The Best Investment Strategies for Long-Term Financial Success

Written: Editor | July 24, 2023

Building a Strong Financial Foundation

When it comes to achieving long-term financial success, having a solid investment strategy is crucial. Building a strong financial foundation involves setting clear goals, creating a budget and saving plan, and building an emergency fund. These steps will help you navigate the ups and downs of the financial world and secure your future.

1. Setting Clear Financial Goals

To achieve long-term financial success, it is important to define your goals. Whether it's saving for retirement, buying a home, or starting a business, setting clear and achievable goals provides focus and direction. Identify your priorities and establish a timeline for reaching each goal. This will help you develop a targeted investment strategy tailored to your specific needs.

2. Creating a Budget and Saving Plan

Creating a budget is an essential step in managing your finances and achieving your long-term financial goals. Start by tracking your income and expenses to get a clear understanding of your financial situation. Set aside a portion of your income for savings and investments. Stick to your budget and regularly review it to make adjustments as needed.

3. Building an Emergency Fund

Unexpected expenses can derail your financial progress. Building an emergency fund is crucial to handle these situations without going into debt. Aim to save three to six months' worth of living expenses in a separate account. This will provide a safety net in case of job loss, medical emergencies, or other unforeseen circumstances.

By following these key strategies, you can build a strong financial foundation that will pave the way for long-term success. Remember to regularly review and adjust your investment strategy as your goals and financial circumstances evolve. With patience, discipline, and a well-thought-out plan, you can achieve your financial dreams and secure your future.

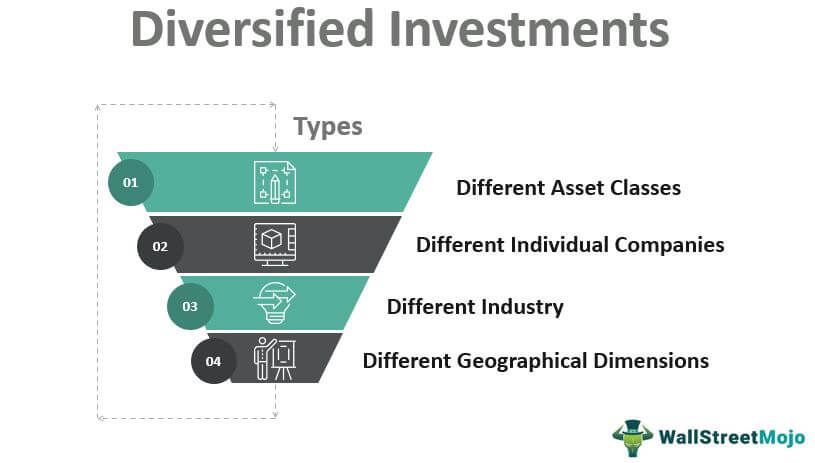

Diversifying Your Investment Portfolio

When it comes to achieving long-term financial success, one of the key strategies is diversifying your investment portfolio. By spreading your investments across different asset classes, you can minimize risk and maximize returns. Here are some important points to consider in order to build a diversified portfolio:

1. Understanding the Importance of Diversification

Diversification is a risk management strategy that involves investing in a variety of assets, such as stocks, bonds, real estate, and commodities. By not putting all your eggs in one basket, you can reduce the impact of any single investment on your overall portfolio. This means that even if one investment performs poorly, the others may still deliver positive returns and help you maintain a balanced portfolio.

2. Exploring Different Investment Options

To diversify your portfolio, it is important to explore different investment options. Consider investing in a mix of stocks, bonds, mutual funds, real estate, and even alternative investments like commodities or cryptocurrencies. Each asset class has its own risk and return characteristics, so having exposure to multiple asset classes can help reduce the overall risk of your portfolio.

3. Managing Risk and Maximizing Returns

While diversification can help manage risk, it is also important to actively manage your investments to maximize returns. Regularly review and rebalance your portfolio to ensure that your asset allocation remains in line with your investment goals and risk tolerance. Additionally, consider seeking professional advice to navigate the complexities of the market and identify investment opportunities that align with your financial objectives.

In conclusion, diversifying your investment portfolio is a crucial strategy for long-term financial success. By spreading your investments across different asset classes and actively managing your portfolio, you can reduce risk, maximize returns, and increase the likelihood of achieving your financial goals.

Long Term Investing Strategies for Financial Success

Whether you're a seasoned investor or just starting out, having a long-term investment strategy is crucial for achieving financial success. Here are three strategies to consider for long-term investing:

1. Investing in Stocks: Fundamental Analysis

Investing in stocks can provide excellent long-term returns if done correctly. The key is to conduct fundamental analysis, which involves evaluating a company's financial health, competitive advantage, and growth prospects. By carefully analyzing these factors, you can identify undervalued stocks with the potential for long-term growth. It's important to diversify your stock portfolio across different industries and company sizes to spread your risk.

2. Investing in Bonds and Fixed Income Securities

Bonds and fixed income securities are another long-term investment option. These investments provide a fixed income stream through periodic interest payments. They are generally considered lower risk than stocks, as they offer a predictable return and are less volatile. Government bonds, corporate bonds, and municipal bonds are common types of fixed income securities. Investing in bonds can provide stability and serve as a hedge against stock market fluctuations.

3. Real Estate Investment Opportunities

Investing in real estate can be an effective long-term investment strategy. Real estate investments offer the potential for both income and capital appreciation over time. Rental properties, commercial real estate, and real estate investment trusts (REITs) are popular options for long-term investors. It's essential to conduct thorough market research, assess potential rental income, and consider property appreciation potential before investing in real estate.

By diversifying your investment portfolio across these different asset classes, you can reduce risk and maximize long-term returns. Additionally, it's important to regularly review and adjust your investment strategy based on changing market conditions and your financial goals. Remember, long-term investing requires patience, discipline, and a focus on the bigger picture.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. It is always recommended to consult with a professional financial advisor before making any investment decisions.

Retirement Planning and Wealth Accumulation

When it comes to long-term financial success, knowing how to invest your hard-earned money is crucial. It's important to have a solid investment strategy in order to maximize your returns and secure a comfortable future.

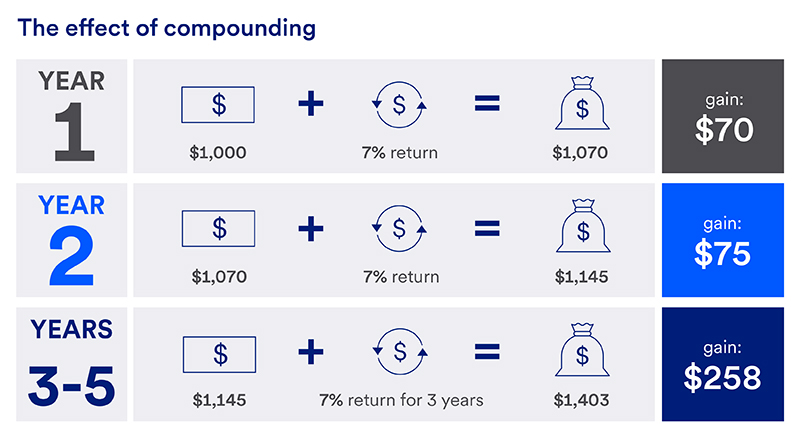

1. The Power of Compound Interest

One of the most powerful investment strategies for long-term financial success is taking advantage of compound interest. Compound interest allows your investments to grow exponentially by reinvesting the interest earned. This means that the longer you invest, the more your money will grow.

2. Retirement Account Options: 401(k), IRA, and Roth IRA

Having a retirement account is another essential investment strategy for long-term financial success. There are several options available, such as a 401(k), IRA, and Roth IRA. These retirement accounts offer tax advantages and can help you save for the future. It's important to understand the contribution limits, tax benefits, and withdrawal rules associated with each type of retirement account.

3. Utilizing Tax-Advantaged Investment Strategies

Utilizing tax-advantaged investment strategies is another key component to long-term financial success. These strategies include investing in tax-efficient funds, utilizing tax-advantaged accounts like a Health Savings Account (HSA), and taking advantage of tax-loss harvesting. These strategies can help you minimize your tax liabilities and maximize your investment returns.

In conclusion, investing for long-term financial success requires careful planning and consideration of various investment strategies. By harnessing the power of compound interest, utilizing retirement accounts, and implementing tax-advantaged investment strategies, you can set yourself up for a secure and comfortable future. Remember to consult with a financial advisor to tailor these strategies to your specific needs and goals

:max\_bytes(150000):strip\_icc()/top-investing-strategies-2466844-FINALV1-0bf945be626a4c9b97bb9ebd6703d8cb.jpg)

Monitoring and Adjusting Your Investment Strategy

When it comes to long-term financial success, having a solid investment strategy is essential. However, it's not enough to simply set it and forget it. Regular monitoring and adjustments are necessary to ensure that your investments are aligned with your goals and market conditions.

1. Regular Portfolio Reviews and Rebalancing

One key aspect of monitoring your investment strategy is conducting regular portfolio reviews and rebalancing. This involves assessing the performance of your investments and making necessary adjustments to maintain your desired asset allocation. For example, if one asset class has significantly outperformed others, you may need to sell some of it and reinvest in underperforming areas to maintain balance and manage risk.

2. Responding to Market Changes and Economic Conditions

Market changes and economic conditions can have a significant impact on your investments. It is important to stay informed and be prepared to adjust your strategy accordingly. For example, during periods of economic downturn, it may be wise to adopt a more defensive approach and allocate a larger portion of your portfolio to more stable investments. On the other hand, during times of economic growth, you may want to take advantage of emerging opportunities and adjust your strategy to include more aggressive investments.

3. Seeking Professional Financial Advice

Seeking professional financial advice is another crucial step in ensuring long-term investment success. Financial advisors have expertise in the field and can provide valuable insights tailored to your specific financial goals and circumstances. They can help you develop a personalized investment strategy, monitor its performance, and make necessary adjustments along the way.

Remember, successful investing is a continuous process. By regularly monitoring and adjusting your investment strategy, responding to market changes, and seeking professional advice when needed, you increase your chances of achieving long-term financial success.

:max\_bytes(150000):strip\_icc()/valueinvesting\_definition\_0801-7e37a086219548a2b454bf45af4835f4.jpg)

Conclusion

In conclusion, implementing the right investment strategies can greatly contribute to your long-term financial success. By following key takeaways such as diversification, consistent saving, and staying informed, you can build a strong investment portfolio that withstands market fluctuations. Remember, patience and discipline are essential in weathering the ups and downs of the market and avoiding impulsive decisions. With these qualities, you can stay focused on your long-term goals and avoid getting swayed by short-term market trends. Lastly, building wealth for a secure future involves making smart investment choices, taking advantage of compound interest, and seeking professional guidance when needed. By investing strategically and optimizing your returns, you can ensure financial security and a comfortable retirement. So take control of your financial future today and start implementing these investment strategies for long-term success.