Best Stocks for Beginners

Written: Editor | June 28, 2023

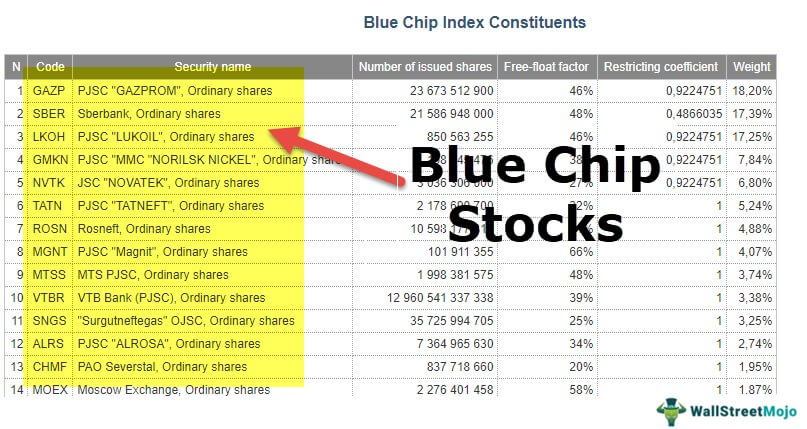

Blue-Chip Stocks

What are blue-chip stocks and why they are ideal for beginners

Blue-chip stocks refer to shares of companies that are well-established, financially stable, and have a history of reliable performance. These companies are typically leaders in their respective industries and have a strong market presence. Due to their stability and reputation, blue-chip stocks are considered ideal investments for beginners.

There are several reasons why beginners should consider investing in blue-chip stocks. First, these stocks are known for their relatively low volatility compared to smaller, riskier stocks. This stability can provide beginners with a sense of security and reduce the potential for significant losses.

Second, blue-chip stocks often pay regular dividends, providing investors with a consistent income stream. This can be particularly beneficial for beginners who are looking for a steady source of passive income.

Top blue-chip stocks for beginners

When it comes to choosing specific blue-chip stocks for beginners, some popular options include:

-

Apple Inc. (AAPL): As one of the largest technology companies in the world, Apple has a strong presence in the consumer electronics industry. The company has a history of consistent revenue growth and a loyal customer base.

-

Johnson & Johnson (JNJ): A global healthcare company, Johnson & Johnson is known for its diverse portfolio of consumer healthcare products, pharmaceuticals, and medical devices. The company has a strong track record of financial stability and dividend payments.

-

The Coca-Cola Company (KO): As a leading beverage company, Coca-Cola has a well-recognized brand and a global distribution network. The company's products have a strong demand and a long history of market success.

Long-term growth potential and stability

One of the main advantages of investing in blue-chip stocks is their long-term growth potential. These companies have a proven track record of success and are likely to continue growing and expanding their market share over time. This can be particularly beneficial for beginners who are looking to build wealth steadily and are willing to hold onto their investments for an extended period.

Additionally, blue-chip stocks tend to be more resilient during economic downturns compared to smaller, riskier stocks. This stability can provide beginners with peace of mind, knowing that their investments are less likely to be heavily impacted by market volatility.

In conclusion, blue-chip stocks are an excellent choice for beginners looking to invest in the stock market. These stocks offer stability, consistent dividends, and long-term growth potential. By carefully selecting blue-chip stocks that align with their investment goals and risk tolerance, beginners can start on the path to building a strong investment portfolio.

:max\_bytes(150000):strip\_icc()/TermDefinitions\_DividenPolicy\_recirc\_3-2-e2e37ae4e643448383899aa6783950cd.jpg)

Introduction

Branding is an essential aspect of establishing and growing any business. It goes beyond just having a logo or catchy slogan, as it encompasses the overall identity, values, and perception of your company. In a competitive market, effective branding can set you apart and enhance your success.

Why is it important to brand your business?

Branding plays a crucial role in the success of your business for several reasons:

-

Builds Trust and Credibility: A strong brand creates trust among consumers. When people recognize and trust your brand, they are more likely to choose your products or services over competitors.

-

Establishes a Unique Identity: Branding allows you to differentiate yourself from competitors. By defining your unique selling points, core values, and brand promise, you can carve out a distinctive spot in the market.

-

Increases Customer Loyalty: Well-executed branding can cultivate customer loyalty. When people feel connected to a brand and its values, they are more likely to become repeat customers and brand advocates.

Distinguish your business from competitors

To distinguish your business from competitors, follow these strategies:

-

Define Your Brand's Unique Value Proposition: Identify what sets your business apart and communicate it clearly to your target audience. Showcase your brand's story, values, and the benefits customers can expect.

-

Create a Memorable Visual Identity: Design a visually appealing logo, select brand colors, and establish consistent brand elements across all platforms. Visual consistency helps customers recognize and remember your brand.

Become more recognizable

To enhance brand recognition, consider the following:

-

Consistent Branding Across Channels: Utilize consistent brand messaging, visuals, and tone of voice across all touchpoints. This enhances brand recall and creates a cohesive image.

-

Engage with Your Target Audience: Actively engage with your audience through social media, content marketing, and community involvement. This fosters brand loyalty and increases recognition.

Branding your business requires an ongoing commitment to nurturing and enhancing your brand image. By investing time and effort into branding, you can establish a unique position in the market, build customer loyalty, and ultimately drive the success of your business.

Growth Stocks

Exploring growth stocks and their potential for beginners

When it comes to investing in the stock market, beginners often seek opportunities that offer high potential for returns. One such option is growth stocks. These are shares of companies that are expected to experience substantial growth in revenue and earnings in the years to come. While investing in stocks comes with risks, growth stocks have the potential to deliver significant gains over time.

Top growth stocks for beginners

1. Amazon (AMZN): Known as the global e-commerce giant, Amazon has consistently demonstrated strong growth. With its diverse range of products and services, including cloud computing and streaming services, Amazon continues to innovate and expand its market share.

2. Alphabet (GOOGL): As the parent company of Google, Alphabet dominates the online advertising market. With continuous product development and expansion into other sectors like autonomous driving and artificial intelligence, Alphabet's growth potential remains high.

3. Microsoft (MSFT): Microsoft has successfully transitioned from a software-focused company to a leader in cloud computing and other emerging technologies. Its strong financials, extensive product portfolio, and strategic acquisitions position it for continued growth.

Strategies for maximizing returns in a dynamic market

While investing in growth stocks can be rewarding, it is essential to have a well-thought-out strategy to maximize returns. Here are a few tips for beginners:

1. Do thorough research: Research the company's financials, management team, competitive landscape, and growth prospects. Use reliable sources and seek expert opinions to make informed investment decisions.

2. Diversify your portfolio: Investing in a variety of growth stocks across different industries can help mitigate risk. This diversification spreads your investment across various sectors and minimizes the impact of a single company's performance.

3. Monitor your investments: Stay updated on news, quarterly earnings reports, and market trends. Regularly review your portfolio to ensure it aligns with your investment goals and make necessary adjustments as needed.

4. Take a long-term perspective: Investing in growth stocks requires patience. While short-term market fluctuations may occur, focusing on the long-term growth potential of a company can yield substantial returns over time.

In conclusion, growth stocks offer beginners an opportunity to invest in companies with high growth potential. By conducting thorough research, diversifying their portfolio, staying informed, and adopting a long-term perspective, beginners can maximize their returns and navigate the dynamic stock market effectively.

Conclusion

In conclusion, investing in the stock market can be a great way for beginners to grow their wealth over time. However, it is important to approach investing with caution and do thorough research before making any decisions. The best stocks for beginners are those that are from stable and well-established companies, have a strong track record of performance, and offer dividends. It is also important for beginners to diversify their portfolios and not put all their eggs in one basket. By following these guidelines and seeking advice from financial professionals, beginners can increase their chances of success in the stock market.

Summary of the best stocks for beginners

When considering the best stocks for beginners, it is important to look for companies with a strong track record, stable financials, and consistent performance. Some top picks for beginners include blue-chip stocks like Apple Inc., Microsoft Corporation, and Coca-Cola Company. These companies have proven to be reliable investments over time and offer the potential for long-term growth. Additionally, dividend stocks such as Johnson & Johnson and Procter & Gamble can provide a steady source of income for beginner investors. It is also worth considering exchange-traded funds (ETFs) and index funds, which provide diversification and low-cost investing options for beginners.

Tips for successful investing as a beginner

- Do thorough research and learn about the company or industry before investing.

- Start with small investments and gradually increase your portfolio as you gain experience.

- Diversify your portfolio to minimize risk by investing in a variety of stocks and sectors.

- Set clear financial goals and have a long-term investment strategy.

- Stay updated on market trends and news that could impact your investments.

- Seek advice from financial professionals or consider working with a financial advisor.

Frequently Asked Questions

Q: What are the best stocks for beginners?

A: The best stocks for beginners are those from stable and well-established companies with a strong track record of performance. Examples include blue-chip stocks like Apple, Microsoft, and Coca-Cola.

Q: Should beginners focus on dividend stocks?

A: Dividend stocks can be a good option for beginners as they provide a steady source of income. However, it is important to consider other factors such as the company's financial health and growth potential.

Q: Is it necessary to invest in individual stocks as a beginner?A: No, beginners have the option to invest in exchange-traded funds (ETFs) and index funds, which offer diversification and low-cost investing options.

Q: What are some tips for successful investing as a beginner?A: Some tips for successful investing as a beginner include doing thorough research, starting with small investments, diversifying your portfolio, and seeking advice from financial professionals.