How to diversify your portfolio with mutual funds

Written: Editor | June 7, 2023

Benefits of Diversifying with Mutual Funds

When it comes to investing, diversification is a key strategy that can help minimize risk and maximize potential returns. One effective way to achieve diversification is by investing in mutual funds.

Increased investment opportunities through diversification

By investing in mutual funds, individuals gain access to a diversified portfolio that is managed by professional fund managers. These fund managers carefully select a variety of stocks, bonds, and other investment instruments to create a well-rounded portfolio. This diversification spreads the risk across different asset classes and industries, allowing investors to benefit from a broader range of investment opportunities. It also helps decrease the impact of any single investment performing poorly and potentially dragging down the overall portfolio's performance.

Reduced risk and volatility in the portfolio

Diversifying with mutual funds can help reduce the risk and volatility associated with investing in individual stocks or bonds. A well-diversified portfolio is less susceptible to the fluctuations of a single investment, as losses in one area may be offset by gains in another. This can provide investors with a smoother and more stable investment experience over time.

Furthermore, mutual funds often exist in different categories, such as growth funds, value funds, or income funds, allowing investors to select options that align with their risk appetite and investment goals. By spreading investments across these different categories, individuals can further reduce the risk associated with having all their eggs in one basket.

In conclusion, diversifying with mutual funds offers increased investment opportunities and reduced risk and volatility. It provides individuals with access to professionally managed portfolios that are diversified across various asset classes and industries. By taking advantage of these benefits, investors can potentially enhance their investment returns and achieve their financial goals.

:max\_bytes(150000):strip\_icc()/the-5-percent-rule-of-investment-allocation-2466542\_FINAL-f143cd6bc6a64b22a80f75a610da985e.gif)

Diversification Strategies with Mutual Funds

When it comes to investing, diversification is key. It helps reduce risk and increase the potential for returns. One effective way to achieve diversification is by investing in mutual funds. These investment vehicles pool money from multiple investors to invest in a diversified portfolio of assets. Here are two key diversification strategies to consider when investing in mutual funds.

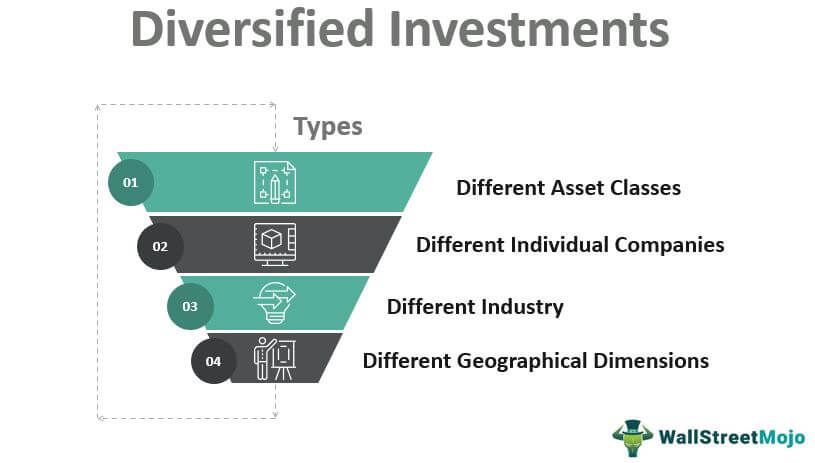

Investing in different asset classes: equities, bonds, money market

One strategy to diversify your mutual fund portfolio is by investing in different asset classes. Equity funds invest in stocks of companies, providing potential for long-term growth. Bond funds invest in fixed-income securities, offering stability and income. Money market funds invest in short-term, low-risk securities, providing liquidity and capital preservation. By allocating your investments across different asset classes, you can balance risk and potential returns.

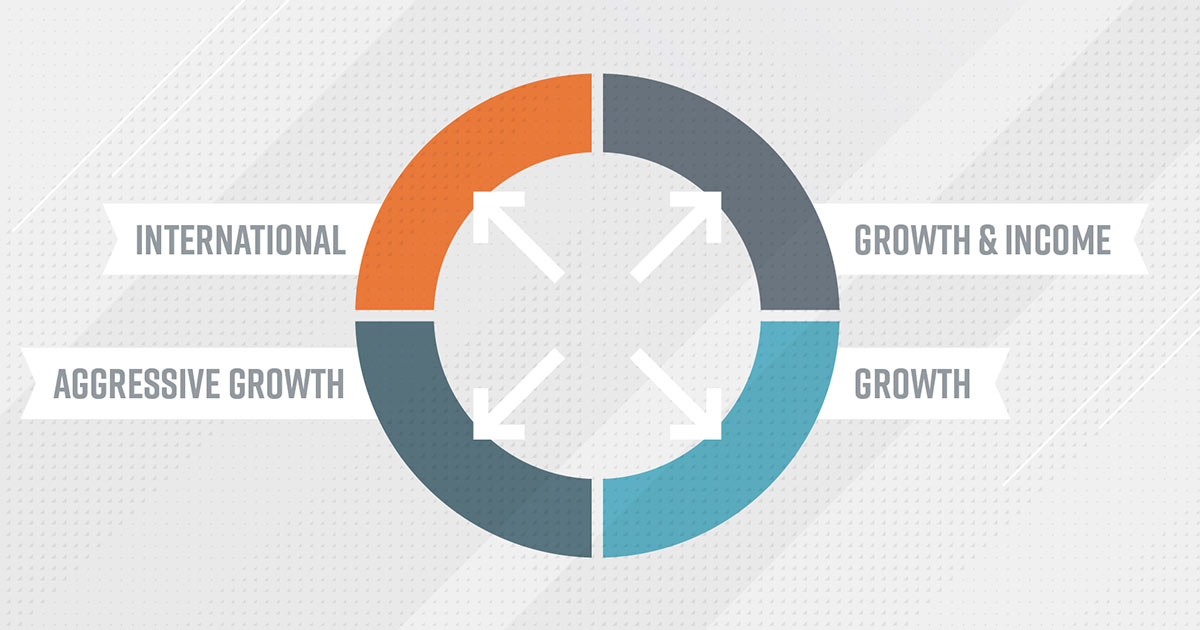

Geographical diversification: domestic and international funds

Another strategy is geographical diversification. Mutual funds offer options to invest in domestic and international markets. Domestic funds focus on companies within a specific country, while international funds invest in companies outside the country. By investing in both domestic and international funds, you can tap into diverse economies, industries, and market cycles. This helps spread risk and capture potential opportunities in different regions.

Overall, diversifying your mutual fund portfolio can help mitigate risk and maximize returns. It is important to assess your investment goals, risk tolerance, and time horizon before selecting mutual funds that align with your objectives. Consulting with a financial advisor can provide guidance and help create a diversified portfolio tailored to your needs.

Factors to Consider when Diversifying with Mutual Funds

When it comes to diversifying your investment portfolio, mutual funds can be a valuable tool. These investment vehicles offer the benefits of diversification by pooling your money with other investors to invest in a variety of assets. However, before you dive into the world of mutual funds, there are a few key factors to consider.

Performance history and fund management

One crucial factor to evaluate when selecting a mutual fund is its performance history. Reviewing the fund's returns over different time periods can give you insight into its consistency and long-term performance. Additionally, researching the fund manager's track record and expertise is essential. A skilled and experienced fund manager may increase the likelihood of achieving favorable returns.

Expense ratios and fees associated with mutual funds

Another important consideration is the expense ratios and fees associated with a mutual fund. These costs can significantly impact your investment returns over time. Look for funds with low expense ratios and be mindful of any additional fees, such as front-end or back-end loads. It's crucial to understand the costs involved and assess whether they align with your investment strategy.

Risk tolerance and investment goals

Everyone's risk tolerance and investment goals differ, so it's essential to evaluate your own before selecting a mutual fund. Mutual funds come in various types, such as equity funds, bond funds, and balanced funds. Understanding your risk tolerance and investment goals will help you determine which types of funds are suitable for your portfolio.

By considering these factors, you can effectively diversify your investment portfolio with mutual funds. Remember to do thorough research and seek professional advice if needed to make informed investment decisions.

Case Studies: Successful Portfolio Diversification with Mutual Funds

Real-life examples of portfolios that have benefited from mutual fund diversification

When it comes to investing, diversification is a key strategy to minimize risk and potentially maximize returns. Mutual funds offer a convenient and effective way to achieve diversification by pooling together investments from various individuals. Let's explore some real-life examples of portfolios that have successfully utilized mutual fund diversification.

-

The Balanced Investor: Sarah, a risk-averse investor, constructed a diversified portfolio using mutual funds. She allocated a portion of her assets to different types of mutual funds, including equities, bonds, and real estate. By diversifying across different asset classes, Sarah was able to reduce the overall risk exposure while maintaining a reasonable rate of return.

-

The Sector Specialist: Robert, an investor with a deep understanding of the technology sector, chose to diversify his portfolio by investing in mutual funds that focus solely on technology companies. This allowed him to diversify across different technology stocks while capitalizing on his knowledge and expertise in the sector.

Analysis of the strategies and outcomes

The Balanced Investor: Sarah's diversified portfolio helped her weather market downturns and fluctuations in specific sectors. By spreading her investments across different asset classes, she was able to mitigate the impact of any single investment performing poorly. Over time, her portfolio achieved consistent growth and provided stability to her overall financial position.

The Sector Specialist: Robert's focused approach to investing in technology mutual funds allowed him to capture the potential upside of the sector while minimizing the risk of individual company failures. While he experienced higher volatility compared to a more diversified portfolio, his knowledge and expertise helped him achieve substantial returns when the technology sector performed well.

In conclusion, mutual funds can be an effective tool for diversifying your investment portfolio. Real-life case studies demonstrate how investors can successfully manage risk and potentially enhance returns by utilizing mutual fund diversification strategies tailored to their individual investment goals and risk tolerance.

Best Practices for Effective Mutual Fund Diversification

Investing in mutual funds can be a smart way to diversify your investment portfolio and minimize risk. By spreading your investments across different asset classes and sectors, you can potentially achieve more stable returns and protect yourself from market downturns. Here are some best practices to consider when diversifying your portfolio with mutual funds.

Setting clear investment objectives and asset allocation

Before investing in mutual funds, it's important to define your investment goals and risk tolerance. Consider factors such as your time horizon, financial situation, and investment preferences. This will guide your asset allocation decisions and help you select the most suitable mutual funds. Diversify your portfolio by choosing funds that invest in various asset classes, such as stocks, bonds, and cash equivalents. This will help you achieve a balance between growth and stability.

Regular portfolio review and rebalancing

To ensure your portfolio remains properly diversified, regularly review your mutual fund holdings. As different assets perform differently over time, your portfolio's allocation may deviate from your original plan. Rebalancing involves selling investments that have gained value and buying more of those that have underperformed. This maintains your desired asset allocation and reduces the risk of being overexposed to a single investment or asset class.

By incorporating these best practices, you can effectively diversify your investment portfolio with mutual funds. Remember to consult with a financial advisor or conduct thorough research before making any investment decisions. With a well-diversified portfolio, you can potentially improve your chances of achieving your financial goals while minimizing risk.

Potential Risks and Challenges of Mutual Fund Diversification

Market risks and potential losses

While diversifying your portfolio through mutual funds can help mitigate risk, it doesn't guarantee protection from market fluctuations and potential losses. The performance of mutual funds is directly influenced by the overall market conditions. Even with a well-diversified portfolio, if the market experiences a downturn, it can still have a negative impact on your investments. It's crucial to understand that diversification doesn't eliminate risk entirely, but rather spreads it across different assets.

Over-diversification leading to diluted returns

While diversification is beneficial, there is also a risk of over-diversification. Investing in too many mutual funds or excessively diversifying your portfolio can lead to diluted returns. When you spread your investments too thin across numerous funds, it can lower the potential for significant gains. It's important to strike a balance between diversification and concentration to optimize returns without sacrificing risk management.

Maintaining an appropriate asset allocation based on your financial goals and risk tolerance is key. Regularly reviewing and rebalancing your portfolio can help ensure it stays aligned with your investment objectives.

Remember to do thorough research and consider consulting with a financial advisor who can help you navigate the potential risks and challenges associated with mutual fund diversification.

Conclusion

Diversifying your portfolio with mutual funds can be a smart strategy to minimize risk and maximize returns. By investing in a variety of assets through mutual funds, you can spread your risk across different market sectors and achieve a more balanced and stable investment portfolio.

Summary of the benefits and strategies of diversifying portfolios with mutual funds

Diversification is crucial for long-term investment success. By investing in mutual funds, you gain access to a diversified pool of assets managed by professional fund managers. This allows you to spread your risk across a range of stocks, bonds, and other securities. Some key benefits of diversifying with mutual funds include:

- Risk reduction: By investing in a variety of asset classes, you can reduce the impact of any single investment's performance on your overall portfolio.

- Professional expertise: Mutual funds are managed by experienced professionals who analyze and select investments on your behalf.

- Convenience and affordability: Mutual funds provide a convenient way for individual investors to access a diversified portfolio without the need for extensive research or large amounts of capital.

Encouragement for readers to consider diversification for their investments

If you want to build a resilient and balanced investment portfolio, diversification through mutual funds is a wise choice. By spreading your investments across different types of securities, sectors, and geographical regions, you can potentially increase your chances of achieving long-term financial goals while minimizing risk.

Frequently Asked Questions

-

How many mutual funds should I own to achieve diversification?

There is no specific number, as it depends on your investment goals and risk tolerance. However, a well-diversified portfolio typically consists of a mix of different types of mutual funds. -

Can I diversify my portfolio with just one mutual fund?

Yes, it is possible. Some mutual funds are designed to be highly diversified, investing in a broad range of assets. However, adding additional funds can further enhance diversification. -

What is the best strategy for selecting mutual funds?It is important to consider factors such as fund performance, fees, risk level, and the fund manager's track record. Conduct thorough research and consult with a financial advisor to determine the best mutual funds for your investment goals.

Remember, diversification is an essential part of investment strategy, and mutual funds can be a valuable tool to achieve that.