Budgeting for College: Tips and Tricks for Students

Written: Editor | April 11, 2023

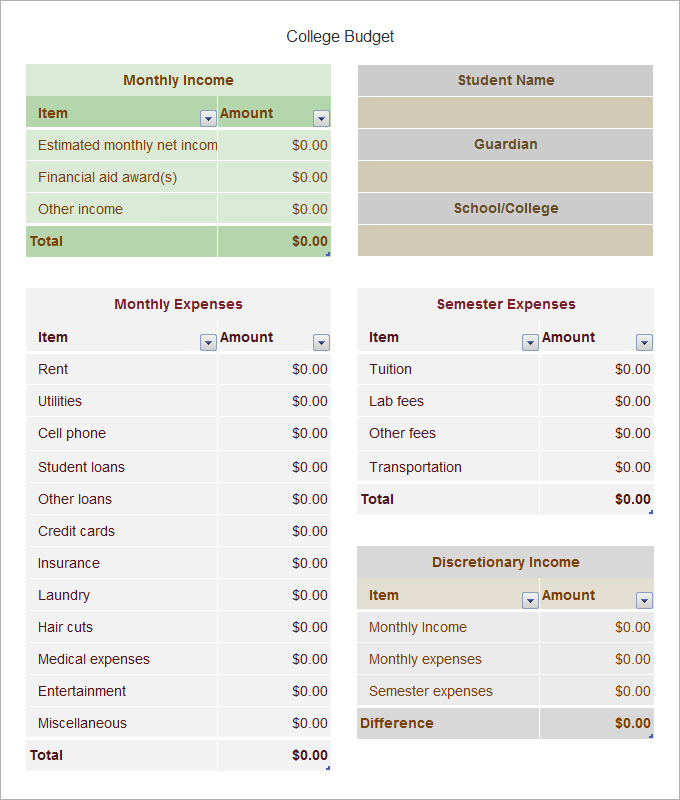

Creating a College Budget

Identifying sources of income for college students

When it comes to managing your finances, creating a budget is a crucial step towards financial independence. As a college student, it's important to consider different sources of income to support your education and living expenses. Some potential income sources include:

-

Part-time job: Working part-time can provide a steady stream of income to cover essential expenses.

-

Scholarships and grants: Apply for scholarships and grants to reduce your financial burden and help finance your education.

-

Financial aid: Explore options such as student loans, grants, and work-study programs that can provide financial assistance during your college years.

Essential expenses to include in a college budget

When creating a college budget, consider the following essential expenses that you need to cover:

-

Tuition and fees: Calculate the cost of tuition, fees, and any additional educational expenses required for your program of study.

-

Housing and utilities: Include the cost of rent, utilities (electricity, water, internet), and other housing-related expenses if you're living off-campus.

-

Food and groceries: Allocate a budget for meals and groceries, including dining hall expenses or grocery shopping if you're cooking your own meals.

Additional expenses and discretionary spending considerations

In addition to the essential expenses, it's important to budget for other costs that may arise during college, including:

-

Textbooks and supplies: Factor in the cost of textbooks, stationery, and other supplies required for your courses.

-

Transportation: Consider transportation costs for commuting to classes, whether it's public transportation or maintaining a vehicle.

-

Healthcare: Account for health insurance premiums, co-pays, and other medical expenses.

Remember to also allocate a portion of your budget for discretionary spending, such as entertainment, social activities, and personal expenses. Being mindful of your income and expenses will help you stay financially secure throughout your college journey.

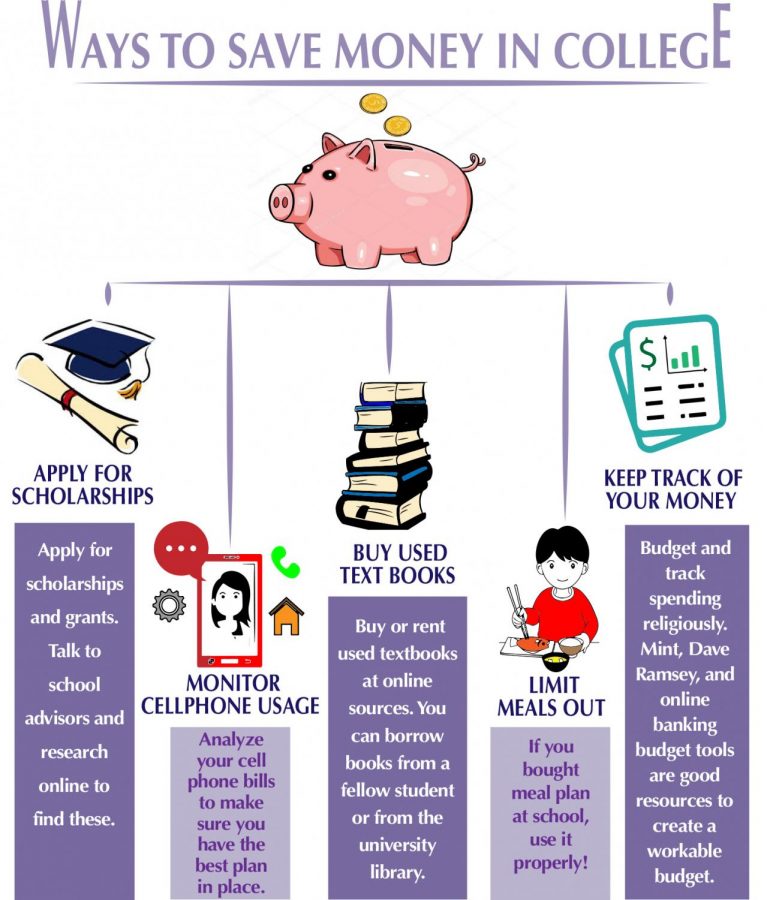

Saving Strategies for College Students

Tips for saving money on textbooks and school supplies

Hey there, college student! We know that tuition fees can take a toll on your wallet, but fret not! Here are some savvy saving tips for your textbooks and school supplies.

-

Buy used textbooks: Instead of purchasing new textbooks, consider buying used ones from your college bookstore or online platforms like Amazon and Chegg. This can save you a significant amount of money.

-

Share with classmates: Connect with your classmates to see if you can share textbooks or split the cost. Many courses only require reading specific chapters, so sharing can be a great way to save.

-

Consider e-books or rentals: E-books and textbook rentals are more affordable options compared to buying new hard copies. Check if your college library offers e-books or look for online rental platforms like VitalSource or BookRenter.

Budget-friendly meal planning and grocery shopping

Time to satisfy those hungry college cravings! Here are some tips for planning budget-friendly meals and saving money on grocery shopping.

-

Meal prep: Plan your meals for the week ahead and prepare them in advance. This will help you avoid impulse purchases and reduce your food waste.

-

Buy in bulk: Purchasing staple items, such as rice, pasta, or canned goods, in bulk can save you money in the long run. Look for discounts or wholesale stores like Costco or Sam's Club.

-

Cook at home: Eating out can quickly drain your funds. Opt for cooking at home, and challenge yourself to learn new recipes. Not only will this save you money, but it can also be a fun and tasty experience.

Creative ways to reduce entertainment and recreational costs

College life doesn't have to break the bank! Here are some creative ways to have fun while saving money on entertainment and recreational activities.

-

Explore student discounts: Many theaters, museums, and attractions offer student discounts. Always carry your student ID and take advantage of these deals.

-

Utilize campus resources: Most colleges offer a range of free or low-cost activities, such as movie nights, concerts, and intramural sports. Take advantage of these opportunities to have a great time without spending a fortune.

-

Find free or cheap alternatives: Instead of going to expensive restaurants, try packing a picnic and enjoying a day at the park. Look for free community events or join clubs and organizations on campus that offer affordable recreational options.

Remember, with a little planning and some smart choices, you can enjoy college life while staying within your budget.

:max\_bytes(150000):strip\_icc()/Private-vs-Federal-College-Loans-Whats-the-Difference-31c92251f6b243e3b1e4bba3b5612791.jpg)

Managing Student Loans and Financial Aid

Understanding the terms and conditions of student loans

When it comes to student loans, it's crucial to have a clear understanding of the terms and conditions before you commit to anything. Here are a few key points to consider:

-

Types of loans: Familiarize yourself with the different types of loans available, such as federal subsidized and unsubsidized loans, as well as private loans. Each type has its own interest rates and repayment options.

-

Interest rates: Pay attention to the interest rates associated with your loans. Federal loans generally have lower interest rates compared to private loans, so it's wise to prioritize them if possible.

-

Repayment options: Understand the repayment options available, such as standard repayment, income-driven repayment plans, or loan forgiveness programs. This knowledge will help you make informed decisions regarding loan repayment.

Maximizing financial aid and scholarship opportunities

Paying for college can be a significant financial burden, but there are ways to maximize your financial aid and scholarship opportunities. Here are some strategies to consider:

-

File the FAFSA: Submit the Free Application for Federal Student Aid (FAFSA) as early as possible. This will determine your eligibility for federal grants, loans, and work-study programs.

-

Research scholarships: Look for scholarships that cater to your specific circumstances, interests, or achievements. Numerous websites and organizations offer scholarships that can help offset the cost of tuition.

-

Apply for grants: In addition to scholarships, explore grant opportunities that are available based on financial need or academic achievements. Grants, unlike loans, do not have to be repaid.

Strategies for minimizing student loan debt and repayment planning

While student loans may be necessary for many individuals, it's essential to develop strategies to minimize debt and plan for repayment. Consider the following tips:

-

Live within your means: Stick to a budget and avoid unnecessary expenses. By managing your money wisely, you can reduce the amount of loans needed.

-

Explore part-time jobs or work-study programs: Look for opportunities to work while attending college. This can help cover some expenses and reduce reliance on loans.

-

Consider loan repayment options: As you approach graduation, research different loan repayment options and choose the one that best suits your financial situation. Some options may provide flexibility based on income.

Remember, careful planning and understanding your financial options are key to managing student loans and making college more affordable.

Building a Safety Net and Emergency Fund

Why having an emergency fund is crucial for college students

Hey there, college student! We know that managing your finances during your college years can be quite challenging. That's why it's important to prioritize building an emergency fund to protect yourself from unexpected expenses that can throw you off track.

College life is full of surprises, from sudden medical bills to unexpected car repairs. Having an emergency fund gives you peace of mind, knowing that you have a safety net to fall back on in times of need. It's like having a financial cushion that can keep you afloat during unexpected circumstances, without necessarily resorting to credit cards or loans.

Methods for setting up an emergency fund on a tight budget

But how can you build an emergency fund when you're on a tight budget? Here are a few strategies that can help:

-

Automate your savings: Set up automatic transfers from your checking account to a separate savings account. Even a small amount set aside each month can add up over time.

-

Cut unnecessary expenses: Take a closer look at your spending habits and identify areas where you can cut back. Can you pack lunch instead of eating out? Cancel unused subscriptions? Every dollar saved can go towards your emergency fund.

-

Take advantage of windfalls: When you receive unexpected cash, like a birthday gift or a tax refund, resist the temptation to spend it right away. Instead, allocate a portion or all of it to your emergency fund.

Steps to handle unexpected expenses and financial setbacks

Even with an emergency fund, unforeseen circumstances can still arise. Here's how to handle unexpected expenses and financial setbacks like a pro:

-

Prioritize and assess the situation: Determine the urgency and severity of the expense. Address immediate needs first, such as medical emergencies or urgent repairs.

-

Explore options: Research financial aid programs, scholarships, or grants that can help alleviate the burden of unexpected costs. Don't hesitate to reach out to your college's financial aid office for assistance and guidance.

-

Create a repayment plan: If you need to borrow money or use credit for immediate expenses, devise a plan to repay the debt as soon as possible. Set a budget, cut unnecessary expenses, and prioritize debt repayment.

Remember, building an emergency fund takes time and discipline. Start small and stay committed to your savings goals. By doing so, you'll be better prepared to handle any financial curveballs that come your way during your college journey.

Long-Term Financial Planning for College and Beyond

Are you a college student looking to secure your financial future? It's never too early to start budgeting and planning for what lies ahead. By taking control of your finances now, you can set yourself up for success both during college and beyond.

Planning for future expenses like graduate school or professional certifications

Thinking ahead: While college may be your current focus, it's important to consider future expenses such as graduate school or professional certifications. These can come with hefty price tags, so it's wise to start planning early. By setting aside a portion of your income or researching scholarship opportunities, you can alleviate the financial burden when the time comes.

Investment and retirement saving strategies for college students

Investing in your future: Even as a college student, you can start investing and saving for retirement. Consider opening a retirement account or investing in low-risk options such as index funds. The power of compound interest means that the earlier you start, the more time your money has to grow. By developing good financial habits now, you can reap the benefits in the long run.

Building credit and establishing a good financial foundation for the future

Building a strong financial foundation: College is a great time to start building credit and establishing a good financial reputation. Opening a credit card and using it responsibly can help you build a positive credit history. This will be valuable when you want to take out loans, get better interest rates, or rent an apartment in the future. Additionally, practicing good financial habits, such as budgeting and paying bills on time, will set you up for success beyond college.

Remember, college is not just about education, but also about preparing for your future. By prioritizing long-term financial planning, you can ensure a secure and successful financial future.

Conclusion

So, you're off to college! Congratulations on this exciting new chapter in your life. As you prepare for your college journey, it's important to start thinking about budgeting. By prioritizing your finances and making smart financial decisions, you can set yourself up for success both during college and beyond.

Benefits of budgeting during college and beyond

-

Financial Independence: Budgeting allows you to take control of your money and become financially independent. It helps you avoid unnecessary debt and build a solid foundation for your future.

-

Reduced Stress: With a budget in place, you can avoid financial worries and reduce stress. Knowing where your money is going and having a clear plan for your expenses will give you peace of mind.

-

Developing Good Habits: Budgeting in college helps you develop good financial habits that will benefit you throughout your life. Learning to manage your money responsibly and make wise financial decisions is a valuable skill.

Final tips and advice for successful budgeting in college

- Create a realistic monthly budget that includes your income and all expenses.

- Track your spending and adjust your budget as needed.

- Look for ways to save money, such as buying used textbooks or cooking meals at home.

- Take advantage of student discounts and free resources available on campus.

- Find a part-time job or explore opportunities for paid internships to supplement your income.

Resources for further financial education and assistance

- Take advantage of financial literacy resources offered by your college or university.

- Consider attending workshops or seminars on budgeting and personal finance.

- Explore online resources such as budgeting apps, blogs, and websites dedicated to financial education.

- Reach out to your college's financial aid office for advice and assistance.

Remember, budgeting is a skill that takes time to master. As you navigate through college, be patient with yourself and keep learning about personal finance. By being mindful of your spending and making smart financial choices, you can set yourself up for a bright financial future.