How to invest in mutual funds for college savings

Written: Editor | October 6, 2023

Understanding Mutual Funds

What are mutual funds and how they work

Mutual funds are professionally managed investment vehicles that pool money from numerous investors to invest in a diversified portfolio of securities, such as stocks, bonds, and money market instruments. These funds are managed by experienced portfolio managers who make investment decisions on behalf of the investors.

When investing in mutual funds, individuals purchase shares of the fund, and each share represents a proportionate ownership in the portfolio. The value of these shares fluctuates based on the performance of the underlying assets. Mutual funds provide investors with the opportunity to access a diversified investment portfolio without the need for extensive research or individual stock selection.

Different types of mutual funds for college savings

When it comes to college savings, individuals can choose from various types of mutual funds depending on their risk tolerance and investment goals. Here are a few options to consider:

-

Equity Funds: These funds primarily invest in stocks and have the potential for higher returns over the long term. However, they also carry a higher level of risk due to market volatility.

-

Bond Funds: Bond funds invest in fixed-income securities, such as government and corporate bonds. They offer more stable returns but with lower growth potential compared to equity funds.

-

Target-Date Funds: These funds are designed to automatically adjust the asset allocation based on the investor's target date for college expenses. They start with a higher allocation to equities and gradually shift towards more conservative investments as the target date approaches.

-

Index Funds: Index funds aim to replicate the performance of a specific market index, such as the S&P 500. They offer broad market exposure at a lower cost compared to actively managed funds.

Remember, before investing in mutual funds for college savings, it's crucial to assess your risk tolerance, investment time horizon, and consult with a financial advisor if needed.

Researching and Selecting the Right Mutual Funds

When it comes to saving for college, investing in mutual funds can be an attractive option. These funds allow you to pool your money with other investors and are managed by professionals who make investment decisions on your behalf. Here are some key points to consider when investing in mutual funds for college savings.

Factors to consider when choosing mutual funds for college savings

-

Investment goals: Determine your investment objectives, risk tolerance, and time horizon for college savings. This will help guide your decisions when selecting mutual funds. Different funds have different strategies, ranging from conservative to aggressive.

-

Diversification: Look for funds that offer a diversified portfolio of investments across different asset classes (stocks, bonds, etc.). Diversification can help manage risk and potentially increase returns.

-

Expense ratios: Consider the expense ratio, which represents the percentage of fund assets used to cover operating expenses. Lower expense ratios can result in higher returns over time, so compare the ratios of different funds before making a decision.

Examining past performance and expense ratios

-

Past performance: While past performance doesn't guarantee future results, it can provide insights into a fund's track record. Research the fund's performance over various time periods and compare it to benchmarks like the S&P 500.

-

Expense ratios: As mentioned earlier, expense ratios should be evaluated. Look for funds with low expense ratios, as they have the potential to affect your overall returns.

It is important to note that investing in mutual funds involves risk, and it is advisable to consult with a financial advisor or do thorough research before making any investment decisions.

Setting up a College Savings Plan with Mutual Funds

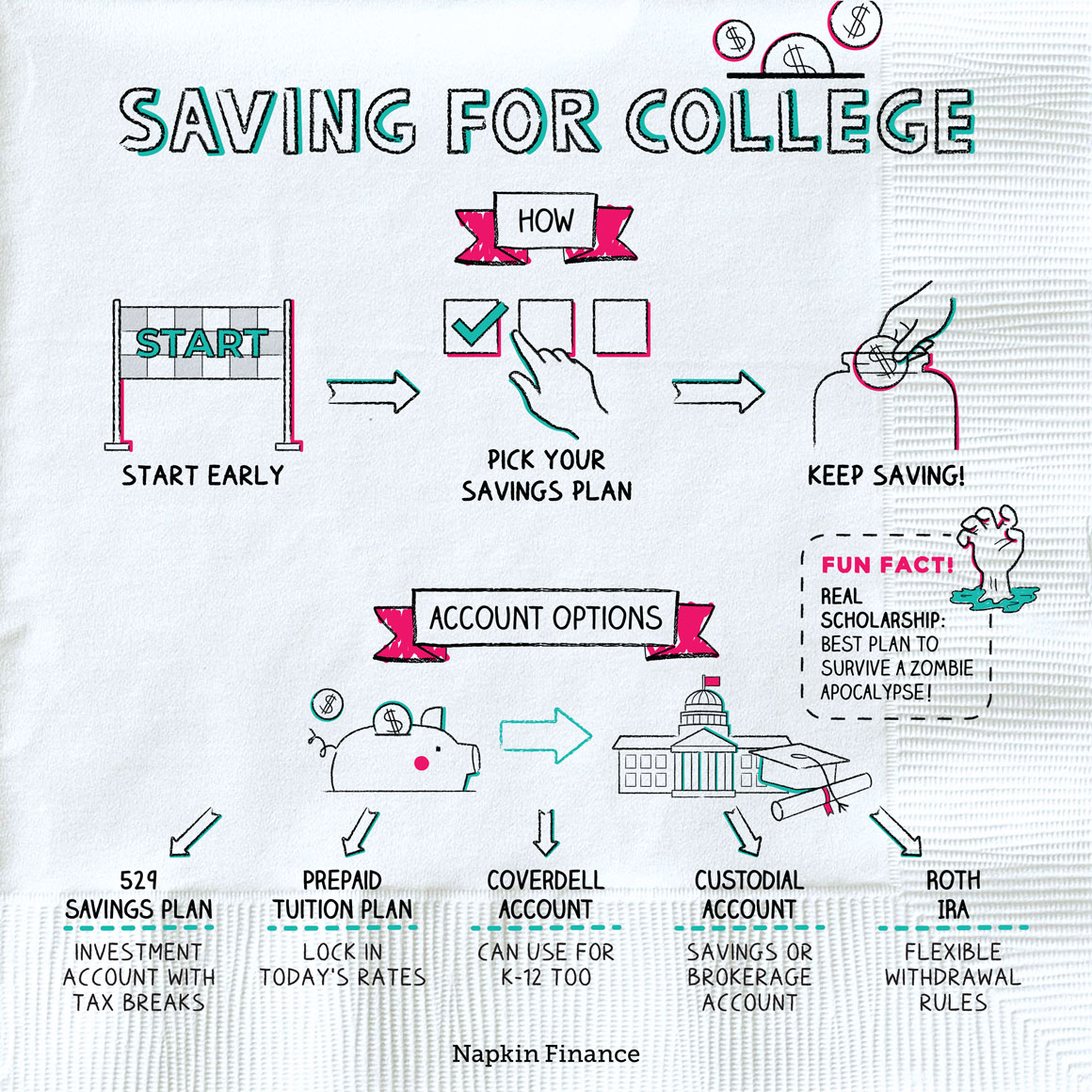

Opening a 529 college savings plan

Opening a 529 college savings plan is an excellent way to invest in mutual funds for college savings. These plans are specifically designed to help families save for college education expenses. To open a 529 plan, you first need to choose a plan that suits your needs. Each state offers its own 529 plan, but you are not limited to investing in your home state's plan. It's important to research different plans and compare their performance, fees, and investment options.

Once you have chosen a plan, you can open an account online or through a financial advisor. The process usually requires some personal information, such as your social security number and date of birth. You will also need to provide details about the beneficiary, the person for whom you are saving for college expenses.

Contributing regularly and taking advantage of tax benefits

To maximize the benefits of investing in a mutual fund for college savings, it is crucial to contribute regularly. Setting up automatic contributions directly from your bank account ensures consistent and disciplined saving. Most 529 plans have a minimum contribution amount, but you can typically make additional contributions at any time.

One major advantage of investing in a 529 plan is the potential tax benefits. Earnings in a 529 plan grow tax-free, and withdrawals are also tax-free when used for qualified education expenses. Some states even offer additional tax incentives, such as deductions or credits, for contributions made to a 529 plan.

Remember to review and adjust your investment strategy periodically. As the beneficiary gets closer to college age, it may be prudent to shift investments to more conservative options to protect against potential market volatility.

By opening a 529 plan and contributing regularly while taking advantage of tax benefits, you can create a solid foundation for your child's college education expenses.

Diversifying Your Mutual Fund Portfolio

Spreading risk through asset allocation

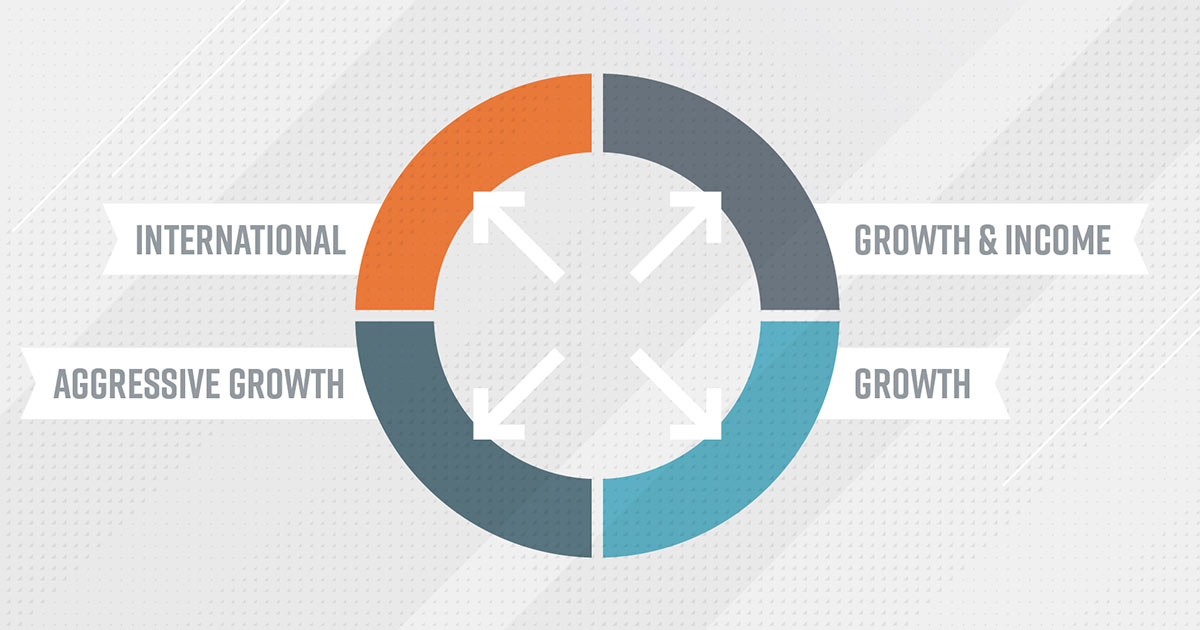

When it comes to investing in mutual funds for college savings, diversification is key. By spreading your investments across different types of assets, you can reduce risk and increase the potential for returns. Asset allocation is the process of dividing your investments among various asset classes, such as stocks, bonds, and cash equivalents. This strategy ensures that you are not overly reliant on one particular investment and helps you minimize the impact of market fluctuations.

To effectively allocate your assets, consider your investment goals, risk tolerance, and time horizon. For college savings, a longer time horizon allows for more aggressive growth investments, such as stocks, while a shorter time horizon may require a greater emphasis on preservation of capital, such as bonds.

Exploring different investment strategies within mutual funds

Mutual funds offer various investment strategies to suit different investor preferences and goals. Some common strategies include:

-

Index Funds: These funds aim to replicate the performance of a specific market index, such as the S&P 500. They offer broad market exposure and low expense ratios.

-

Active Management: Active mutual funds are managed by professional fund managers who actively buy and sell securities in an attempt to outperform the market. This strategy may involve higher costs but offers the potential for higher returns.

-

Target Date Funds: Target date funds automatically adjust their asset allocation based on a specific target retirement or college savings date. They start with a more aggressive allocation and gradually shift towards more conservative investments as the target date approaches.

-

Asset Allocation Funds: These funds maintain a specific allocation across different asset classes, providing investors with a diversified portfolio in a single investment.

When investing in mutual funds for college savings, it's crucial to consider your risk tolerance, investment time horizon, and ongoing fees associated with the funds. Consulting with a financial advisor can help you make informed decisions that align with your goals.

Monitoring and Adjusting Your Investments

The importance of reviewing your mutual fund portfolio regularly

Investing in mutual funds for college savings requires more than just picking the right funds. It also involves monitoring and adjusting your portfolio regularly to ensure that it remains aligned with your goals. Regular reviews are essential for a successful investment strategy.

By reviewing your mutual fund portfolio regularly, you can assess its performance and make informed decisions. Look for any significant changes in the fund's performance, such as underperformance compared to its benchmark or changes in the fund's management team. These factors can impact the future performance of the fund and may require adjustments to your investment strategy.

Reassessing risk tolerance and making necessary adjustments

Risk tolerance is an important factor when investing in mutual funds for college savings. As you near your goal of funding your child's education, it's crucial to reassess your risk tolerance and make any necessary adjustments to your portfolio.

If your risk tolerance has decreased or if you are uncomfortable with market volatility, you may consider shifting your investments to more conservative options, such as bond funds or cash equivalents. On the other hand, if you have a longer time horizon and can tolerate higher risk, you may opt for a more aggressive investment approach.

Remember, your risk tolerance and investment goals may change over time, and it's important to review and adjust your investments accordingly. Consult with a financial advisor if you need guidance in reassessing your risk tolerance and making appropriate adjustments to your mutual fund portfolio.

In conclusion, monitoring and adjusting your mutual fund investments for college savings is a crucial part of maintaining a successful investment strategy. Regular reviews, reassessing risk tolerance, and making necessary adjustments will help ensure that your investments remain aligned with your goals and provide the necessary funds for your child's education.

College Savings Withdrawals and Managing the Funds

Understanding the withdrawal process and potential penalties

When it comes to investing in mutual funds for college savings, it's important to understand how the withdrawal process works to avoid any potential penalties. Here are some key points to consider:

-

Qualified Expenses: Before making a withdrawal, familiarize yourself with the list of qualified expenses that can be paid for using the college savings funds, as defined by the IRS. These may include tuition, room and board, textbooks, and certain educational supplies.

-

Penalties: If you withdraw funds for non-qualified expenses, you may be subject to income taxes on the earnings portion of the withdrawal, along with a 10% penalty. It's crucial to plan your withdrawals carefully to avoid unnecessary penalties.

-

Timing: Take into account the timing of withdrawals. For example, it's generally advisable to begin withdrawing funds during the student's college years to maximize the potential tax benefits and ensure the funds are available when needed.

Utilizing college savings funds effectively

To make the most of your college savings funds, consider the following strategies:

-

Asset Allocation: Review and adjust the asset allocation within your mutual funds periodically. As your child gets closer to college age, it may be prudent to shift investments to more conservative options to preserve capital.

-

Regular Contributions: Continue making regular contributions to the college savings fund. Even small amounts over time can help grow the account and mitigate the need for larger withdrawals.

-

Tax-Efficiency: Be mindful of the tax implications when withdrawing funds. Consider using tax-advantaged strategies such as utilizing education tax credits and scholarships to minimize taxes on withdrawals.

-

Professional Advice: Consulting with a financial advisor who specializes in college savings can help you navigate the complexities of managing your mutual funds effectively and making informed decisions along the way.

By understanding the withdrawal process and managing your college savings funds wisely, you can ensure that your investment in mutual funds serves its intended purpose of financing your child's education.

:max\_bytes(150000):strip\_icc()/TheDifferencesBetweenSavingandInvesting-bc50bd28537e4fb7b2d696047bee33eb.jpg)

Conclusion

Investing in mutual funds for college savings can be a smart financial strategy for parents and students looking to secure their future. By diversifying their investments and taking advantage of the potential for growth, individuals can make their money work harder for them. It is important to carefully consider their risk tolerance, time horizon, and investment objectives before choosing the right mutual funds for their college savings goals. Seeking professional advice and doing thorough research can help in making informed investment decisions.

Key takeaways for investing in mutual funds for college savings

-

Start early: The power of compounding can significantly boost your savings over time. The earlier you start investing in mutual funds for college savings, the better.

-

Diversify your investments: By investing in a variety of mutual funds across different asset classes, you can spread your risk and potentially increase your returns.

-

Consider your risk tolerance: Choose mutual funds that align with your risk tolerance level. If you have a longer time horizon, you may be able to tolerate more risk for the potential of higher returns.

-

Regularly review and rebalance: Keep track of your investments and make necessary adjustments to ensure they remain aligned with your goals and risk tolerance.

Additional resources for further guidance and support

- The Securities and Exchange Commission (SEC) provides educational resources on mutual funds and investing for college savings. Visit their website at www.sec.gov.

- College savings websites, such as Savingforcollege.com, offer calculators, tools, and information to help with planning and investing for college.

- It is always advisable to consult with a financial advisor who can provide personalized advice based on your specific financial situation.