The Secret Money-Saving Hacks of the Rich and Famous

Written: Editor | April 25, 2023

Budgeting and Financial Planning

Creating a budget plan

To save money effectively, it's essential to have a budget plan in place. Start by listing all your income sources and fixed expenses, such as rent, utility bills, and loan payments. Allocate a portion of your income to savings and divide the rest among variable expenses, such as groceries, transportation, and entertainment. Use budgeting apps or tools to track your spending and ensure you stay within your allocated amounts.

Tracking expenses and identifying areas to cut back

Keeping track of your expenses is crucial for finding areas where you can cut back and save more. Review your spending habits regularly and identify any unnecessary expenses or areas where you tend to overspend. Consider alternatives or cheaper options for certain purchases, such as cooking at home instead of eating out, or using public transportation instead of driving.

Setting financial goals and saving targets

Setting clear financial goals can help you stay motivated and focused on saving money. Determine your short-term and long-term goals, whether it's saving for a down payment on a house, an emergency fund, or a vacation. Set specific saving targets and create a timeline for achieving them. Automate your savings by setting up recurring transfers to a dedicated savings account.

By implementing these money-saving hacks and making conscious financial choices, you'll be well on your way to achieving your financial goals and building a secure financial future. Remember, small changes can add up over time, so start today and watch your savings grow.

Smart Shopping Strategies

Comparison shopping and using price comparison tools

When it comes to saving money, comparison shopping is a must. Before making a purchase, take the time to research and compare prices from different retailers. This can be done online or by visiting physical stores. Additionally, there are various price comparison websites and apps available that can help you find the best deal. These tools allow you to compare prices across different stores, ensuring that you get the lowest price possible.

Utilizing coupons, discounts, and loyalty programs

Coupons, discounts, and loyalty programs are great ways to save money on your purchases. Keep an eye out for coupons in newspapers, magazines, and online platforms. Many retailers also offer discounts for first-time buyers or during certain promotional periods. Joining loyalty programs can also provide you with exclusive deals, rewards, and discounts. Make sure to sign up for newsletters and follow your favorite brands on social media to stay updated on upcoming promotions.

Tips for negotiating and haggling for better prices

Don't be afraid to negotiate for better prices, especially when making large purchases. Research the market value of the product beforehand and be prepared to walk away if the price is too high. It's also helpful to be polite, build a rapport with the salesperson, and point out any flaws or minor damages that may justify a lower price. Remember, it never hurts to ask, and you may just end up saving a significant amount of money.

By implementing these smart shopping strategies and being proactive in finding the best deals, you can save a substantial amount of money in the long run. Happy shopping!

Frugal Living and Cutting Expenses

Tips for reducing utility bills

Are you tired of the ever-increasing utility bills? Here are some simple yet effective tips to help you reduce your monthly expenses:

-

Energy-efficient appliances: Consider investing in energy-efficient appliances that consume less electricity, such as LED light bulbs or Energy Star-rated electronics.

-

Unplug unused devices: Many devices consume energy even when not in use. Unplug them or use power strips with an on/off switch to easily turn off multiple devices at once.

-

Conservative thermostat settings: Adjust your thermostat to an energy-saving temperature, especially when you're away from home. A programmable thermostat can help automate this process.

DIY hacks for everyday items and services

Save money by trying these do-it-yourself hacks:

-

Homemade cleaning products: Make your own cleaning solutions using simple ingredients like vinegar, baking soda, and lemon juice.

-

Repurpose and reuse: Before throwing something away, think about how it can be repurposed or reused. Get creative with old containers, furniture, or clothing.

-

Learn basic repairs: Instead of hiring professionals for minor repairs, learn some basic skills to fix things yourself. YouTube tutorials and online resources can be helpful.

Simple lifestyle changes for saving money

Implement these lifestyle changes to cut down on unnecessary expenses:

-

Budgeting: Create a monthly budget and track your expenses. This will help you identify areas where you can save and prioritize your spending.

-

Pack your meals: Eating out can be expensive. Prepare lunches and snacks at home to save money on food costs.

-

Use public transportation or carpool: Reduce your transportation expenses by using public transportation, sharing rides with coworkers, or joining carpool programs.

Remember, saving money is a gradual process. Start by implementing one or two tips and gradually incorporate more into your routine. Over time, these small changes can add up to significant savings.

Introduction

Welcome to the world of money-saving hacks! In this article, you will discover some valuable tips and tricks that can help you save more money and achieve your financial goals. So, let's jump right in!

Investment and Retirement Planning

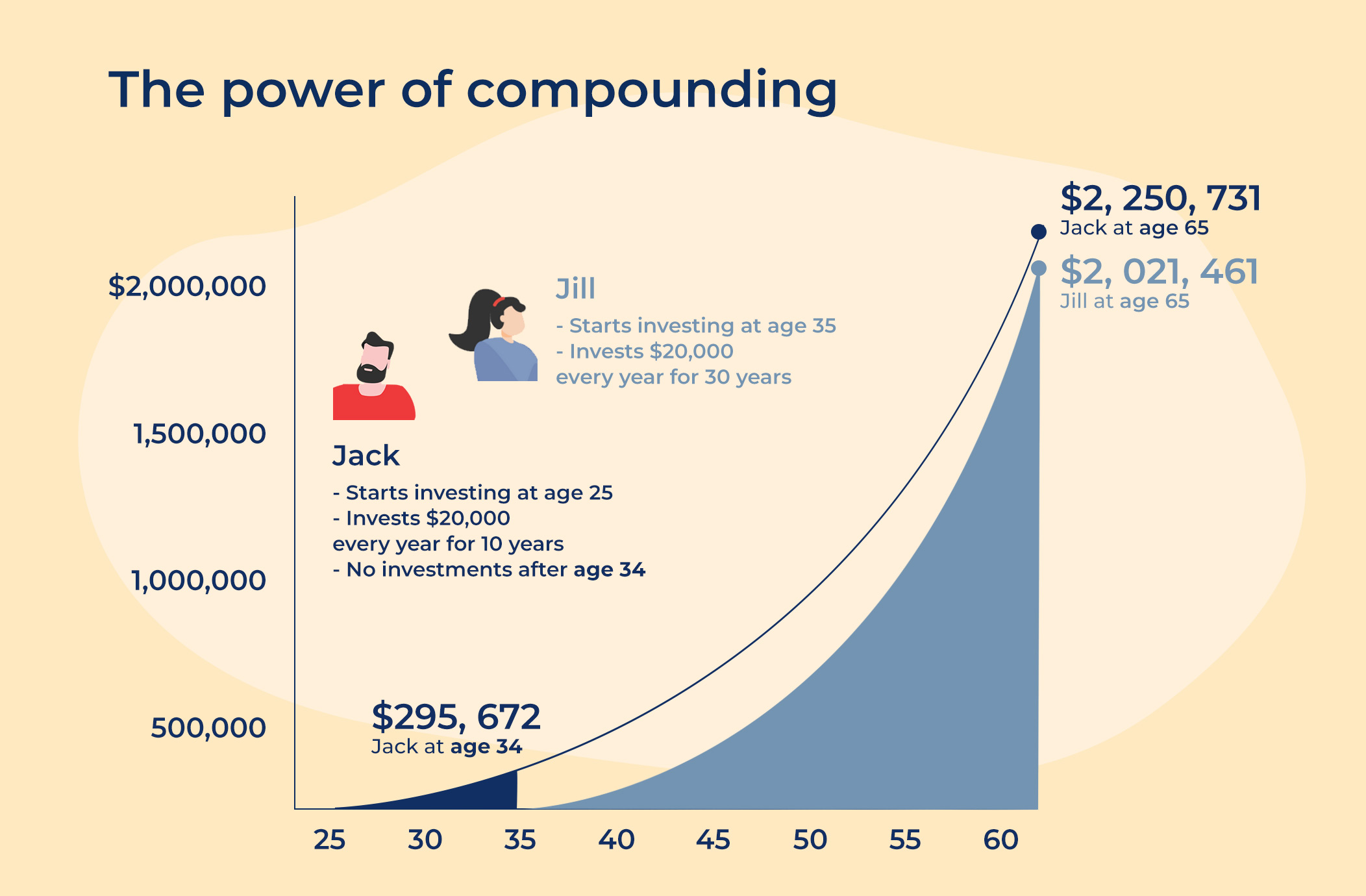

Basics of investment and compounding returns

To start saving and growing your wealth, it's important to understand the basics of investment and compounding returns. Compounding returns refer to the concept of earning interest on your initial investment, as well as on the accumulated interest over time. By investing early and regularly, you can take advantage of compounding to maximize your savings and build a substantial nest egg for retirement.

Understanding different investment options

When it comes to investing, it's crucial to be aware of the different options available. Some popular choices include stocks, bonds, mutual funds, real estate, and index funds. Each investment option comes with its own set of risks and rewards, so make sure to do thorough research and consider seeking advice from a financial advisor before making any decisions.

Tips for planning a secure retirement

Planning for a secure retirement requires careful consideration and long-term planning. Here are a few tips to help you on your journey:

-

Start early: The earlier you start saving for retirement, the more time you have to accumulate wealth and benefit from compounding returns.

-

Set realistic goals: Determine how much money you will need for retirement and create a budget and savings plan that aligns with your goals.

-

Diversify your investments: Spread your investments across different asset classes to minimize risk and maximize returns.

-

Stay disciplined: Stick to your savings plan and avoid impulsive spending to stay on track.

Remember, saving for retirement is a marathon, not a sprint. By taking small steps now and being consistent, you can enjoy a financially secure future.

Additional Money-Saving Ideas

Meal planning and cooking at home

When it comes to saving money, one of the most effective strategies is meal planning and cooking at home. By planning your meals in advance, you can make a grocery list and stick to it, avoiding unnecessary impulse purchases. Cooking at home also allows you to portion your meals appropriately, saving you money on takeout and leftovers. Plus, it's healthier too!

Finding free or low-cost entertainment options

Entertainment doesn't have to break the bank. Look for free or low-cost options in your community such as local parks, libraries, and community centers that offer free classes or events. Check out local websites or social media pages for updates on live performances, art exhibits, or outdoor movies that are often free to attend. Instead of going out for expensive dinners or drinks, consider hosting a game night or potluck with friends.

Using technology to save money (apps, websites, etc.)

Technology can be your best friend when it comes to saving money. Take advantage of money-saving apps and websites that offer discounts, coupons, or cashback opportunities. Compare prices and read reviews online before making a purchase. Use apps that track your spending and help you create a budget. Consider using streaming services instead of cable TV to cut down on monthly expenses. With the right technology tools, you can save money on everyday purchases and make more informed financial decisions.

Remember, saving money doesn't have to be difficult. By implementing these money-saving hacks into your daily life, you can make a significant difference in your overall financial well-being.

Conclusion

Recap of money-saving hacks discussed

-

Create a budget: Set clear financial goals and track your spending to identify areas where you can cut back.

-

Automate savings: Set up automatic transfers to a separate savings account to ensure consistent savings.

-

Cut back on unnecessary expenses: Evaluate your monthly bills and subscriptions and eliminate any that are not essential.

-

Cook at home: Eating out can be expensive, so try cooking meals at home to save money on food.

-

Shop smarter: Look for deals, compare prices, and use coupons or discount codes when making purchases.

Encouragement for readers to implement and benefit from these strategies

By implementing these money-saving hacks, you can take control of your finances and start building wealth. Remember, small changes can add up to significant savings over time.

Final thoughts on achieving financial freedom through smart money management

Financial freedom is attainable for anyone who is willing to make smart money management a priority. By being mindful of your spending, saving diligently, and making strategic decisions, you can improve your financial situation and enjoy a more secure future.

Start implementing these money-saving hacks today and take the first step towards achieving your financial goals.

Frequently Asked Questions (FAQs)

Common questions about money-saving hacks

- What are money-saving hacks and why should I use them?

Money-saving hacks are strategies or tips that can help you save more money in your everyday life. Whether you are trying to build up your savings, pay off debt, or simply make your money stretch further, money-saving hacks can make a big difference. They can help you identify areas where you can cut back on expenses, find creative ways to save, and make smart financial decisions.

- How can I save money on groceries?

There are several ways you can save money on groceries. One hack is to make a shopping list and stick to it, avoiding impulse purchases. Another is to compare prices and look for discounts or coupons. You can also plan your meals in advance and cook at home more often, which can be cheaper than eating out. Shopping in bulk and taking advantage of sales can also help you save.

- What are some energy-saving hacks for my home?

To save on energy costs, you can turn off lights and unplug devices when they are not in use. Using energy-efficient light bulbs, adjusting your thermostat, and insulating your home can also help reduce energy consumption. Additionally, using power strips for electronics and appliances can prevent energy loss from devices on standby mode.

- Are there money-saving hacks for travel?

Yes, there are many money-saving hacks for travel. Booking flights and accommodations in advance, being flexible with travel dates, and using comparison sites can help you find the best deals. Taking advantage of loyalty programs, packing your own snacks, and exploring free or low-cost activities at your destination can also save money during your trip.

Remember, everyone's financial situation is different, so it's important to choose money-saving hacks that work best for you and your goals. Experiment with different strategies and see which ones have the biggest impact on your savings.