Alternative Investments You Should Consider Today

Written: Editor | June 21, 2023

Real Estate Investments

Types of real estate investments

Real estate has long been a popular alternative investment option. There are several types of real estate investments that individuals can consider:

-

Residential Properties: This includes single-family homes, apartments, condominiums, or townhouses that are purchased with the intention of renting or reselling.

-

Commercial Properties: These are properties used for business purposes, such as office buildings, retail spaces, or warehouses. Investing in commercial real estate can offer higher potential returns but also carries higher risks.

-

Real Estate Investment Trusts (REITs): REITs are companies that own, operate, or finance income-generating properties. By investing in REITs, individuals can gain exposure to a diversified portfolio of real estate assets without directly owning or managing the properties.

Benefits and risks of investing in real estate

Investing in real estate offers several benefits, including:

-

Income Generation: Rental properties can provide a steady stream of rental income.

-

Appreciation: Real estate has the potential to increase in value over time, allowing investors to benefit from capital appreciation.

However, there are also risks to consider:

-

Liquidity: Real estate investments are relatively illiquid compared to other investment options, making it challenging to convert them into cash quickly.

-

Market Fluctuations: Real estate values can fluctuate based on market conditions and economic factors, which can impact the profitability of investments.

Factors to consider before investing in real estate

Before diving into real estate investments, it's essential to consider the following factors:

-

Financial Considerations: Evaluate your financial situation, including your investment goals, risk tolerance, and available funds.

-

Market Analysis: Research the local real estate market to determine its growth potential and demand for rental properties.

-

Property Management: Decide whether you want to manage the property yourself or hire a professional property management company.

-

Legal and Regulatory Factors: Familiarize yourself with the local laws and regulations governing real estate investments, such as zoning restrictions and licensing requirements.

By carefully considering these factors and conducting thorough research, investors can make informed decisions about their real estate investments.

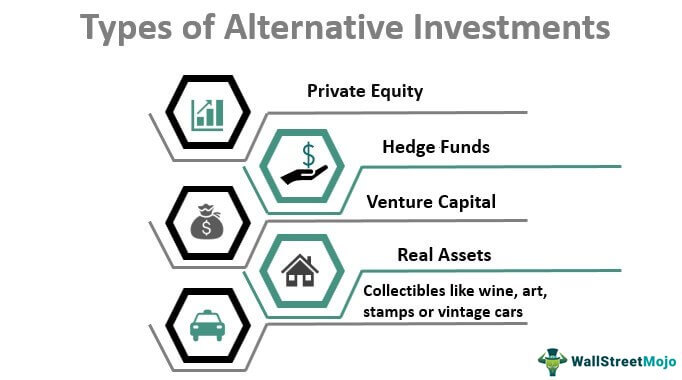

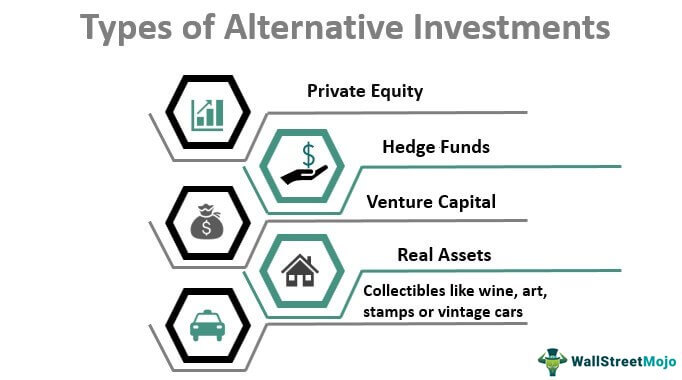

Hedge Funds

Understanding hedge funds

Hedge funds are alternative investment vehicles that are managed by professional fund managers and are open to a limited number of investors. Unlike traditional investment options such as stocks or bonds, hedge funds have a more flexible investment approach and can employ various complex strategies to generate returns.

Strategies employed by hedge funds

Hedge funds can use a variety of strategies to maximize returns and manage risk. Some common strategies include long/short equity, global macro, event-driven, and arbitrage. These strategies enable hedge funds to take advantage of market inefficiencies, hedge against potential risks, and seek opportunities in various market conditions.

Pros and cons of investing in hedge funds

Investing in hedge funds can have both advantages and disadvantages. Here are some pros and cons to consider:

Pros:

- Potential for higher returns: Hedge funds can provide opportunities for higher returns compared to traditional investments.

- Diversification: Investing in hedge funds allows investors to diversify their portfolio, reducing the overall risk exposure.

- Professional management: Hedge funds are managed by experienced professionals who aim to optimize returns while managing risks.

Cons:

- High minimum investment: Hedge funds typically have high minimum investment requirements, making them inaccessible to smaller investors.

- Limited regulation: Unlike traditional investment options, hedge funds are subject to fewer regulatory requirements, which may increase the risk.

- Lock-up periods: Hedge funds often have lock-up periods where investors cannot easily withdraw their funds, limiting liquidity.

Overall, hedge funds can be a valuable addition to an investment portfolio for qualified investors who understand and are comfortable with the risks associated with alternative investments.

Commodities

Investing in commodities

When it comes to alternative investments, commodities can be an attractive option for investors looking for diversification and potential returns. Investing in commodities involves buying and selling physical goods that are typically used in the production of goods and services. This can include natural resources like gold, silver, oil, or agricultural products like corn, wheat, and soybeans.

One of the main advantages of investing in commodities is that they tend to have a low correlation with traditional asset classes like stocks and bonds. This means that when the stock market is performing poorly, commodities may still hold value or even rise, providing a hedge against market volatility.

Types of commodities

There are two main types of commodities: hard commodities and soft commodities. Hard commodities include natural resources like metals, energy products, and agricultural products. Soft commodities mainly consist of agricultural products like corn, wheat, coffee, and sugar.

Investors can choose to invest directly in physical commodities by purchasing them and storing them, or they can invest indirectly through commodity futures contracts, exchange-traded funds (ETFs), or mutual funds.

Factors affecting commodity prices

Commodity prices are influenced by various factors, including supply and demand dynamics, geopolitical events, weather conditions, and global economic trends. For example, a natural disaster could disrupt the supply of agricultural commodities, leading to higher prices. Similarly, political instability in oil-producing regions can impact the price of oil.

It's important for investors to carefully consider these factors and conduct thorough research before investing in commodities. Consulting with financial advisors or experts in the field can also be helpful in navigating this complex market.

Overall, investing in commodities can be a way to diversify an investment portfolio and potentially generate attractive returns. However, as with any investment, there are risks involved, and investors should carefully assess their risk tolerance and investment goals before entering the commodities market.

Private Equity

Introduction to private equity investments

Private equity refers to investments made in companies that are not publicly traded on stock exchanges. It involves investing in privately held businesses for the purpose of generating substantial returns on investment. Private equity investors often acquire a significant stake in the company, giving them control and influence over its operations and strategic direction.

How to invest in private equity

Investing in private equity requires a significant amount of capital and is typically limited to high-net-worth individuals, institutional investors, and private equity firms. Here are some common methods to invest in private equity:

-

Direct Investments: Investors can directly invest in private companies by purchasing equity or providing capital in exchange for a stake in the business.

-

Private Equity Funds: Another way to invest in private equity is through private equity funds. These funds pool investments from multiple investors and use the capital to acquire or invest in various private companies.

-

Secondary Market: Investors can also access private equity by buying shares from existing investors in private companies on the secondary market.

Advantages and challenges of private equity investments

Private equity investments offer several advantages, including the potential for high returns, diversification, and active involvement in the company's growth and strategy. However, there are also challenges to consider, such as illiquidity, longer investment horizons, and higher risk compared to public market investments.

It is essential for investors to carefully evaluate the investment opportunities, conduct thorough due diligence, and seek professional advice before investing in private equity.

In summary, private equity investments provide an opportunity to invest in privately held companies and potentially earn significant returns. However, it is important to assess the risks and benefits, and seek expert advice to make informed investment decisions in the private equity market.

Cryptocurrencies

Overview of cryptocurrencies

Cryptocurrencies, such as Bitcoin and Ethereum, are digital or virtual currencies that use cryptography for security. They operate on a decentralized network known as blockchain, which ensures transparency and immutability. Cryptocurrencies have gained popularity due to their potential for high returns and the ability to bypass traditional financial systems.

Investing in cryptocurrencies

Investing in cryptocurrencies can be an exciting and potentially profitable venture. Here are a few steps to get started:

-

Research: Take the time to understand the various cryptocurrencies available and their underlying technology. Consider factors such as market capitalization, liquidity, and potential use cases.

-

Choose a reliable exchange: Select a reputable cryptocurrency exchange platform to buy, sell, and store your digital assets. Ensure the exchange has robust security measures in place to protect your investments.

-

Create a wallet: Set up a digital wallet to securely store your cryptocurrencies. Wallets can be either software-based (on your computer or smartphone) or hardware-based (physical devices).

-

Diversify your portfolio: Spread your investments across different cryptocurrencies to minimize risk. Consider investing in well-established coins as well as promising new projects.

Risks and rewards of investing in cryptocurrencies

While investing in cryptocurrencies can yield substantial profits, it also comes with risks. Some potential risks include:

-

Volatility: Cryptocurrency prices can be highly volatile, leading to significant value fluctuations within short periods.

-

Regulatory uncertainty: Government regulations can impact the cryptocurrency market, causing uncertainty and potential restrictions.

-

Security risks: Despite advancements in security measures, the digital nature of cryptocurrencies makes them vulnerable to hacking and fraudulent activities.

However, investing in cryptocurrencies also offers rewards, such as high returns and diversification opportunities. It is crucial to approach cryptocurrency investment with caution and only invest what you can afford to lose.

For more information on cryptocurrencies, refer to the Cryptocurrency Wikipedia page.

Art and Collectibles

Investing in art and collectibles

Investing in art and collectibles can be an exciting and potentially profitable alternative investment strategy. Many people are drawn to this asset class due to the potential for high returns and the ability to diversify their portfolio. However, it's important to approach this type of investment with caution and consider a few key factors before diving in.

Key factors to consider in art investments

Before investing in art, here are some important factors to keep in mind:

-

Research and knowledge: It's crucial to research the artists, art movements, and market trends before making any investment decisions. Understanding the market and having knowledge about the specific artwork or collectible can help you make informed choices.

-

Authenticity and provenance: Ensuring the authenticity and provenance of an artwork is essential. This involves verifying its origin, history, and previous owners. Working with reputable art dealers or getting expert opinions can help you avoid fraudulent or counterfeit pieces.

-

Market demand and liquidity: Consider the current and future market demand for the artwork or collectible. Some pieces may have limited appeal, while others may be highly sought after. Additionally, assess the liquidity of the market and how easy it would be to sell your investment if needed.

Benefits and challenges of collecting art

Investing in art and collectibles offers several benefits, including:

-

Potential for high returns: Art investments have the potential to generate significant profits if the value of the artwork increases.

-

Diversification: Art and collectibles can diversify your investment portfolio, providing a hedge against market fluctuations.

-

Emotional connection and enjoyment: Owning art and collectibles can bring intrinsic value, allowing you to appreciate the beauty and history behind the pieces.

However, there are also some challenges to consider, such as the subjective nature of valuing art and the potential illiquidity of the market. It's important to carefully evaluate the risks and rewards before committing to art and collectibles as an investment strategy.

Conclusion

In today's volatile financial markets, it is crucial for investors to consider alternative investments as a means of diversifying their portfolio. While traditional investments, such as stocks and bonds, can provide stability and long-term growth, alternative investments offer unique benefits that can enhance a portfolio's overall performance and mitigate risk.

Benefits of diversifying your portfolio through alternative investments

-

Improved Risk-Adjusted Returns: Alternative investments, such as real estate, private equity, and hedge funds, have the potential to deliver higher returns compared to traditional investments. With their low correlation to stock and bond markets, they can act as a hedge against market volatility and provide a consistent income stream.

-

Increased Portfolio Diversification: By allocating a portion of your portfolio to alternative investments, you can reduce the risk associated with a concentrated investment strategy. Different asset classes have varying return patterns, and diversifying across them can help protect your capital from market downturns.

-

Access to Unique Opportunities: Alternative investments provide access to investment opportunities that may not be available in the public markets. This includes investments in startups, venture capital, private debt, and infrastructure projects. These opportunities have the potential for high returns but are typically only accessible to accredited investors.

-

Inflation Hedge: Some alternative investments, such as commodities and real estate, can act as a hedge against inflation. These investments have the potential to maintain their value or even appreciate during periods of rising inflation, providing a valuable diversification tool.

In conclusion, incorporating alternative investments into your portfolio can offer numerous benefits, including improved risk-adjusted returns, increased diversification, access to unique opportunities, and protection against inflation. However, it is essential to conduct thorough research and seek professional advice before making any investment decisions.