The beginner’s guide to investing in mutual funds

Written: Editor | July 7, 2023

:max\_bytes(150000):strip\_icc()/dotdash-TheBalance-saving-money-vs-investing-money-358062-Final-729ad1c64fdc460ca99144c105173cbb.jpg)

Getting Started with Mutual Fund Investments

Are you new to the world of investing and looking to grow your wealth? Mutual funds can be a great option to consider. With their diverse portfolio of stocks, bonds, and other securities, mutual funds provide individuals with a professionally managed and diversified investment strategy. Here's a beginner's guide to help you get started.

1. Setting Investment Goals

Before diving into mutual fund investments, it's crucial to define your investment goals. Are you saving for retirement, a down payment on a house, or your child's education? Knowing your objectives will help you choose the right mutual fund that aligns with your financial goals.

2. Assessing Risk Tolerance

Understanding your risk tolerance is another important factor when investing in mutual funds. Different funds carry varying levels of risk. Conservative investors may prefer funds with lower volatility, while aggressive investors may be comfortable with higher-risk funds that have the potential for greater returns. Assess your risk tolerance and choose funds accordingly.

3. Determining Investment Horizon

Consider the timeframe of your investment. Are you investing for the short-term or long-term? This will impact the type of mutual funds you should choose. Generally, for long-term goals, such as retirement, you may opt for equity funds that offer higher growth potential, while for short-term goals, you might consider debt or money market funds that offer stability and liquidity.

Remember, mutual funds come with management fees, so it's essential to research and compare fees across different funds. Additionally, consult with a financial advisor if you're unsure about the right mutual fund strategy for your needs.

With a well-defined investment goal, a clear understanding of your risk tolerance, and a suitable investment horizon, you can begin your journey into mutual fund investments and start building wealth for the future.

Choosing the Right Mutual Fund

Are you new to investing and looking to get started with mutual funds? Don't worry, we've got you covered! With so many options out there, it can be overwhelming to choose the right mutual fund. But fear not, this beginner's guide will help you make an informed decision.

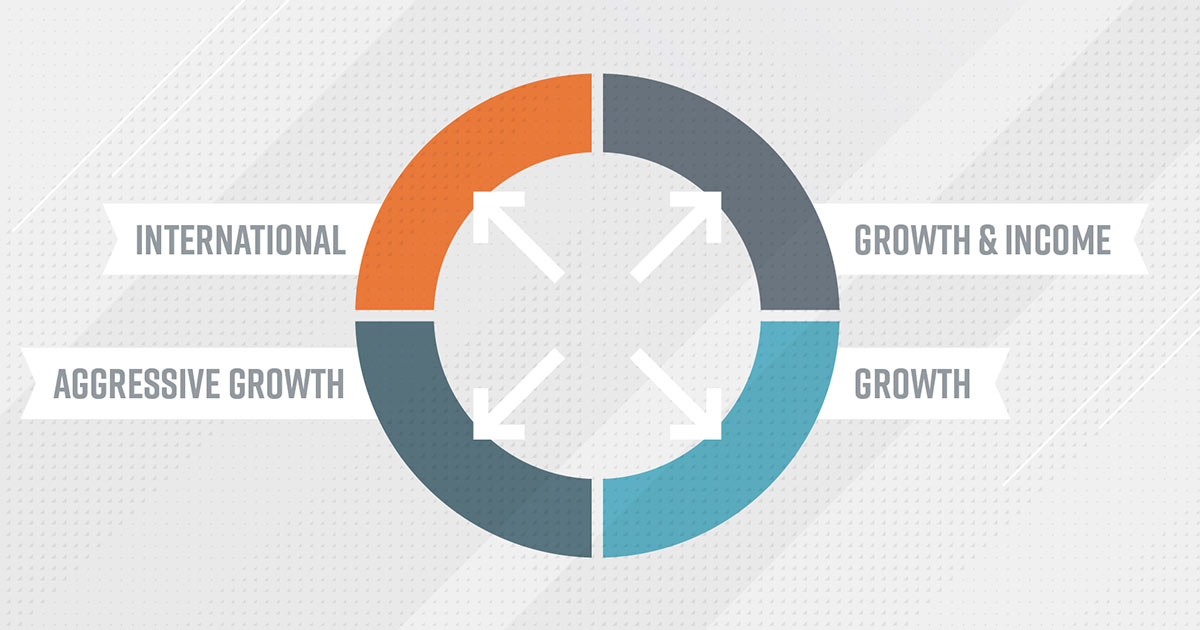

1. Understanding Fund Categories

Before diving into the world of mutual funds, it's essential to understand the different fund categories available:

- Equity Funds: These funds invest in stocks and are suitable for long-term growth.

- Bond Funds: These funds invest in fixed-income securities and are relatively less risky.

- Money Market Funds: These funds invest in short-term debt instruments and offer stability.

- Hybrid Funds: These funds invest in a combination of stocks and bonds, offering a balanced approach.

2. Evaluating Fund Performance

When choosing a mutual fund, it's crucial to evaluate its performance:

- Check the fund's historical returns over different time periods.

- Compare the fund's performance to its benchmark index and similar funds.

- Look at the fund's expense ratio, which represents the fees and expenses associated with the fund.

3. Researching Fund Managers

The fund manager plays a crucial role in the success of a mutual fund:

- Research the experience and track record of the fund manager.

- Understand their investment philosophy and strategy.

- Look for consistency in delivering good performance over the long term.

Remember, investing in mutual funds involves risk, and it's essential to diversify your portfolio. Consider consulting with a financial advisor for personalized guidance based on your financial goals and risk tolerance.

By following these guidelines, you'll be well on your way to choosing the right mutual fund and taking your first steps towards achieving your financial objectives. Happy investing!

Investing in Mutual Funds

For individuals looking to grow their wealth and achieve their financial goals, mutual funds can be an excellent investment option. Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, and other assets. Here are some key points to consider when starting out with mutual fund investments.

1. Investing Strategies for Beginners

- Define your goals: Start by identifying your financial goals. Whether it's saving for retirement, buying a house, or funding your child's education, having a clear objective will help you choose the right mutual funds for your investment portfolio.

- Research and diversify: Conduct thorough research before investing in mutual funds. Look for funds with a proven track record, experienced fund managers, and low expense ratios. Diversify your investments across different asset classes to mitigate risk.

- Consider your risk tolerance: Evaluate your risk appetite before selecting mutual funds. Different funds have varying levels of risk, and it's important to choose ones that align with your comfort level.

- Monitor and review: Regularly review the performance of your mutual funds and make adjustments if necessary. Stay updated on market trends and economic conditions that may impact your investments.

2. Dollar-Cost Averaging

Dollar-cost averaging is a strategy where you invest a fixed amount at regular intervals, regardless of market conditions. It helps you average out the purchase price of your investments over time. This strategy can be beneficial for beginners as it removes the need to time the market and reduces the impact of short-term market fluctuations.

3. Systematic Investment Plans (SIPs)

Systematic Investment Plans (SIPs) allow investors to invest a fixed amount regularly in a mutual fund of their choice. SIPs provide the benefit of rupee-cost averaging and discipline in investing. By investing small amounts consistently, you can benefit from market volatility and potentially earn higher returns over the long term.

Remember, investing in mutual funds involves market risk, and it's important to consult with a financial advisor and carefully read the fund's prospectus before making any investment decisions.

Managing Mutual Fund Investments

1. Monitoring Fund Performance

When investing in mutual funds, it's important to regularly monitor the performance of your funds. Keep an eye on factors such as returns, fees, and expenses. Review the fund's prospectus and annual report to understand the fund's investment strategy and performance history. Additionally, pay attention to any changes in the fund's portfolio or management team, as these can impact future performance.

2. Rebalancing Portfolio

Rebalancing is the process of adjusting the allocation of your investments to maintain your desired asset mix. Over time, market fluctuations may cause your portfolio to deviate from its original allocation. Rebalancing helps you stay on track with your investment goals and manage risk. Regularly review your portfolio and make necessary adjustments to ensure it aligns with your risk tolerance and investment objectives.

3. Tax Implications and Reporting

Mutual fund investments can have tax implications. Different types of mutual funds may generate taxable income, such as dividends or capital gains. It's important to understand the tax consequences of your investments and consult with a tax advisor if needed. Additionally, make sure to keep track of important tax documents, such as Form 1099-DIV or Form 1099-B, which provide information needed for tax reporting.

Remember to consider your investment time horizon, risk tolerance, and personal financial goals when managing your mutual fund investments. Regularly review and adjust your investment strategy as needed, and seek guidance from a financial professional if you have any questions or concerns.

Maximizing Returns with Mutual Funds

Investing in mutual funds can be a great way for beginners to build wealth and achieve financial goals. However, it's important to understand some key strategies that can help maximize returns and make informed investment decisions. Here are three essential tips for beginners looking to invest in mutual funds:

1. Diversification and Asset Allocation

Diversification is the fundamental principle that helps manage risk in investment portfolios. By investing in a variety of different mutual funds across various industries, asset classes, and geographic regions, you can reduce the impact of any one investment on your overall portfolio. Additionally, asset allocation involves distributing your investments across different types of assets, such as stocks, bonds, and cash. This strategy helps balance risk and return potential based on your investment goals and risk tolerance.

2. Long-Term Investment Strategies

Mutual funds are designed for long-term investment. While short-term market fluctuations may affect the value of your investment, it's important to stay committed to your long-term goals and avoid making impulsive decisions based on short-term market movements. By staying focused on your investment horizon and maintaining a disciplined approach, you can benefit from the potential compounding of returns over time.

3. Reinvesting Dividends and Capital Gains

Many mutual funds offer the option to reinvest dividends and capital gains. Instead of withdrawing these distributions, reinvesting them allows you to buy additional shares of the mutual fund without incurring transaction fees. This strategy can help boost your overall investment returns by taking advantage of the power of compounding.

By following these strategies and continually educating yourself about mutual funds and investment options, you can set yourself on a path towards maximizing returns and achieving your financial goals. Remember, it's always a good idea to consult a financial advisor or do thorough research before making any investment decisions.

Risks and Considerations in Mutual Fund Investing

When it comes to investing in mutual funds, beginners should be aware of the various risks and considerations involved. While mutual funds offer opportunities for diversification and professional management, there are important factors to keep in mind.

1. Market Risk

Investing in mutual funds means exposing your money to market risk. The value of mutual fund investments can fluctuate due to changes in the overall market, which can lead to potential losses. It's essential to understand that there is no guarantee of positive returns, especially during periods of economic volatility.

2. Expenses and Fees

Mutual funds come with expenses and fees that investors need to consider. These costs can include management fees, transaction fees, and operating expenses. Paying attention to these expenses is crucial since they can impact your overall returns. It's important to review the fund's prospectus and understand the fees associated with the specific mutual fund you are considering.

3. Liquidity and Redemption

Liquidity refers to how easily you can buy or sell your mutual fund shares. While mutual funds offer daily liquidity, there can be restrictions on redemption during certain circumstances. It's essential to understand the fund's redemption policies, including any applicable redemption fees or holding period requirements. This knowledge ensures that you have a clear understanding of the time frame and potential costs associated with accessing your investment.

Overall, investing in mutual funds can provide a way to grow your wealth, but it's important to be aware of the risks and considerations involved. By understanding market risk, expenses and fees, and liquidity and redemption policies, you can make informed decisions that align with your investment goals. Consulting with a financial advisor can also provide valuable guidance in navigating the world of mutual fund investing.

Conclusion

Investing in mutual funds can be a great way for beginners to enter the world of investing. With the help of a professional fund manager, you can diversify your portfolio and potentially earn higher returns than you would with traditional savings accounts. By following the steps outlined in this beginner's guide, you can start your investment journey with confidence and peace of mind.

3. Frequently Asked Questions about Mutual Fund Investing

Q: How much money do I need to start investing in mutual funds?

A: The minimum investment required to start investing in mutual funds can vary depending on the fund and the provider. Some funds may have a minimum investment requirement as low as $500 or even lower, while others may require several thousand dollars. It's important to research different funds and providers to find one that suits your budget.

Q: Are mutual funds safe investments?

A: While mutual funds offer the potential for high returns, like any investment, they come with a certain level of risk. The value of your investment can go up or down depending on market conditions. However, mutual funds are regulated by government bodies and are subject to strict rules and regulations to protect investors.

Q: How do I choose the right mutual fund?

A: Choosing the right mutual fund depends on your investment goals, risk tolerance, and time horizon. Consider factors such as the fund's performance history, expense ratios, and the types of investments it holds. It's also a good idea to consult with a financial advisor who can provide personalized advice based on your individual circumstances.

Remember, investing in mutual funds involves risks, and it's important to do thorough research and seek professional guidance before making any investment decisions. With careful consideration and a long-term investment mindset, mutual funds can be a valuable tool in building your wealth.