How to Organize Your Tax Documents for a Stress-Free Tax Season

Written: Editor | August 3, 2023

Gathering and Sorting

When it comes to organizing your tax documents, being meticulous is key. Follow these steps to ensure a smooth and efficient process.

Important tax documents to collect

To start, gather all the necessary documents for tax preparation. This may include:

- W-2 forms: These are provided by your employers and summarize the income you earned throughout the year.

- 1099-MISC forms: If you're self-employed or received income as a freelancer or independent contractor, you'll need these forms.

- 1099-INT and 1099-DIV forms: If you earned interest or received dividends from investments, you'll need these forms.

- Mortgage and property tax statements: These documents are important if you own a home.

- Receipts for deductible expenses: Keep receipts for expenses such as medical bills, charitable donations, business expenses, and education costs.

Organizing documents by category

Once you've gathered all your documents, sort them into categories. Create separate folders or envelopes for each category, such as income, deductions, and investments. This will make it easier to find specific documents when you need them.

Creating a filing system

To keep your tax documents organized year-round, develop a filing system. Consider using a file cabinet, expanding file folder, or digital storage solution. Label each folder with the appropriate tax year and category, making it easy to locate specific documents in the future.

By following these steps and maintaining an organized system, you'll save time and minimize stress when tax season rolls around. Remember to consult with a tax professional or use tax software for accurate filing.

Digital Organization

Scanning and saving documents electronically

When it comes to organizing tax documents, digital organization can be a game-changer. Start by scanning all your paper documents and saving them electronically. Invest in a good quality scanner to ensure clear and readable digital copies of your documents. Save them in PDF format to maintain compatibility across different devices and platforms.

Using cloud storage for easy access

Cloud storage is a convenient solution for storing and accessing your tax documents from anywhere, at any time. There are various cloud storage services available, such as Google Drive, Dropbox, and Microsoft OneDrive. Take advantage of these services to securely store your electronic copies of tax documents. Make sure to choose a service with robust security measures to protect sensitive financial information.

Organizing digital files by year or category

To keep your tax documents easily accessible and organized, create folders on your computer or in your cloud storage service. Organize your documents by year or category, such as income, expenses, deductions, and receipts. This will help you quickly locate specific documents when needed and streamline the tax filing process.

By adopting digital organization methods for your tax documents, you can save time, reduce clutter, and improve overall efficiency. Remember to regularly back up your digital files to ensure they are protected and readily available when required.

Physical Organization

Organizing your tax documents may seem like a daunting task, but with the right strategies in place, it can become a more manageable process. Here are some key tips to help you organize your tax documents efficiently.

Choosing the right storage containers

Invest in sturdy storage containers that are designed specifically for organizing documents. Consider using file folders, document wallets, or binders to keep your paperwork organized and protected. Make sure to choose containers that are labeled and easily accessible so that you can quickly find the documents you need when tax season arrives.

Labeling and categorizing physical files

Create a logical system for labeling and categorizing your physical files. Use clear and descriptive labels that make it easy to identify the contents of each file. Organize your documents by category, such as income, expenses, deductions, and receipts. This will help streamline the process when you need to locate specific documents for tax purposes.

Keeping track of receipts and other supporting documents

Keep a designated folder or envelope for storing receipts and other supporting documents throughout the year. This will ensure that you have all the necessary documentation when it's time to file your taxes. Sort receipts by date or category to make them easier to find. Consider digitizing your receipts using a scanning app or software to reduce clutter and make it easier to store and access them.

By implementing these strategies, you can maintain an organized system for your tax documents and make the tax filing process smoother and more efficient.

Timeframe for Organization

Monthly maintenance tasks

To keep your tax documents organized throughout the year, it is essential to perform monthly maintenance tasks. Start by creating a file system that categorizes your documents, such as income statements, expense receipts, and investment records. Label folders or use color-coding for easy identification.

Each month, compile your income and expense statements, making sure to include all relevant receipts and invoices. Update your financial spreadsheets or software with the latest data. This regular maintenance will save you time and stress when tax season arrives.

Year-end document review and purge

As the year comes to a close, set aside time to review and purge your tax documents. Go through your files and discard any outdated or irrelevant documents. Keep only the records that are necessary for tax filing purposes, such as W-2 forms, 1099 forms, and charitable donation receipts.

Organize the remaining documents in separate folders labeled with the tax year. This will make it easier to retrieve specific documents if needed in the future.

Retaining tax records for future reference

While it's important to purge unnecessary documents, it is equally important to retain certain records for future reference. Generally, it is recommended to keep tax-related documents for at least three to seven years, depending on your country's tax regulations. These records include tax returns, supporting documents, and any documents related to major transactions like property purchases or sales.

Consider digitizing your tax documents and keeping backups in cloud storage or external drives. This ensures easy access and protects your documents from loss or damage.

By following these organization tips and sticking to a regular maintenance routine, you can effectively manage your tax documents throughout the year and be prepared for tax season.

Digital Tools and Apps

Best apps for organizing tax documents

When it comes to organizing your tax documents, technology can be your best friend. There are many apps available that can help you streamline the process and stay organized throughout the year. Some of the best apps for organizing tax documents include:

-

Evernote: Evernote is a versatile app that allows you to capture and organize your tax documents in one place. You can easily snap photos of receipts, invoices, and other important documents and tag them with relevant keywords for easy searching.

-

Expensify: Expensify is a popular app for tracking and organizing expenses. It allows you to easily scan and categorize receipts, as well as create expense reports for tax purposes.

-

Shoeboxed: Shoeboxed is an app that specializes in organizing receipts. You can simply snap a photo of your receipt and Shoeboxed will extract the important information and categorize it for you.

Using spreadsheets or tax software

If you prefer a more traditional approach, using spreadsheets or tax software can also be effective for organizing your tax documents. You can create a spreadsheet with different tabs for each category, such as income, expenses, and deductions. Alternatively, you can use tax software like TurboTax or H&R Block to input and organize your documents electronically.

Automating document organization with software

To save even more time and effort, consider using document organization software. These tools automatically scan and categorize your documents, making it easy to find what you need come tax time. Some popular options include Neat, FileCenter, and PaperPort.

Remember, staying organized with your tax documents not only makes filing your taxes easier, but it can also save you time and potentially reduce the risk of errors or audits. Using digital tools, spreadsheets, or document organization software can help streamline the process and ensure you have everything you need when it's time to file.

Tips for Effective Organization

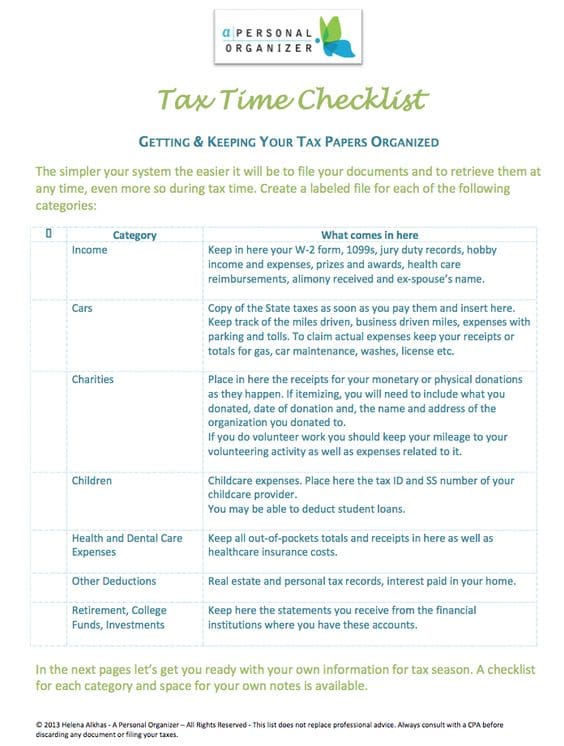

Creating a document checklist

To ensure a smooth and efficient tax filing process, it's crucial to establish a document checklist. This will help you keep track of all the necessary documents and information needed to complete your tax return accurately. Here are some steps to follow:

-

Gather past tax returns: Collect your previous tax returns and use them as a reference to identify the documents you will need for the current year.

-

Identify income sources: Make a list of all your income sources, such as W-2 forms, 1099 forms, or any other income documentation.

-

Compile expense records: Categorize your expenses, including receipts for business expenses, medical expenses, and charitable donations.

-

Organize financial statements: Gather all relevant financial statements, such as bank statements, investment reports, and mortgage interest statements.

Organizing documents as they arrive

Once you have your document checklist, it's essential to stay organized as documents come in throughout the year. Here are some tips to help you stay on top of your tax documents:

-

Create designated folders: Designate separate folders for each category of the document checklist and label them accordingly.

-

File documents immediately: As you receive tax-related documents, file them in their respective folders. This way, you won't have to scramble to find them when it's time to file your taxes.

-

Digitize receipts: Consider using a mobile scanning app or good old-fashioned scanner to digitize receipts and store them electronically. This will save space and make it easier to retrieve them when needed.

By implementing these tips, you can effectively organize your tax documents and make the tax filing process less stressful and more efficient.

Maintaining Security and Privacy

Protecting sensitive information

When it comes to organizing your tax documents, it's crucial to prioritize the security and privacy of your sensitive information. Here are some essential tips to help you protect your data:

-

Create a secure digital storage system: Invest in reliable encryption software and password-protect your digital files. Store your tax documents in a separate folder or a secure cloud storage platform with two-factor authentication.

-

Keep physical documents safe: If you have physical copies of your tax documents, store them in a locked filing cabinet or a secure location. Consider using a fireproof and waterproof safe for added protection.

-

Dispose of documents properly: Shred any outdated or unnecessary tax documents before discarding them. This prevents sensitive information from falling into the wrong hands.

-

Use secure communication methods: When sharing tax-related information with your accountant or the tax authorities, opt for encrypted email services or secure file-sharing platforms.

-

Regularly update your software and devices: Install the latest security updates and patches for your operating system, antivirus software, and other applications. This helps protect against potential vulnerabilities.

-

Beware of phishing scams: Be cautious of unsolicited emails or calls claiming to be from tax authorities. Avoid clicking on suspicious links or providing personal information unless you can verify the legitimacy of the request.

By following these tips, you can ensure the security and privacy of your tax documents, giving you peace of mind and protecting yourself from identity theft or fraud.

Conclusion

Organizing tax documents may seem like a daunting task, but with the right approach and mindset, you can streamline the process and ensure compliance with tax regulations. Remember to keep your records accurate, up-to-date, and easily accessible for future reference. Utilize digital tools and software to simplify paperwork and stay organized throughout the year. By following these tips, you can save time and reduce stress when tax season comes around.

Common mistakes to avoid when organizing tax documents

-

Disorganization: Failing to keep your tax documents organized could result in missing deductions, errors, and potential penalties. Maintain a system that separates receipts, invoices, and other relevant documents to make the filing process smoother.

-

Missing deadlines: Late filing or payment can result in penalties and interest charges. To avoid this, mark important tax deadlines on your calendar and set reminders. Plan ahead and start organizing your documents well before the filing date.

-

Ignoring receipts: Receipts are essential for claiming deductions and verifying expenses. Keep track of all receipts, both for personal and business expenses, and organize them by category.

-

Not backing up digital records: Storing important tax documents digitally is convenient, but it's crucial to back up your digital records regularly. Use cloud storage or external hard drives to ensure data security and accessibility.

-

Inconsistent record-keeping: Maintain a consistent system for recording your income and expenses throughout the year. This includes regularly updating your financial records and reconciling bank statements.

By avoiding these common mistakes and adopting efficient organizational practices, you can make your tax preparation easier and less stressful. Take the time to implement these strategies, and you'll be well-prepared for tax season.