The Pros and Cons of Investing in ETFs

Written: Editor | April 18, 2023

Factors to Consider Before Investing in ETFs

Understanding the underlying index or asset

When considering investing in Exchange-Traded Funds (ETFs), it's important to understand the underlying index or asset that the ETF is tracking. Different ETFs focus on various sectors, industries, or regions, so you'll want to ensure that the ETF aligns with your investment goals and strategy. Research the performance and historical data of the index or asset to gain insight into its potential future returns.

Expense ratio and trading costs

Another crucial factor to consider when investing in ETFs is the expense ratio and trading costs associated with the fund. The expense ratio represents the annual fees charged by the fund manager, which are deducted from the fund's assets. Lower expense ratios mean more of your investment contributes to potential earnings. Additionally, consider trading costs, including brokerage commissions and bid-ask spreads, as these can impact your returns over time.

Liquidity and volume of the ETF

Adequate liquidity and trading volume are essential factors to evaluate before investing in ETFs. Liquidity refers to the ability to buy or sell shares of the ETF without causing significant price movement. Higher trading volume generally indicates greater liquidity. It's prudent to invest in ETFs with sufficient liquidity to ensure efficient execution of trades and to avoid price slippage.

Taking the time to consider these factors before investing in ETFs can help you make informed decisions and align your investments with your overall financial goals. Remember to consult with a financial advisor or do thorough research to ensure that ETFs are suitable for your investment strategy.

Top ETFs for Beginners

If you're a beginner looking to dip your toes into the world of investing, exchange-traded funds (ETFs) can be an excellent option. They provide a diversified portfolio of stocks or bonds, making them a less risky and more cost-effective choice compared to individual stocks. Here are three top ETFs that are perfect for beginners:

Vanguard Total Stock Market ETF (VTI)

The Vanguard Total Stock Market ETF (VTI) is an excellent choice for beginners due to its broad exposure to the U.S. market. This ETF aims to replicate the performance of the CRSP US Total Market Index, which includes stocks of all sizes. VTI provides instant diversification across various sectors and offers a low expense ratio, making it an attractive option for long-term investors.

SPDR S&P 500 ETF Trust (SPY)

The SPDR S&P 500 ETF Trust (SPY) is one of the most popular ETFs in the market. It tracks the performance of the S&P 500 index, which consists of 500 large-cap U.S. companies. Investing in SPY gives you exposure to some of the biggest and most reputable companies across different sectors. This ETF is a great choice for beginners looking for broad market exposure.

iShares Core MSCI EAFE ETF (IEFA)

For those looking to diversify their portfolio internationally, the iShares Core MSCI EAFE ETF (IEFA) is a great option. IEFA tracks the performance of international stocks from developed markets, excluding the U.S. This ETF allows beginners to invest in companies from Europe, Australia, Asia, and the Far East. With a low expense ratio and a diverse range of international investments, IEFA can provide portfolio diversification beyond the U.S. market.

Before investing in any ETF, it's important to do your research and consider your investment goals and risk tolerance. ETFs offer flexibility and ease of investment, making them an ideal choice for beginners looking to build a diversified portfolio.

Advanced ETF Investment Strategies

If you're looking to take your ETF investing game to the next level, there are several advanced strategies you can consider. These strategies can provide opportunities for enhanced returns, diversification, and exposure to specific sectors or markets.

Sector-specific ETFs

One strategy to consider is investing in sector-specific ETFs. These funds focus on a specific industry or sector of the economy, such as technology, healthcare, or energy. By investing in sector-specific ETFs, you can target your investments towards industries that you believe will outperform the broader market. This can provide you with exposure to high-growth sectors and potentially higher returns.

Smart Beta ETFs

Another advanced strategy is investing in smart beta ETFs. Smart beta ETFs are designed to provide exposure to factors that are believed to drive long-term performance, such as value, momentum, or quality. These ETFs aim to outperform traditional market-cap weighted index funds by following a rules-based approach. By investing in smart beta ETFs, you can enhance your portfolio's returns and potentially reduce risk.

Global and emerging market ETFs

Investing in global and emerging market ETFs is another strategy to consider for advanced ETF investors. These funds provide exposure to international markets outside of your domestic market. By diversifying your portfolio with global and emerging market ETFs, you can benefit from the growth potential of economies around the world. This can help reduce risk and enhance returns by tapping into opportunities in different regions and sectors.

Remember, advanced ETF investing strategies come with their own risks and considerations. It's important to thoroughly research and understand the specific ETFs you're investing in, as well as the sectors or markets they represent. Diversification, risk management, and a long-term investment perspective should always be key considerations in your investment strategy.

Risks and Limitations of ETF Investing

Tracking error and deviation from the index

When investing in ETFs, it's important to be aware of the potential for tracking error and deviation from the index. While ETFs aim to closely track the performance of an underlying index, there can be slight discrepancies due to various factors such as fees, trading costs, and rebalancing. These deviations can impact your returns and may not align perfectly with the index performance.

Market volatility and liquidity risks

Like any investment, ETFs are subject to market volatility. During periods of market turbulence, the value of ETFs can fluctuate, potentially resulting in losses. Additionally, some ETFs may have lower trading volumes, making them less liquid. This could lead to difficulty buying or selling shares at desired prices, especially during times of market stress.

Diversification limitations

While ETFs offer the benefit of diversification, it's important to note that they are not immune to concentration risk. Some ETFs may have a heavy concentration in specific sectors, industries, or regions. If these areas experience a downturn, it could negatively impact the performance of the ETF. It's important to evaluate the holdings and diversification strategy of an ETF before investing to ensure it aligns with your investment goals and risk tolerance.

Understanding the risks and limitations of ETF investing is crucial for making informed decisions. It's recommended to conduct thorough research, consider your investment objectives, and consult with a financial advisor before allocating your capital. By being aware of these factors, you can better navigate the ETF market and make educated investment choices that align with your financial goals.

ETF vs Mutual Funds: Which is Better?

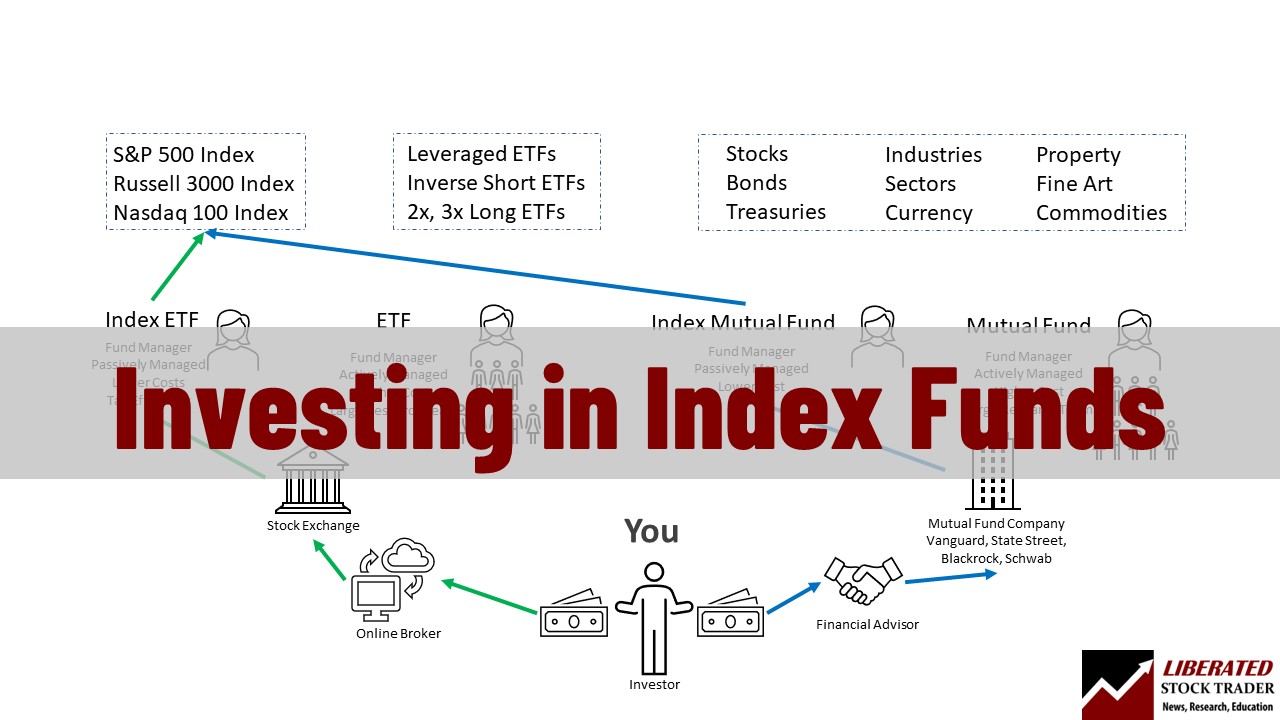

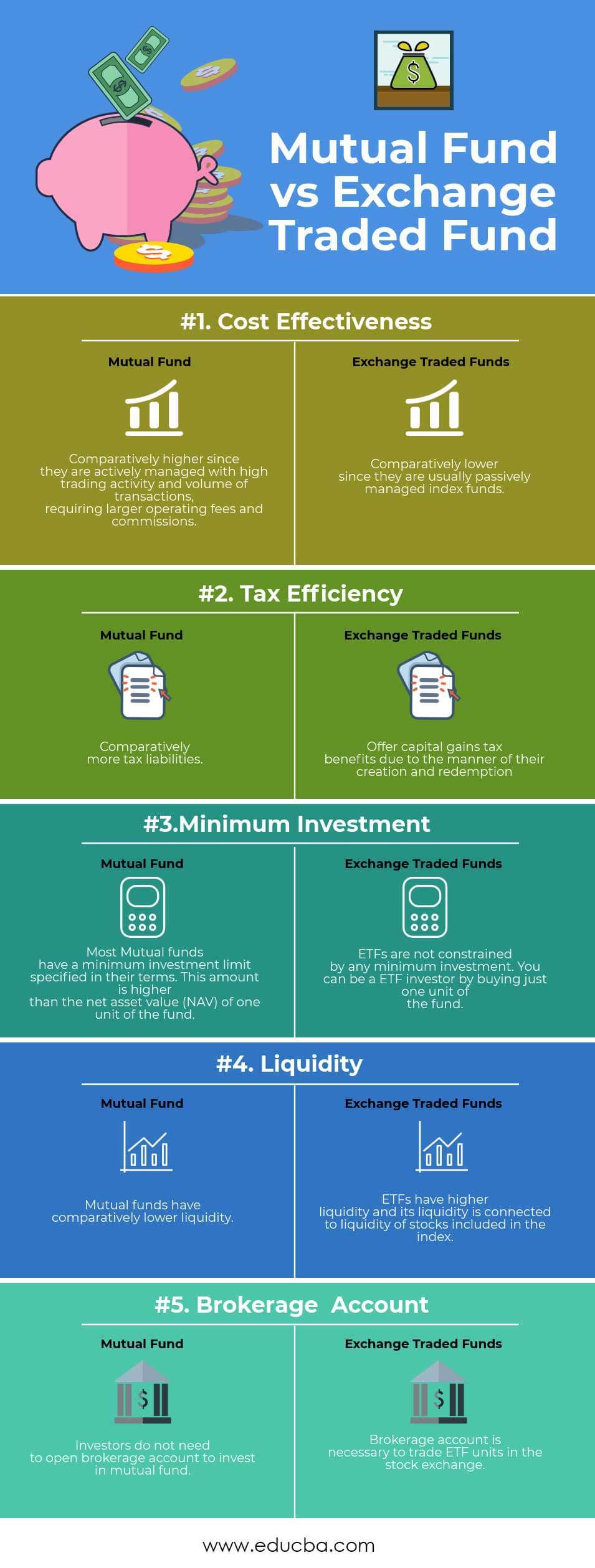

Key differences between ETFs and mutual funds

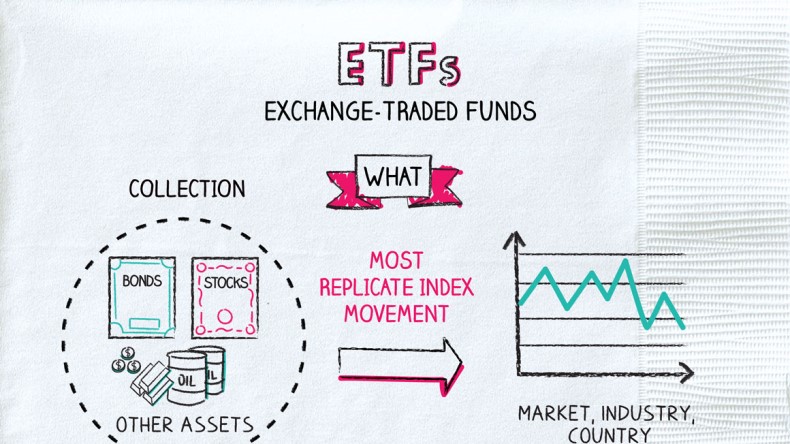

If you are considering investing in the stock market, you may have come across two popular investment options: Exchange-traded funds (ETFs) and mutual funds. While both options allow you to invest in a diversified portfolio, they have some key differences.

ETFs: ETFs are traded on stock exchanges, just like individual stocks. This means you can buy and sell them throughout the trading day at market prices. They typically have lower expense ratios compared to mutual funds and offer greater tax efficiency due to their unique structure.

Mutual funds: Mutual funds are professionally managed investment funds that pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets. They are priced at the end of each trading day and investors can buy or sell them at the net asset value (NAV) price.

Pros and cons of ETFs and mutual funds

ETFs: Some advantages of ETFs include lower expense ratios, flexibility in trading, and the ability to invest in specific sectors or themes. However, they also come with potential downsides such as brokerage commissions and potential tracking error.

Mutual funds: Mutual funds offer the benefit of professional management, diversification, and the convenience of automatic investment options. On the flip side, they may have higher expense ratios and some funds charge sales loads or redemption fees.

Choosing the right investment vehicle for your goals

When deciding between ETFs and mutual funds, consider your investment goals, risk tolerance, time horizon, and investment strategy. ETFs may be more suitable for active traders or those seeking specific sector exposure, while mutual funds may be preferred by long-term investors looking for professional management and consistent performance.

Ultimately, the choice between ETFs and mutual funds depends on your individual preferences and investment objectives. It's important to thoroughly research and understand both options before making a decision.

Tips for Successful ETF Investing

Setting clear investment objectives

When it comes to ETF investing, having clear investment objectives is crucial. Before you start investing, take the time to determine your financial goals and risk tolerance. Are you looking for long-term growth, steady income, or a combination of both? Understanding your objectives will help you choose the right ETFs that align with your investment goals.

Diversifying your ETF portfolio

Diversification is key to managing risk in any investment portfolio, and ETFs make it easy to achieve. By investing in a variety of ETFs across different asset classes, sectors, and geographic regions, you spread out your risk. This helps to protect your investments from the potential volatility of any single asset or market. Remember, diversification is not just about owning many ETFs; it's about having a mix of investments that work together to reduce risk.

Regularly reviewing and rebalancing your holdings

To ensure your ETF portfolio stays aligned with your investment objectives, it's important to regularly review and rebalance your holdings. Market conditions and the performance of different asset classes can change over time, causing your portfolio to drift away from your original strategy. By reviewing and rebalancing, you can realign your investments, selling relatively high-performing ETFs and buying more of those that have underperformed. This helps maintain your desired asset allocation and ensures you stay on track towards achieving your investment objectives.

Remember, successful ETF investing requires patience, discipline, and a long-term perspective. By setting clear objectives, diversifying your portfolio, and regularly reviewing and rebalancing, you can increase your chances of achieving your financial goals.

Conclusion

Now that you have a basic understanding of EFT investing, it's time to take action and start building your investment portfolio. Remember, EFTs offer a convenient and cost-effective way to diversify your investments and potentially earn solid returns over time. So, here are a few final thoughts and recommendations to guide you on your EFT investing journey.

Final thoughts and recommendations

-

Do your research: Before investing in any EFT, thoroughly research the fund's performance, expense ratios, and management team. Look for EFTs that align with your investment goals and risk tolerance.

-

Start small: If you're new to EFT investing, consider starting with a small investment amount until you become more comfortable with the process. This way, you can learn and gain experience without risking a significant amount of capital.

-

Diversify your portfolio: One of the key benefits of EFTs is their ability to offer diversification across different asset classes and sectors. Make sure to allocate your investments across various EFTs to minimize risk and maximize potential returns.

-

Monitor your investments: Stay up to date with the performance of your EFTs and regularly review your portfolio. Assess whether any adjustments or rebalancing is needed to ensure your investments align with your long-term goals.

-

Consider professional advice: If you're unsure or overwhelmed by the world of EFT investing, don't hesitate to seek guidance from a certified financial planner or investment advisor.

By following these recommendations and staying informed, you'll be well-equipped to navigate the world of EFT investing and potentially achieve your financial goals. Happy investing!