The Best Budgeting Apps for 2023

Written: Editor | July 26, 2023

Mint

Mint Overview and Key Features

If you're looking for a budgeting app that can help you gain control of your finances, Mint is a great option to consider. Mint is a free, user-friendly app that allows you to track and manage your spending, create budgets, and set financial goals. With over 20 million users, Mint has become one of the most popular budgeting tools available.

One of Mint's key features is its ability to automatically sync with your bank accounts, credit cards, and other financial accounts. This means that all your transactions are automatically imported and categorized, making it easy to see where your money is going.

How to Set Up and Use Mint for Budgeting

Getting started with Mint is a breeze. Simply download the app from your device's app store and create an account. Once you've set up your account, you can link it to your bank accounts and other financial accounts.

With Mint, you can create a budget based on your income and expenses. The app will automatically categorize your transactions, making it easy to see where you may be overspending.

Analyzing Spending and Setting Goals with Mint

Mint makes it easy to analyze your spending habits and set goals to help you achieve your financial objectives. The app provides detailed charts and graphs that show you exactly where your money is going. You can also set specific financial goals, such as saving for a vacation or paying off debt, and Mint will track your progress towards these goals.

Additionally, Mint provides personalized suggestions for ways to save money based on your spending habits. It can help you find better deals on credit cards, loans, and insurance, and even notify you when there are potential savings opportunities.

Overall, Mint is a powerful and user-friendly budgeting app that can help you take control of your finances. Whether you're trying to save money, pay off debt, or simply track your spending, Mint's features and tools make it a top choice for budget-conscious individuals.

PocketGuard

PocketGuard Features and Functionality

If you're looking for a budgeting app that can help you effectively manage your finances without breaking the bank, PocketGuard may be the perfect fit for you! This intuitive app provides a range of features and functionality to help you stay on top of your budget and make smarter financial decisions.

With PocketGuard, you can link your bank accounts, credit cards, and loans all in one place, allowing you to easily track your income and expenses. The app automatically updates your transactions and categorizes them, giving you a clear overview of where your money is going.

Creating a Personalized Budget with PocketGuard

One of the standout features of PocketGuard is its ability to create a personalized budget based on your income, expenses, and financial goals. The app takes into account your spending patterns and suggests a budget that is realistic and achievable.

You can set specific spending limits for different categories, such as groceries, entertainment, and transportation. PocketGuard will then track your expenses in real-time and notify you if you're approaching or exceeding your budget. This feature helps you stay accountable and make necessary adjustments to ensure you're staying within your financial means.

Tracking Expenses and Saving Money with PocketGuard

PocketGuard is not just about tracking your expenses; it also helps you save money. The app analyzes your spending habits and identifies areas where you can cut back and save. It provides insights on how much you're spending on various categories and even suggests ways to reduce costs.

Additionally, PocketGuard offers a variety of money-saving tools, such as finding better deals on bills, optimizing credit card rewards, and even recommending cheaper alternatives for certain products or services. These features empower you to make informed decisions and maximize your savings potential.

In conclusion, PocketGuard is a comprehensive budgeting app that offers a range of features to help you manage your finances effectively. Whether you're looking to create a personalized budget, track your expenses in real-time, or save money, PocketGuard has you covered. Give it a try and take control of your financial future!

Introduction

As someone who strives to manage their personal finances effectively, you might be on the lookout for the best budgeting app to help you stay on top of your money. Look no further than YNAB (You Need a Budget)!

Getting Started with YNAB and Setting Up Budget Categories

When you first start using YNAB, it's essential to set up your budget categories. This step allows you to allocate your income to different spending areas. Start by adding your regular expenses like rent, utilities, groceries, and transportation. YNAB also encourages you to create categories for your less frequent expenses, like vacations or car repairs. Categorizing your spending helps you see where your money is going and identify areas where you can save.

Using YNAB's Rule of Thumb: Give Every Dollar a Job

One of the core principles of YNAB is the “give every dollar a job” rule. This means assigning a purpose to every dollar you have. When you receive income, allocate it to your budget categories according to your priorities. By giving each dollar a job, you ensure that your money is working towards your financial goals and nothing goes unnoticed.

Goal Setting and Savings Strategies with YNAB

YNAB offers powerful tools for goal setting and saving strategies. You can create goals for various objectives like paying off debt, saving for a down payment, or building an emergency fund. YNAB helps you track your progress towards these goals and provides insights on how to adjust your spending to achieve them faster. The app also encourages saving by automatically analyzing your spending patterns and suggesting areas where you can cut back.

Here's a table to highlight the key features of YNAB:

| Feature | Explanation |

|---|---|

| Getting Started with YNAB | Set up your budget categories and allocate your income to different spending areas. |

| Using YNAB's Rule of Thumb | Assign a purpose to every dollar you have, ensuring that your money is working towards your financial goals. |

| Goal Setting and Savings Strategies | Set goals for paying off debt, saving for specific purchases, or building an emergency fund. YNAB helps track progress and provides insights on adjusting spending for faster goal achievement. |

In conclusion, YNAB is an excellent budgeting app that guides you through the process of financial management. By properly setting up your budget categories, following the “give every dollar a job” rule, and leveraging the app's goal-setting features, you'll be well on your way to achieving financial success. Give YNAB a try and take control of your money today!

Conclusion

If you're looking to take control of your finances and stay on top of your budget, budgeting apps can be a great tool to help you achieve your financial goals. With a budgeting app, you can easily track your income and expenses, set savings goals, and even get personalized financial advice. Three popular budgeting apps to consider are Mint, PocketGuard, and YNAB.

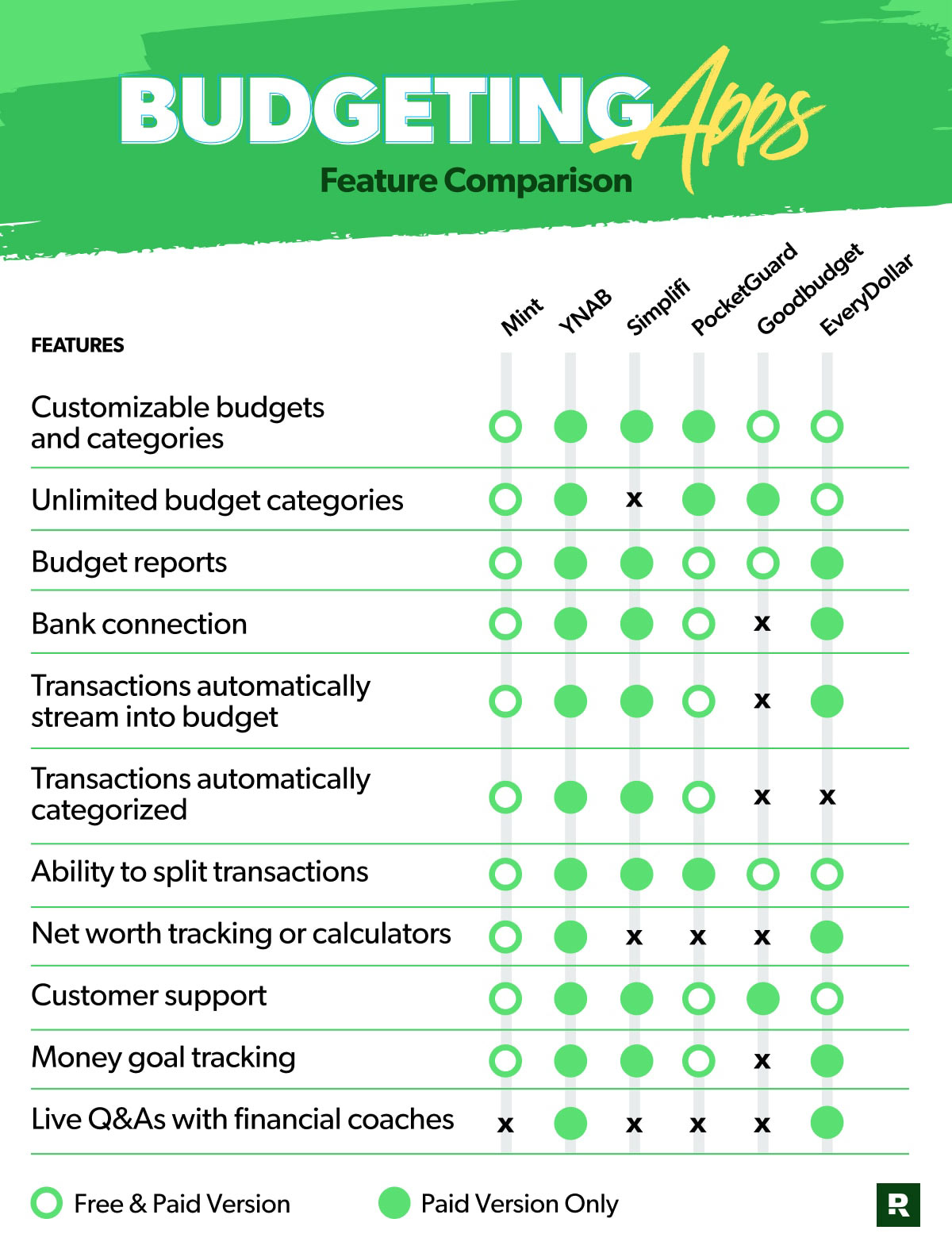

Comparing Mint, PocketGuard, and YNAB

Mint: Mint is a free budgeting app that offers a wide range of features, including expense tracking, bill reminders, and credit score monitoring. It also allows you to create custom budgets and provides insights into your spending habits. However, Mint does display ads, which some users may find intrusive.

PocketGuard: PocketGuard is another free budgeting app that focuses on helping you save money. It analyzes your income and expenses and provides recommendations on how you can optimize your spending. It also alerts you when you're nearing your budget limits or when there are potentially fraudulent charges on your accounts.

YNAB (You Need A Budget): YNAB is a paid budgeting app with a subscription-based model. It follows a zero-based budgeting approach, where every dollar you earn is assigned a job. YNAB also emphasizes goal-setting and offers educational resources to help you improve your financial literacy.

Choosing the Right Budgeting App for Your Needs

When choosing a budgeting app, it's important to consider your specific financial needs and preferences. Here are a few factors to consider:

-

Cost: Decide whether you're willing to pay for a budgeting app or prefer to use a free one.

-

Features: Consider the features that are essential to managing your finances effectively. Do you need bill reminders, goal tracking, or investment tracking?

-

User experience: Look for an app with an intuitive interface and easy navigation. Reading user reviews can help you gauge the app's user-friendliness.

Frequently Asked Questions about Budgeting Apps

Here are some common questions about budgeting apps:

-

Are budgeting apps safe and secure? Most budgeting apps use bank-level security to encrypt and protect your financial data. However, it's important to choose a reputable app and enable two-factor authentication for added security.

-

Can I use a budgeting app for joint accounts? Some budgeting apps allow you to sync joint accounts, while others may have limitations. Check the app's features and compatibility before making a decision.

Remember, the best budgeting app is the one that suits your financial goals and preferences. Experiment with different apps and choose the one that helps you stay on track and achieve financial success.