The Best Tax Software for DIY Tax Preparation

Written: Editor | June 13, 2023

Top DIY Tax Software Options

Are you looking to file your taxes on your own? DIY tax software can make the process easier and less stressful. Here are three top options for DIY tax software to consider:

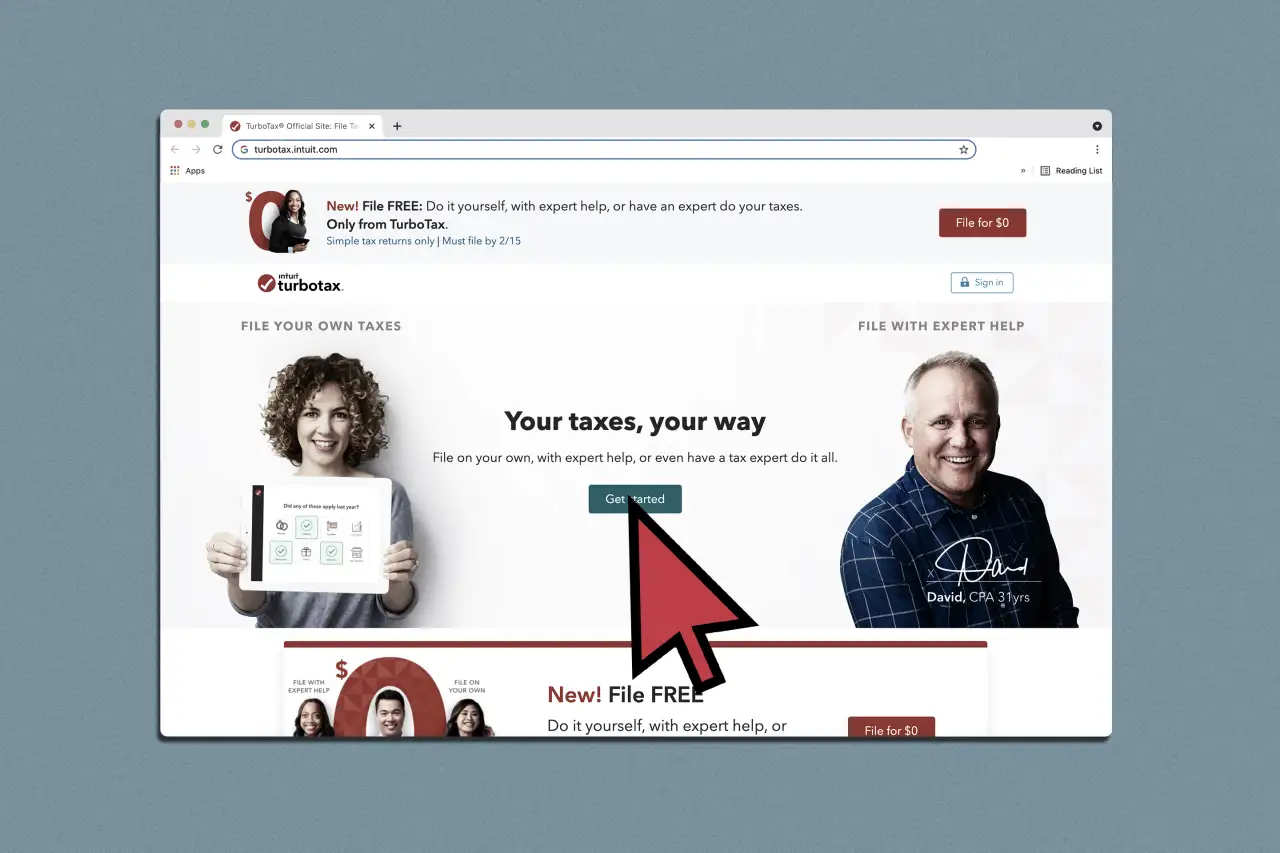

TurboTax

TurboTax is one of the most popular tax software options available. It offers a user-friendly interface and guides you through the tax-filing process step-by-step. With TurboTax, you can easily import your tax documents, such as W-2s and 1099s, making it quicker to complete your return. The software also provides helpful advice and explanations, ensuring that you understand each section. TurboTax offers different versions to accommodate different tax situations, including free filing for simple returns.

H&R Block

H&R Block is another great option for DIY tax software. It offers a variety of features, including the ability to import tax documents, access to expert tax advice via chat or phone, and error-checking to help reduce the risk of mistakes. H&R Block also has a user-friendly interface and provides step-by-step guidance. They offer different versions to fit different tax needs and even have an online tax preparation service if you prefer to have a professional review your return.

TaxAct

TaxAct is a budget-friendly option for those looking for DIY tax software. It provides a straightforward and intuitive interface. TaxAct offers free filing for simple tax returns and has affordable pricing options for more complex tax situations. The software offers various features, including the ability to import tax documents, review your return for accuracy, and access to tax resources and calculators. TaxAct is a reliable option that can help you efficiently file your taxes.

Overall, these top DIY tax software options offer user-friendly interfaces, step-by-step guidance, and various features to make your tax-filing experience easier. Consider your tax situation and preferences when choosing the best software for you.

Features and Functionality of DIY Tax Software

User-friendly Interfaces

When it comes to preparing your taxes, using the right software can make all the difference. DIY tax software is designed to be user-friendly, making it easy for individuals to navigate through the tax preparation process without feeling overwhelmed. These software solutions often have intuitive interfaces and step-by-step instructions, ensuring that even those with minimal tax knowledge can complete their returns accurately. Whether you're a first-time filer or a seasoned taxpayer, these user-friendly interfaces make the tax preparation process a breeze.

Importing and Organizing Documents

Gone are the days of manually entering each and every piece of tax information. DIY tax software offers the convenience of importing and organizing your documents electronically. You can easily import data from your previous year's tax return, W-2 forms, 1099 forms, and more. This feature saves you time and reduces the likelihood of making errors while manually entering information. Additionally, these software solutions often provide tools for organizing your documents, keeping everything in one place for easy access when needed.

Error Checking and Audit Support

One of the greatest advantages of using DIY tax software is the built-in error checking and audit support. These programs automatically scan your tax return for common errors and inconsistencies, minimizing the risk of mistakes. This helps ensure that your return is accurate and increases the chances of maximizing your deductions and credits. In the unlikely event of an audit, many DIY tax software solutions offer audit support, guiding you through the process and providing assistance with any necessary documentation.

By utilizing these features and functionalities, DIY tax software empowers individuals to take control of their tax preparation process. With user-friendly interfaces, importing and organizing documents, and error checking and audit support, these software solutions make filing your taxes easier and more efficient than ever before.

Support and Customer Service

When it comes to DIY tax software, getting the right support and customer service is crucial. As a do-it-yourself taxpayer, you want to ensure that you have access to help whenever you need it. Here are some key points to consider when evaluating the support and customer service offered by tax software providers.

Live Chat and Phone Support Options

One important feature to look for is the availability of live chat and phone support options. These channels allow you to connect directly with customer service representatives who can provide immediate assistance. Whether you have a question about a specific deduction or need help navigating the software, having the option to chat or speak with a knowledgeable representative can make a big difference in your tax filing experience.

Online Help Center and Resources

In addition to live chat and phone support, a comprehensive online help center and resources section is another valuable feature to consider. This provides you with a self-service option to find answers to common questions and troubleshoot any issues you may encounter. Look for software providers that offer easy-to-understand tutorials, FAQs, and articles that cover a wide range of tax-related topics.

Availability of Professional Assistance

While DIY tax software is designed for users who prefer to handle their taxes independently, having access to professional assistance can be beneficial in certain situations. Look for software providers that offer the option to connect with certified tax professionals who can review your return or provide guidance on complex tax matters. This can provide you with added peace of mind and ensure that you are maximizing your deductions and credits.

Remember, selecting the best DIY tax software is not just about the features and functionality, but also about the level of support and customer service offered. By choosing a provider that prioritizes customer satisfaction and assistance, you can have the confidence to navigate the tax filing process with ease.

Pricing and Packages

Are you dreading tax season and looking for an easy and affordable way to file your taxes? Look no further than DIY tax software! With a wide range of options available, filing your taxes has never been easier. Let's explore the pricing and packages offered by the best DIY tax software.

Free Editions and Basic Packages

If you have a simple tax situation and don't want to spend a dime, there are free editions of DIY tax software available. These editions offer basic features such as simple tax return preparation and e-filing. While they may not have all the bells and whistles of the paid versions, they are a great option for those on a tight budget.

Upgrades and Additional Features

For more complex tax situations or for those who need additional features, most DIY tax software providers offer upgraded packages. These packages typically include features such as assistance for deductions, investments, and rental income. They also often provide live chat support or access to tax experts for more advanced tax-related questions.

Comparison of Prices and Value for Money

When choosing the right DIY tax software, it's essential to compare prices and value for money. While some providers offer packages at a higher cost, they may come with additional features that could save you time and money in the long run. Take into consideration the level of support, ease of use, and accuracy of their calculations when comparing prices.

In conclusion, DIY tax software offers a convenient and cost-effective way to file your taxes. Whether you opt for the free edition or upgrade to a more advanced package, you'll find a solution that meets your specific tax needs. Take the stress out of tax season and start maximizing your tax return with the best DIY tax software available.

User Reviews and Ratings

Positive Feedback and Customer Satisfaction

If you're looking for the best DIY tax software, it's important to consider what other users have to say. Positive feedback and high customer satisfaction are strong indicators of a reliable and user-friendly software. Many users appreciate the convenience and simplicity of DIY tax software, as it allows them to easily file their taxes without the need for expensive professional help. Some common positive feedback includes:

-

Ease of Use: DIY tax software is often praised for its user-friendly interface and step-by-step guidance, making it easy for anyone to navigate through the filing process.

-

Time-Saving: Users appreciate how DIY tax software saves them time by automatically calculating deductions and credits, minimizing the need for manual calculations.

-

Cost-Effective: Compared to hiring a professional tax preparer, DIY tax software is much more affordable, allowing users to save money while still ensuring accurate tax filing.

Common Criticisms and Drawbacks

While the overall feedback for DIY tax software is positive, there are some common criticisms and drawbacks to consider:

-

Limited Support: Some users have reported difficulties in finding prompt and helpful support when encountering technical issues or more complex tax situations.

-

Software Limitations: DIY tax software may not be suitable for businesses with complex tax situations or those requiring specialized tax advice.

-

Learning Curve: Although DIY tax software is designed to be user-friendly, there can still be a learning curve for first-time users who are not familiar with tax filing processes.

Comparison of User Ratings for Each Software

To help you make an informed decision, here is a comparison of user ratings for some popular DIY tax software:

| Software | User Ratings (out of 5) |

|---|---|

| TurboTax | 4.5 |

| H&R Block | 4.3 |

| TaxAct | 4.2 |

| FreeTaxUSA | 4.0 |

| Credit Karma | 3.9 |

These ratings are based on user reviews and reflect the overall satisfaction and usability of each software. However, it's important to note that individual experiences may vary, so it's recommended to read user reviews and consider your specific needs before choosing the best DIY tax software for your situation.

Conclusion

When it comes to filing your taxes, using the right software can greatly simplify the process and help you save time and money. With the wide range of options available, it's important to choose the best DIY tax software that suits your specific needs. By considering factors such as user-friendliness, features, pricing, and customer support, you can find the perfect software to handle your tax preparation efficiently.

Summary of the Best DIY Tax Software Options

Here's a roundup of the top DIY tax software options:

-

TurboTax: Known for its user-friendly interface, TurboTax offers a variety of packages to suit different tax situations, including options for freelancers and small business owners.

-

H&R Block: With its extensive knowledge base and excellent customer support, H&R Block provides a comprehensive solution for individuals and businesses alike.

-

TaxAct: TaxAct offers affordable options for both simple and complex tax returns, with step-by-step guidance and helpful tools.

-

TaxSlayer: Ideal for budget-conscious individuals, TaxSlayer provides a range of affordable packages with features like audit protection and live chat support.

Final Thoughts and Recommendations

When choosing DIY tax software, consider your specific tax situation, budget, and desired level of support. Take advantage of free trials or demos to test out the software and ensure it meets your needs. Remember to stay organized and gather all necessary documents before starting the tax preparation process to ensure accuracy.

FAQs about DIY Tax Software

-

Can DIY tax software handle complex tax situations?

Yes, many DIY tax software options offer advanced features and guidance for complex tax situations, including self-employment income, rental properties, and investment income. -

How much does DIY tax software cost?

The cost of DIY tax software varies depending on the provider and the package you choose. Prices can range from free for simple returns to higher fees for more complex tax situations. -

Is DIY tax software safe?Yes, reputable DIY tax software providers utilize stringent security measures to protect your personal and financial information. Look for software with encryption and data protection features for added security.