The Ultimate Guide to Building Wealth for Millennials

Written: Editor | August 17, 2023

Setting Financial Goals

For many millennials, building wealth and achieving financial success may seem like a daunting task. However, with the right mindset and a clear plan, it is possible to create a solid foundation for a prosperous future.

Defining Financial Goals for Millennials

Before embarking on your wealth-building journey, it is crucial to define your financial goals. These goals may include saving for retirement, purchasing a home, paying off student loans, or starting a business. Take the time to assess your current financial situation and envision where you want to be in the future.

Tips for Setting Realistic and Achievable Goals

To ensure your goals are attainable, follow these tips:

-

Be Specific: Clearly define what you want to achieve and set a timeline for accomplishing each goal.

-

Break it Down: Divide your long-term goals into smaller, more manageable milestones. This allows you to track your progress and stay motivated.

-

Make it Measurable: Set measurable metrics to gauge your progress and make adjustments along the way.

Creating a Budget to Support Your Goals

A budget is a valuable tool in achieving your financial goals. Consider the following steps:

-

Track Your Expenses: Keep a record of your spending habits to identify areas where you can cut back and save more.

-

Set Priorities: Allocate your income towards your highest priority goals and eliminate unnecessary expenses.

-

Review and Adjust: Regularly review your budget and make adjustments as needed to align with your changing financial situation.

By setting personalized financial goals and creating a budget that supports those goals, millennials can take control of their financial future and build wealth over time.

Saving and Investing Strategies

For millennials looking to build wealth, it's important to understand the power of saving and investing. With the right strategies, you can set yourself up for financial success in the future.

The Importance of Saving for Millennials

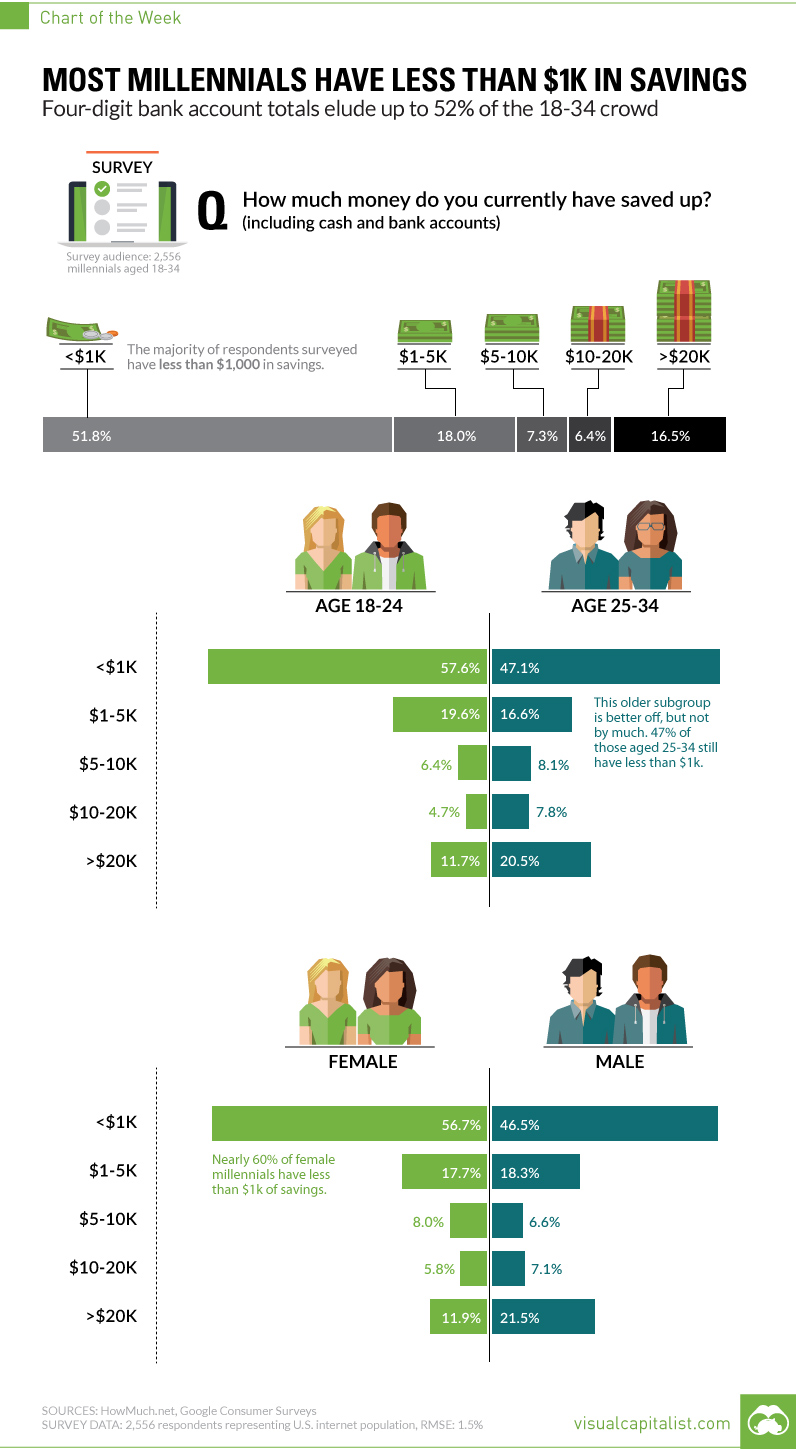

Saving money is crucial for millennials as it provides a strong financial foundation. It allows you to build an emergency fund, have money for big purchases, and plan for retirement. By developing good saving habits early on, you can avoid excessive debt and achieve financial stability.

Different Types of Investments for Building Wealth

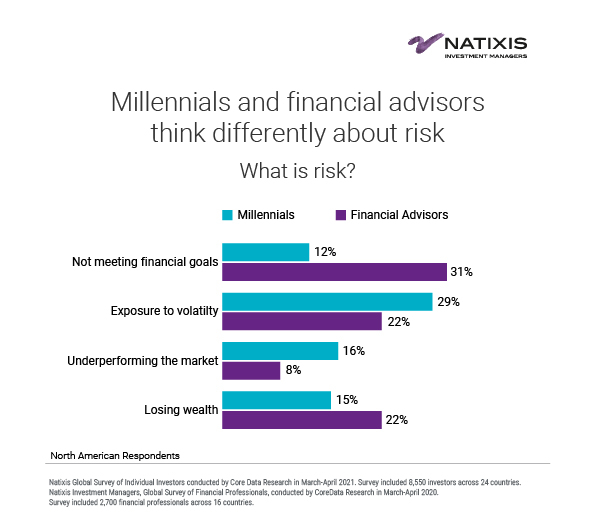

When it comes to building wealth, investing is key. There are various investment options available for millennials, such as stocks, bonds, real estate, and mutual funds. It's important to do your research and choose investments that align with your risk tolerance and financial goals.

Understanding the Power of Compound Interest

Compound interest is a powerful tool for building wealth. It allows your investments to grow exponentially over time. By starting to invest early, you can take advantage of compounding and see significant returns on your investments in the long run.

In conclusion, by incorporating saving and investing strategies into your financial plan, millennials can actively work towards building wealth and securing a solid financial future. Through discipline, research, and understanding the power of compound interest, you can set yourself up for financial success.

Building Multiple Income Streams

For millennials looking to build wealth, relying solely on a 9-to-5 job may not be enough. Building multiple income streams is essential to achieve financial success in today's rapidly changing economy. Here are some key strategies to consider:

Exploring Side Hustles and Freelancing Opportunities

-

Identify your skills: Take stock of your abilities and interests to find side hustles or freelance opportunities that align with your strengths. This could include freelance writing, graphic design, tutoring, or driving for rideshare services.

-

Start small: Begin by taking on part-time gigs or projects in your spare time. As you gain experience and build your reputation, you can gradually increase your workload and potentially turn your side hustle into a full-time business.

Investing in Passive Income Streams

-

Real estate: Consider investing in rental properties or real estate investment trusts (REITs) to generate passive income through rental payments or dividends.

-

Stock market: Invest in stocks, bonds, or index funds to benefit from long-term capital appreciation and regular dividends.

-

Peer-to-peer lending: Explore platforms that allow you to lend money directly to individuals or small businesses and earn interest on your investment.

-

Digital products or online courses: Create and sell digital products, such as e-books, online courses, or software, to generate passive income from intellectual property.

Remember, building multiple income streams takes time and dedication. It's crucial to diversify your sources of income and continuously educate yourself on various investment opportunities. By implementing these strategies, millennials can work towards financial independence and build long-term wealth.

Debt Management and Credit Score Improvement

As millennials navigate their way through adulthood, building wealth becomes a significant goal. One crucial aspect of achieving financial success is effectively managing debt and improving credit scores. By implementing strategies for debt management and credit score improvement, millennials can set themselves up for a more secure future.

Strategies for Managing and Reducing Debt

- Create a Budget: Start by tracking your income and expenses to identify areas where you can cut back and allocate more towards debt repayment.

- Prioritize Debt: Focus on high-interest debts first, such as credit cards, personal loans, or student loans. Make minimum payments on all debts while putting extra money towards the highest interest debt.

- Negotiate with Creditors: If you're struggling to meet your debt payments, reach out to your creditors to explore options such as lower interest rates or extended repayment plans.

Building and Improving Your Credit Score

- Pay Bills on Time: Set up automatic payments or reminders to ensure timely payment of bills. Payment history contributes significantly to your credit score.

- Keep Credit Card Balances Low: Aim to keep credit card balances below 30% of your credit limit. High balances can negatively impact your credit score.

- Regularly Monitor Your Credit Report: Check your credit report for errors and fraudulent activity. Dispute any inaccuracies promptly.

By implementing these strategies, millennials can take control of their debt and work towards improving their credit score. Building wealth starts with a strong financial foundation, and effective debt management and credit score improvement are essential steps in the journey.

Real Estate Investments and Homeownership

When it comes to building wealth, millennials have unique challenges that require a different approach. One avenue worth exploring is real estate investments and homeownership.

Benefits and Risks of Real Estate Investments

Investing in real estate offers several benefits for millennials. First, it provides an opportunity to build equity and generate passive income. Real estate can also serve as a hedge against inflation and diversify an investment portfolio. However, it is important to be aware of the risks involved. These include potential market downturns, property maintenance costs, and vacancies. Conducting thorough research and seeking expert advice can help mitigate these risks.

Tips for First-time Homebuyers

Buying a home is a significant milestone for millennials. To make the process smoother, it is important to consider a few tips. First, save for a down payment to secure a more favorable mortgage rate. Second, get pre-approved for a mortgage to know your budget and increase your chances of getting your dream home. Third, research neighborhoods and work with a trusted real estate agent. Finally, conduct thorough inspections and negotiate the best price.

Exploring Alternative Housing Options for Millennials

In addition to traditional homeownership, millennials can consider alternative housing options. Cohousing, where individuals or families share communal spaces, offers a sense of community and shared expenses. Renting out spare rooms through platforms like Airbnb can also generate extra income. Finally, investing in real estate through real estate investment trusts (REITs) or crowdfunding platforms can provide exposure to the real estate market without the hassles of property management.

Overall, real estate investments and homeownership can play a significant role in building wealth for millennials, offering both financial stability and income generation opportunities. It is important to educate oneself and carefully weigh the benefits and risks before embarking on this path.

Managing Risks and Protecting Wealth

Importance of Emergency Funds and Insurance

It's never too early for millennials to start building wealth and securing their financial future. However, along with wealth-building comes the need to manage risks and protect that hard-earned money. Here are some key considerations for millennials:

Understanding Different Types of Insurance Policies

Insurance is an important part of protecting your wealth. Understanding the different types of insurance policies available can help millennials make informed decisions. Here are a few to consider:

-

Health Insurance: It provides coverage for medical expenses and protects against unexpected healthcare costs. It's crucial to have health insurance to safeguard your financial well-being.

-

Life Insurance: Life insurance ensures financial protection for your loved ones in case of your untimely demise. It can help pay off debts, cover funeral expenses, or provide funds for your family's future.

-

Homeowner's/Renter's Insurance: If you own a home or rent an apartment, having insurance to protect your property is essential. It covers damages, theft, liability, and more.

-

Auto Insurance: If you own a car, auto insurance is a necessity. It provides financial protection in case of accidents, theft, or damage to your vehicle.

Being adequately insured and having emergency funds can safeguard millennials against unforeseen circumstances and financial setbacks. By managing risks and protecting their wealth, millennials can build a strong foundation for a secure financial future.

Growing Wealth Through Entrepreneurship

Entrepreneurship Opportunities for Millennials

Millennials have the advantage of being a tech-savvy generation, which opens up a wide range of opportunities for entrepreneurship. Here are some areas where millennials can explore:

-

E-commerce: With the rise of online shopping, starting an e-commerce business can be a lucrative venture. Millennials can sell their products or use dropshipping models to minimize inventory costs.

-

Online Services: Many millennials are skilled in digital marketing, web design, content creation, and social media management. These skills can be monetized by offering services to businesses or individuals.

-

App Development: As the demand for mobile applications continues to grow, millennials can tap into this market by creating innovative and useful apps.

Key Steps in Starting and Growing a Business

-

Identify a Niche: Research the market and identify a gap where your product or service can fill a need.

-

Create a Business Plan: Outline your business goals, target audience, marketing strategies, and financial projections. This will serve as a roadmap for your business.

-

Build a Strong Network: Connect with mentors, industry experts, and potential customers. Networking can provide valuable advice, partnerships, and opportunities for growth.

-

Focus on Customer Experience: Provide exceptional service, listen to customer feedback, and continuously improve your products or services.

-

Embrace Digital Marketing: Utilize social media, SEO, email marketing, and content creation to reach and engage your target audience.

By leveraging their skills, embracing innovation, and following these key steps, millennials can build successful businesses and grow their wealth through entrepreneurship.

:max\_bytes(150000):strip\_icc()/financial-independence-retire-early-fire-c928050718c9429584e88a5df23ebb1d.jpg)

Introduction

Being a millennial means having a unique set of financial challenges and opportunities. Building wealth may seem daunting, but with the right approach, it can be achievable. One crucial aspect of wealth building for millennials is retirement planning.

Importance of Early Retirement Planning

It's never too early to start planning for retirement, and millennials have a tremendous advantage when it comes to time. Here are a few key reasons why early retirement planning is essential for this generation:

-

Power of compounding: By starting early, millennials have the potential to take advantage of the power of compounding. Even small contributions made early can grow significantly over time.

-

Longer time horizon: Millennials have a longer time horizon before they reach retirement age. This means they have more time to save and invest, increasing the potential for greater wealth accumulation.

-

Changing retirement landscape: Traditional pensions are becoming less common, making it even more crucial for millennials to take control of their retirement savings. Planning early gives them a better chance of building a sufficient nest egg.

-

Flexibility and adaptability: Starting early allows millennials to be more flexible in their retirement plans. They have the ability to explore different investment strategies, take on more risk, and make adjustments along the way.

By prioritizing retirement planning and starting early, millennials can set themselves up for financial security in their later years. With the right strategies and financial discipline, they can build wealth and achieve their retirement goals.

Conclusion

Building wealth as a millennial may seem like a daunting task, but with the right mindset and strategies, it is definitely achievable. By focusing on saving, investing, and building multiple streams of income, millennials can set themselves up for long-term financial success. It's important for millennials to prioritize their financial goals, educate themselves about personal finance, and seek out opportunities to grow their wealth.

Remember, building wealth is a marathon, not a sprint. It requires patience, discipline, and a long-term mindset. With dedication and perseverance, millennials can break free from financial constraints and achieve their financial goals.

Frequently Asked Questions about Building Wealth for Millennials

- How can millennials start building wealth?

- Start by creating a budget and saving a portion of your income.

- Educate yourself about investing and explore different investment options.

- Consider building multiple streams of income through side hustles or entrepreneurship.

- What are some common mistakes millennials make when it comes to building wealth?

- Neglecting to save and invest early.

- Accumulating high levels of debt.

- Failing to diversify their investments.

- How can millennials stay motivated on their wealth-building journey?

- Set specific financial goals and track your progress.

- Surround yourself with a supportive network of like-minded individuals.

- Stay informed and continuously educate yourself about personal finance.

Remember, building wealth is a journey that takes time and dedication. With discipline, perseverance, and the right strategies, millennials can create a solid foundation for their financial future.