How to invest in the stock market with just $100

Written: Editor | May 17, 2023

Choosing the Right Brokerage Platform for Small Investments

Factors to Consider When Selecting a Brokerage Platform

So, you're ready to dip your toes into the stock market and invest your $100. Congratulations on taking the first step towards financial growth!

Before you dive in, it's crucial to choose the right brokerage platform that suits your needs and goals. Here are a few factors to consider:

-

Fees and Commissions: As a small investor, minimizing costs is essential. Look for platforms that offer low commission fees or even commission-free trades.

-

Account Minimums: Some brokerage platforms require a minimum investment to open an account. To start with $100, choose a platform that caters to small investors with no or low minimum account requirements.

-

User-Friendly Interface: As a novice investor, you'll want a platform with an intuitive interface. Look for user-friendly platforms with educational resources and tools to help you make informed decisions.

Best Brokerage Platforms for Investing with $100

Now that you know what to look for in a brokerage platform, here are some options that are beginner-friendly and perfect for investing with $100:

-

Robinhood: Known for its commission-free trades, Robinhood is an excellent choice for small investors. With its user-friendly interface and no account minimums, it's perfect for starting with a small investment.

-

Acorns: Acorns is an investment app that allows you to invest spare change from everyday purchases. It's an innovative way to grow your investment with just a few dollars at a time.

-

Charles Schwab: While Charles Schwab has a $0 minimum deposit requirement, it doesn't offer commission-free trades. However, it provides excellent customer service and a wide range of investment options.

Remember, investing in the stock market comes with risks, so it's essential to do thorough research and consult with a financial advisor if needed. Start small, learn as you go, and watch your investment grow over time. Happy investing!

###

:max\_bytes(150000):strip\_icc()/assetclass\_sourcefile-Final-718dadc60705471094ea684bec0cee1d.jpg)

Building a Diversified Portfolio with $100

Understanding the Importance of Diversification

If you have $100 and are considering investing in the stock market, it's essential to understand the importance of diversification. Diversification is a strategy that involves spreading your investment across different assets to minimize risk. By diversifying your portfolio, you can better protect yourself from potential losses.

Strategies for Creating a Diversified Portfolio with a Limited Budget

-

Invest in Exchange-Traded Funds (ETFs): ETFs are investment funds that trade on stock exchanges, and they offer exposure to a broad range of stocks or other assets. Investing in ETFs allows you to diversify with a relatively small investment since you're gaining exposure to multiple companies or sectors.

-

Consider Fractional Shares: Many platforms now allow you to buy fractional shares, which enables you to invest in a portion of a single share of a company's stock. This way, you can diversify your investment across different companies and industries with just $100.

-

Explore Robo-Advisors: Robo-advisors are automated investment platforms that create and manage diversified portfolios based on your risk tolerance and goals. Some robo-advisors offer low minimum investment requirements, making them accessible for those with limited budgets.

-

Research and Choose Low-Cost Index Funds: Index funds are investment funds that track a specific market index. They are often low-cost and offer broad market exposure. Look for index funds with low expense ratios to maximize your investment.

Remember, while diversification is essential, it's also important to do your research and consider your risk tolerance and investment goals. Investing in the stock market carries risks, and you should only invest what you can afford to lose.

By utilizing these strategies and understanding the importance of diversification, you can begin building a diversified portfolio with $100. Start small, stay informed, and continue to grow your investment over time.

Making Smart Investment Decisions with $100

Researching and Analyzing Potential Stocks

If you've got $100 to spare and you're considering investing in the stock market, it's important to do your homework before making any decisions. Here are some tips to help you research and analyze potential stocks:

-

Identify your investment goals: Before diving into the stock market, determine what you hope to achieve with your $100 investment. Are you looking for long-term growth or short-term gains?

-

Research companies and sectors: Look for companies and sectors that align with your investment goals. Consider factors such as financial stability, growth potential, and industry trends.

-

Analyze financial indicators: Review key financial indicators such as company earnings, revenue growth, and debt levels. This will give you insights into the financial health and performance of the companies you are considering.

Investment Strategies for Small Budgets

Having a small budget doesn't mean you can't make smart investment choices. Here are a few investment strategies to consider when working with a limited budget:

-

Diversify your portfolio: Even with $100, it's important to spread your investment across multiple stocks or exchange-traded funds (ETFs). This reduces the risk of losing all your investment if one stock performs poorly.

-

Consider fractional shares: Some investment platforms allow you to invest in fractional shares, which means you can buy a portion of a stock instead of a whole share. This is a great option for investors with limited funds.

-

Start with low-cost investments: Look for low-cost stocks or ETFs that fit within your budget. Avoid high-priced stocks that may eat up a significant portion of your $100.

Remember, investing in the stock market involves risks, and it's important to consult with a financial advisor or do thorough research before making any investment decisions.

Tracking and Monitoring Your Investments with $100

Investing in the stock market can be an exciting and potentially profitable venture, even with just $100 to start. To make the most of your investment, it's important to track and monitor your investments effectively. Here are some tips to help you get started:

Utilizing Investment Tracking Tools and Apps

-

Online Brokerage Platforms: Many online brokerage platforms offer free account options and tools to track and manage your investments. Take advantage of these platforms to monitor your portfolio's performance and make informed decisions.

-

Financial News Websites: Stay updated with the latest market news and trends by regularly visiting financial news websites. These platforms provide valuable insights and analysis that can help you make informed investment decisions.

-

Investment Tracking Apps: There are numerous investment tracking apps available for both iOS and Android devices. These apps offer features such as real-time portfolio tracking, customized alerts, and performance analysis. Some popular options include Mint, Personal Capital, and Acorns.

Tips for Monitoring Your Portfolio's Performance

-

Set Realistic Goals: Define your investment objectives and set realistic goals based on your risk tolerance and time horizon. Regularly monitor your portfolio's performance against these goals and make adjustments if necessary.

-

Review and Diversify: Regularly review your investments to ensure they align with your investment strategy. Diversify your portfolio by investing in a mix of stocks, bonds, and other asset classes to reduce risk.

-

Stay Calm and Avoid Emotional Decisions: The stock market can be volatile, and prices may fluctuate. Avoid making impulsive decisions based on short-term market movements. Stick to your long-term investment plan and avoid emotional reactions.

By utilizing investment tracking tools and apps, and following these monitoring tips, you can effectively track and manage your investments with just $100. Remember to stay informed and make

:max\_bytes(150000):strip\_icc()/valueinvesting\_definition\_0801-7e37a086219548a2b454bf45af4835f4.jpg)

Growing Your Investment over Time with $100

Importance of Patience and Long-Term Investing

Are you interested in investing in the stock market but don't have much to start with? Don't worry, with just $100, you can begin your journey towards financial growth!

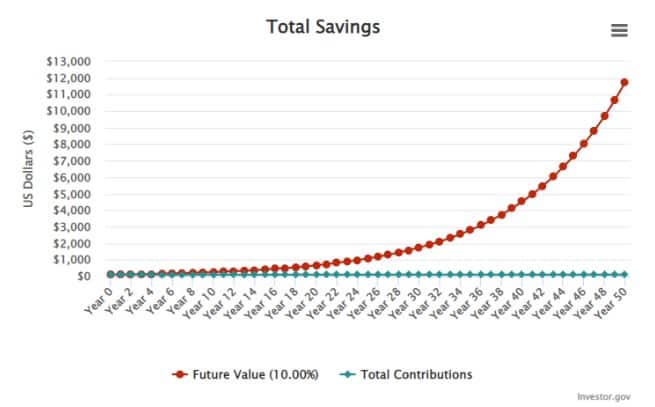

When investing with limited funds, it's crucial to understand the importance of patience and long-term investing. The stock market can be unpredictable in the short-term, but historically, it has shown growth over the long run. By adopting a patient and long-term mindset, you allow your investments to weather market fluctuations and potentially generate significant returns.

Strategies for Increasing Your Investment with Limited Funds

-

Start with Low-Cost Investments: Look for low-cost index funds or exchange-traded funds (ETFs) that provide diversified exposure to the market. These investments offer a cost-effective way to own a basket of stocks, reducing the risk associated with individual stocks.

-

Utilize Fractional Shares: With limited funds, purchasing individual shares of expensive stocks may be challenging. Instead, consider using platforms that offer fractional shares, allowing you to invest in a portion of a stock with as little as $1. This way, you can diversify your portfolio even with limited funds.

-

Reinvest Dividends: If you invest in dividend-paying stocks or funds, consider reinvesting those dividends. Reinvesting dividends allows you to buy additional shares, compounding your investment over time.

-

Regularly Contribute Funds: Even with a small initial investment, make it a habit to contribute additional funds regularly. By consistently adding to your investment, you can benefit from dollar-cost averaging, purchasing more shares when prices are low.

Remember, investing in the stock market carries risks, so it's important to do thorough research, diversify your portfolio, and seek professional advice if needed. With patience, a long-term mindset, and strategic investment choices, you can grow your investment over time, even with limited funds.

Conclusion

So, you have $100 and you want to get started in the stock market? While it may seem like a small amount, it is still possible to make meaningful investments and grow your wealth. By following a few key tips and strategies, you can make the most out of your $100 investment and work towards your financial goals.

Benefits of Starting with a Small Investment

-

Learn and Gain Experience: Investing with a smaller amount allows you to learn the ropes of the stock market without risking a significant amount of money.

-

Start Early: Beginning your investment journey early can have long-term benefits, as compounding returns can help grow your wealth over time.

-

Manage Risk: By diversifying your portfolio, you can spread the risk and minimize the potential impact of any single investment.

Tips for Success in Investing with $100

-

Research and Educate Yourself: Before making any investment decisions, take the time to research and understand the companies or funds you are interested in.

-

Utilize Low-Cost Investment Options: Look for brokerage platforms or apps that offer low fees or commission-free trades, allowing you to make the most of your investment without eating into your returns.

-

Set Realistic Expectations: Understand that investing $100 may not immediately result in significant profits. Patience and a long-term mindset are key to successful investing.

Frequently Asked Questions

Have questions about investing with $100? Here are some FAQs:

-

Can I buy individual stocks with $100? Yes, some stocks may have low prices that allow you to buy a few shares with your $100.

-

Is it better to invest in stocks or funds with $100? Investing in low-cost index funds can provide diversification and minimize risk, especially with a smaller investment amount.

-

What is the best strategy for growing my $100 investment? Regularly contribute to your investment, stay informed, diversify your portfolio, and have a long-term perspective.

Remember, investing always carries some level of risk, so do your due diligence and consult with a financial advisor if needed. Happy investing!