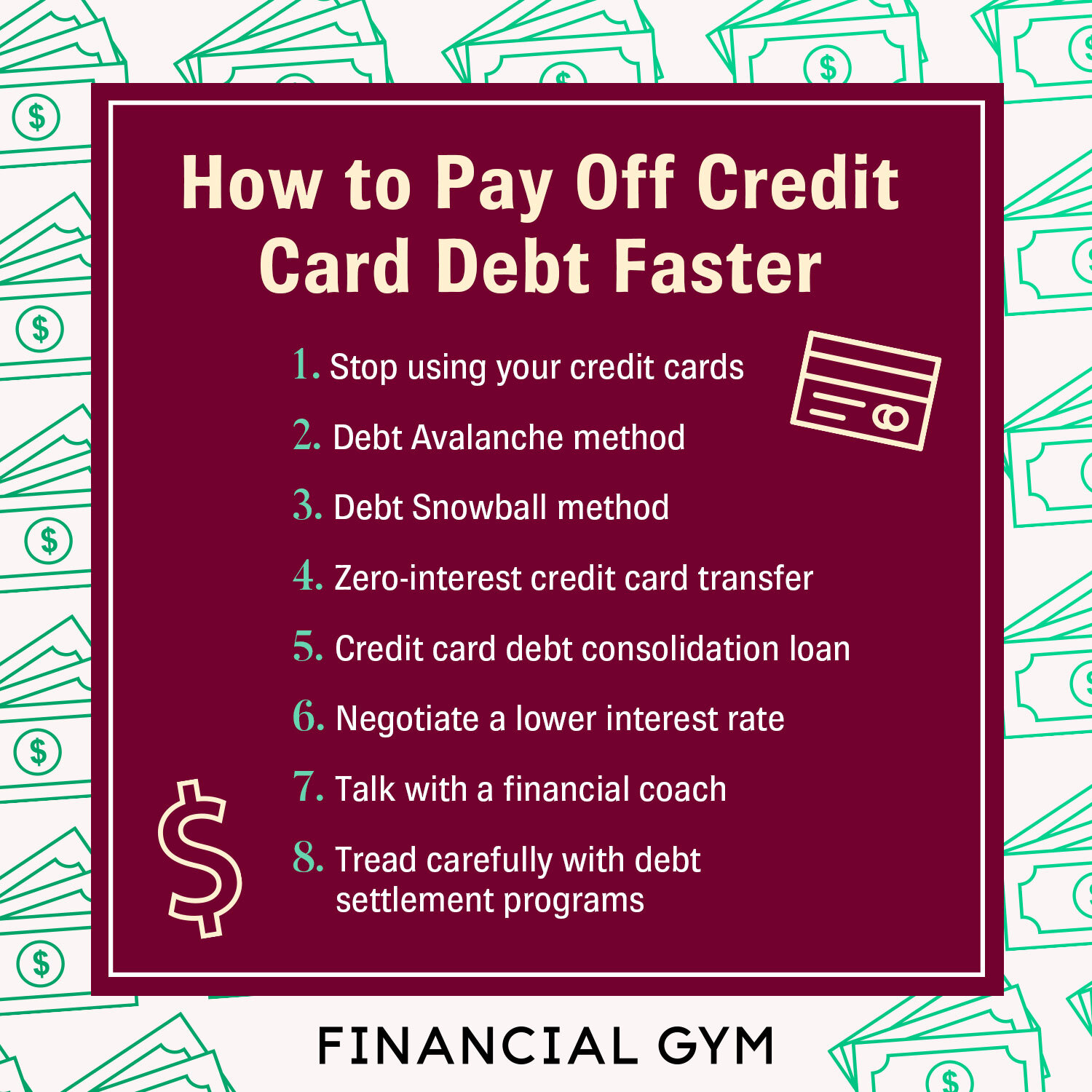

Exploring Debt Payoff Strategies

There are several strategies you can use to pay off your credit card debt. Consider these options and choose the one that aligns best with your financial goals:

-

Debt Snowball Method: Focus on paying off your smallest debts first while making minimum payments on the rest. Once you pay off a debt, redirect that payment towards the next smallest balance. This method provides psychological motivation as you see quick wins along the way.

-

Debt Avalanche Method: Start by paying off the debt with the highest interest rate while making minimum payments on the others. Once the highest interest debt is paid off, move on to the one with the next highest interest rate.

Budgeting and Cutting Expenses to Free Up Money for Repayment

To speed up your debt payoff journey, consider budgeting and cutting expenses to free up more money for repayment.

-

Create a Budget: Evaluate your income and expenses to create a budget that allocates enough funds towards debt repayment. Track your spending and identify areas where you can cut back.

-

Reduce Discretionary Spending: Identify non-essential expenses that can be temporarily eliminated or reduced. This can include dining out less frequently, cutting down on subscription services, or finding cost-effective alternatives for entertainment.

Remember, paying off credit card debt takes time and discipline. Stay focused on your goals and celebrate every milestone along the way. With a solid payoff plan, you can regain control of your finances and achieve a debt-free future.

Implementing Debt Repayment Strategies

Paying off credit card debt can be a daunting task, but with the right strategies, it is definitely achievable. Here are some effective methods to help you pay off your debt and regain control of your finances:

Snowball Method: Paying off Smaller Balances First

The snowball method focuses on paying off your debts from smallest to largest, regardless of interest rates. By tackling your smaller balances first, you can experience a sense of accomplishment and motivation when you see those debts disappear. Here's how it works:

- List all your credit card debts from smallest to largest balance.

- Make minimum payments on all your cards except the smallest one.

- Use any extra funds you have to pay off the smallest debt as quickly as possible.

- Once the smallest debt is paid off, take the money you were putting towards it and apply it to the next smallest debt.

- Repeat this process until all your debts are paid off.

Avalanche Method: Tackling High-Interest Debts First

The avalanche method, on the other hand, focuses on paying off your debts with the highest interest rates first. This method helps you save money in the long run by reducing the total amount of interest you will pay. Here's how it works:

- List all your credit card debts from highest to lowest interest rate.

- Make minimum payments on all your cards except the one with the highest interest rate.

- Use any extra funds you have to pay off the debt with the highest interest rate as quickly as possible.

- Once the highest interest rate debt is paid off, take the money you were putting towards it and apply it to the next debt with the highest interest rate.

- Repeat this process until all your debts are paid off.

Consolidation Options: Transferring Balances or Taking a Loan

Consolidating your credit card debts into a single payment can make it easier to manage and potentially save you money. You can consider two consolidation options:

- Balance transfer: Transfer your high-interest credit card balances to a card with a lower interest rate. This can help you save on interest fees and focus on paying off the debt.

- Personal loan: Take out a personal loan to pay off your credit card debts. This can provide you with a fixed interest rate and a structured repayment plan.

Remember, paying off credit card debt requires discipline and commitment. Choose the method that suits your financial situation best and stick to your repayment plan. With determination and dedication, you can achieve your goal of becoming debt-free.

Staying Motivated and Tracking Progress

Celebrating Small Wins and Milestones

Congratulations on taking the first step towards paying off your credit card debt! It's important to celebrate your progress along the way to stay motivated and keep going. Set small milestones for yourself, such as paying off a certain amount or reaching a specific credit utilization ratio. Treat yourself to something small as a reward for reaching each milestone, like a coffee or a new book. Celebrating these small wins will help you stay positive and motivated on your journey to becoming debt-free.

Using Debt Repayment Apps and Tools

There are plenty of useful apps and tools available to help you track and manage your credit card debt repayment progress. These tools can help you create a budget, set goals, and visualize your progress over time. Some popular debt repayment apps include Mint, YNAB (You Need a Budget), and Debt Payoff Planner. These apps can help you stay organized and motivated by showing you how much you've already paid off and how much you have left to go. By using these tools, you can stay on top of your payments and make informed decisions about your finances.

Seeking Support from Friends, Family, or Support Groups

Paying off credit card debt can be a challenging journey, but remember that you don't have to go through it alone. Seek support from friends, family, or even join support groups online or in your community. Talking about your progress, discussing challenges, and sharing your goals with others who are going through a similar experience can provide a great source of support and motivation. They can offer advice, encouragement, and accountability, helping you stay on track and overcome any hurdles along the way. Remember, you are not alone in this journey, and with the right support, you can achieve your goal of becoming debt-free.

Remember, paying off credit card debt takes time and dedication. Stay motivated by celebrating your small wins, using helpful tools and apps, and seeking support from those around you. With these strategies in place, you'll be on your way to financial freedom and a debt-free future.

Maintaining Healthy Financial Habits

Managing credit card debt can be overwhelming, but with some discipline and strategic planning, you can regain control of your finances and pay off your credit card debt. Here are a few key steps to help you on your journey to financial freedom.

Developing a Monthly Budget

Creating a monthly budget is essential in managing your expenses and prioritizing your debt payments. Start by tracking your income and all your expenses, including credit card payments. Look for areas where you can cut back on unnecessary expenses and redirect those funds towards paying off your credit card debt. Make sure your budget is realistic and allows for some flexibility.

Building an Emergency Fund

Building an emergency fund is crucial in protecting yourself from future financial setbacks and covering unexpected expenses without relying on credit cards. Aim to save three to six months' worth of living expenses in a separate savings account. Start by setting aside a small amount from each paycheck and gradually increase the amount as you pay off your credit card debt.

Avoiding Credit Card Traps and Minimizing Future Debt

To avoid accumulating more credit card debt, it's important to be aware of common pitfalls and adopt responsible credit card habits. Here are some tips:

- Pay off your balance in full each month to avoid interest charges.

- Use credit cards sparingly and only for necessary expenses.

- Avoid unnecessary fees and penalties by making payments on time.

- Consider negotiating interest rates or transferring high-interest balances to low or zero-interest credit cards.

- Seek professional advice if you are struggling with overwhelming debt.

Remember, paying off credit card debt takes time and persistence. Celebrate small victories along the way and stay motivated by visualizing a debt-free future. The key is to make consistent payments, avoid accruing more debt, and maintain healthy financial habits beyond your credit card debt repayment journey. With discipline and determination, you can achieve financial freedom and build a secure future for yourself.

Conclusion

Congratulations on taking the first step towards achieving a debt-free life! Paying off credit card debt can be challenging, but with determination and a solid plan, it is possible to become financially free. Remember, it's important to stay disciplined, make consistent payments, and avoid accumulating new debt in the process.

Achieving Debt-Free Living

Develop a Budget: Start by assessing your income and expenses to create a realistic budget. Allocate as much money as possible towards debt repayment while still meeting your basic needs.

Pay More Than the Minimum: Whenever possible, pay more than the minimum payment on your credit cards. This will help you pay off the debt faster and save on interest charges.

Consolidate or Negotiate: Consider consolidating your credit card debt into a single loan with a lower interest rate or negotiating with your credit card company for a lower interest rate or a more manageable repayment plan.

Long-Term Strategies for Financial Success

Build an Emergency Fund: Set aside a portion of your income each month into an emergency fund. This will provide a safety net for unexpected expenses and help prevent the need to rely on credit cards.

Live Below Your Means: Avoid unnecessary expenses and prioritize saving money. Cut back on non-essential purchases and find ways to save on everyday expenses like groceries and entertainment.

Invest in Retirement: Allocate a portion of your income towards retirement savings. This will ensure financial security in the long run and help you avoid relying on credit cards during retirement.

Frequently Asked Questions about Paying Off Credit Card Debt

How long will it take to pay off my credit card debt? The time it takes to pay off your credit card debt depends on factors like the amount of debt, interest rates, and your monthly repayment amount. Use a debt repayment calculator to estimate the timeline.

Should I prioritize paying off high-interest rate debt first? Yes, it's generally wise to tackle high-interest debt first as it accrues more interest over time. Focus on paying off the credit cards with the highest interest rates while making minimum payments on the others.

Can I negotiate with creditors for a lower interest rate? Yes, it's worth contacting your creditors to negotiate a lower interest rate or a more affordable repayment plan. Explain your situation and discuss possible options to reduce your interest charges.

Remember, paying off credit card debt requires patience and perseverance. With the right strategies and mindset, you can achieve financial freedom and enjoy a debt-free life.